The 12 Week Cash Flow Forecast Spreadsheet is an essential tool for managing your business’s finances. It allows you to anticipate cash inflows and outflows over the next three months. With this simple yet powerful spreadsheet, you can create a clear financial roadmap. It helps you identify potential cash shortages and avoid costly mistakes. If you’re a small business owner, understanding this tool is crucial for your success.

In this article, I’ll guide you through the key components of creating your own twelve week cash flow forecast spreadsheet. You’ll learn how to track your cash flow effectively and discover the numerous benefits of this financial tool. Don’t let cash flow issues disrupt your business operations. Read on to empower yourself with the knowledge to optimize your cash flow and ensure your financial stability.

What is a Twelve Week Cash Flow Forecast?

A twelve-week cash flow forecast is a planning tool that helps businesses track their finances over the next three months. Using a simple spreadsheet, you can see your expected cash inflows (money coming in) and outflows (money going out) each week. This financial tool helps you anticipate whether you’ll have enough cash to cover upcoming expenses or if you need to prepare for a shortfall.

For many small businesses, managing cash flow is essential. Unlike larger firms, small businesses may not have big cash reserves. They need to monitor their finances to stay afloat carefully. A twelve week cash flow forecast gives a “financial roadmap” that allows business owners to act quickly if cash flow problems are likely.

Many business owners find this forecast helpful because it breaks down cash flow into manageable, weekly snapshots. This way, owners can focus on making small adjustments, such as cutting back on non-essential spending or finding short-term funding options if needed. By looking at only twelve weeks at a time, businesses can respond quickly to changes without feeling overwhelmed by the larger financial picture.

Benefits of a Weekly Cash Flow Projection

A weekly cash flow projection improves financial control. A 12-week cash forecast focuses on short-term liquidity. It shows if your business has enough cash to cover expenses like payroll, rent, and supplies in upcoming weeks. This is crucial because around 82% of small businesses fail due to poor cash flow management, according to studies by financial experts.

Here is the benefit of twelve week cash flow forecast benefit in short:

- Identify potential cash shortages: Knowing when you might have less money coming in than going out can help you plan ahead.

- Make informed financial decisions: By understanding your cash flow, you can make better decisions about spending, saving, and investing.

- Improve your business’s financial health: A 12-week cash flow forecast can help you identify opportunities to increase revenue and reduce costs.

- Prepare for unexpected expenses: By tracking your cash flow, you can set aside money for unexpected costs.

Overall, a 12 week forecast is a great way to start building a solid financial foundation. It’s a relatively short timeframe, which makes it easier to manage and adjust your plans as needed.

Essential Elements for 12 Week Cash Flow Forecast Spreadsheet

Creating a twelve week cash flow forecast spreadsheet involves organizing several key elements to ensure accuracy and usability. Each element in the forecast helps capture different aspects of your business’s financial activity. You can plan and adjust cash flow as needed.

1. Beginning Cash Balance

This is the cash your business has on hand at the start of each week. It sets the foundation for your cash flow forecast, showing you the amount you’re starting with. By tracking this regularly, you can see trends and adjust as needed to avoid negative balances.

2. Weekly Cash Inflows

Cash inflows are the money you expect to receive during the week. This can include revenue from sales, payments from clients, or other income sources. Regularly updating these amounts in your forecast lets you know when cash is coming in and from where helping to avoid cash shortages. Small businesses, particularly those with irregular income streams, can find this element crucial for staying financially secure.

3. Weekly Cash Outflows

Cash outflows represent all the money going out, including expenses like payroll, rent, supplies, and loan payments. By itemizing outflows, you can better understand where your money is going each week. This level of detail helps in identifying areas to cut costs if cash flow becomes tight.

4. Net Cash Flow

Net cash flow is calculated by subtracting outflows from inflows. This figure gives a quick snapshot of whether your cash flow is positive (inflows exceed outflows) or negative (outflows exceed inflows) for each week. A positive net cash flow means your business has enough cash to cover expenses, while a negative cash flow indicates the need to take action, such as delaying purchases or seeking additional funding.

5. Projected Ending Cash Balance

This is the estimated cash balance at the end of each week after factoring in all inflows and outflows. It’s calculated by adding the net cash flow to the beginning cash balance. This figure helps you see if your business will end each week with enough cash to operate smoothly, allowing for better financial planning.

Step-by-Step Guide to Creating Your 12 Week Cash Flow Forecast Spreadsheet

Setting up a twelve week cash flow forecast spreadsheet might seem complex, but following a step-by-step approach makes it manageable. Below is a simple guide to help you get started in Excel or any similar spreadsheet software.

1. Set Up Weekly Columns and Essential Rows

Begin by creating columns for each of the twelve weeks. Label these columns as “Week 1,” “Week 2,” and so on. In the rows, add labels for each essential component: beginning cash balance, cash inflows, cash outflows, net cash flow, and projected ending cash balance. This layout keeps your information organized and easy to review at a glance.

2. Input Starting Cash Balance

Under the first week, enter your current cash on hand in the “Beginning Cash Balance” row. This figure is crucial as it sets the baseline for your forecast. Remember, accurate cash balance tracking can help avoid overestimating your available funds.

3. Forecast Weekly Cash Inflows

Estimate your expected income for each week. Be as specific as possible with categories, such as sales revenue, payments from clients, or any other regular income sources. Use past financial records to estimate these amounts if available, as historical data often provides a realistic forecast for cash inflows. If you’re uncertain, try to keep your estimates conservative to avoid potential cash flow shortfalls.

4. Estimate Weekly Cash Outflows

In this section, enter all anticipated weekly expenses, such as rent, utilities, payroll, supplies, and debt payments. Grouping expenses by category (e.g., operating costs, fixed expenses) can make this part of the forecast clearer. Small business owners should also remember to include irregular costs, such as quarterly tax payments or seasonal expenses. This step is critical to accurately understanding your cash needs and avoiding surprises.

5. Calculate Net Cash Flow

Subtract total outflows from total inflows to determine the net cash flow for each week. A positive net cash flow means you’re generating enough revenue to cover expenses, while a negative one signals a potential shortfall. Monitor weekly to make quick adjustments if needed, such as finding ways to increase inflows or reduce expenses.

6. Project Ending Cash Balance

Add the net cash flow to the beginning cash balance to calculate the projected ending cash balance for each week. This final balance rolls over to become the beginning balance for the following week. Tracking your ending balance for each week gives a clear picture of whether your business is staying financially stable throughout the twelve weeks.

7. Review and Update Regularly

Cash flow forecasting is most effective when it’s updated frequently. Make a habit of reviewing your twelve week cash flow forecast spreadsheet each week to compare actual figures with estimates. Adjust any future weeks based on this information. Consistent updates ensure your forecast remains accurate and helps you catch any issues before they become critical.

By following these steps, you’ll build a practical 12 week cash flow forecast spreadsheet that provides a clear view of your business’s short-term finances. This tool empowers you to make informed decisions and avoid cash-related crises, helping your business run smoothly even in uncertain times.

Common Mistakes to Avoid When Creating Your Cash Flow Forecast

When preparing a twelve week cash flow forecast, it’s essential to be aware of common pitfalls that can undermine its effectiveness. Here are some mistakes to avoid:

1. Overestimating Inflows

One frequent error is being overly optimistic about expected cash inflows. Many business owners assume sales will be high without considering seasonal fluctuations or customer payment patterns. To avoid this, use historical data for inflow estimates. Take a conservative approach. Account for possible delays in customer payments.

2. Ignoring Irregular Expenses

Small businesses often forget to include irregular or unexpected expenses in their forecasts. These might include equipment repairs, seasonal inventory purchases, or one-time fees like licenses and permits. To avoid cash shortfalls, make a list of these potential expenses and incorporate them into your forecast.

3. Not Updating Regularly

A static cash flow forecast is less valuable. Failing to review and update your forecast regularly can lead to inaccuracies. Real-life circumstances can change quickly, affecting both inflows and outflows. Regularly comparing your forecasts to actual cash flows allows you to adjust your estimates and make informed decisions.

4. Neglecting to Plan for Contingencies

Emergencies can arise at any time. A sudden sales drop or unexpected expense can hit hard. That’s why a contingency plan is essential. Add a small buffer in your cash flow projections. This can help you manage financial shocks without major issues.

Analyzing Your 12 Week Cash Flow Forecast

Regularly review your cash flow forecast to spot issues early. Simple strategies can greatly enhance your financial health. Here, we highlight common cash flow issues and ways to fix them.

Identifying Potential Cash Flow Issues

By analyzing your cash flow forecast, you can identify potential issues like:

- Cash shortages: If you anticipate having less money than you need to cover your expenses, you may need to adjust your spending or find additional sources of income.

- Excess cash: Having too much cash on hand can be a missed opportunity. Consider investing the excess funds or using them to pay off debt.

Optimizing Business Cash Flow

To improve your cash flow, consider the following strategies:

- Reduce expenses: Look for ways to cut costs, such as negotiating better deals with suppliers or reducing unnecessary expenses.

- Accelerate income: Implement strategies to speed up the collection of payments from customers, such as offering early payment discounts or using online payment tools.

- Negotiate payment terms: Work with your suppliers to extend payment terms or negotiate early payment discounts.

- Improve your pricing strategy: Review your pricing to ensure that you’re charging enough to cover your costs and generate a profit.

Leveraging Technology for Effective Cash Flow Forecasting

In today’s digital age, there are many software tools and applications available to help you create and manage your cash flow forecasts. Some popular options include:

- Microsoft Excel: While Excel is a versatile tool, it can be time-consuming to create and maintain complex financial models.

- Google Sheets: A cloud-based alternative to Excel, Google Sheets offers similar functionality with the added benefit of real-time collaboration.

- Specialized financial software: Dedicated financial software like QuickBooks and Xero can automate many of the tasks involved in creating and analyzing cash flow forecasts.

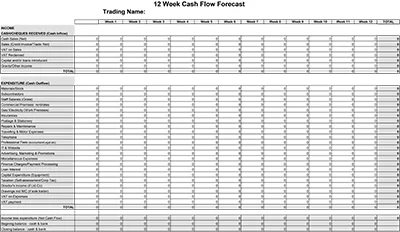

Download 12 Week Cash Flow Forecast Spreadsheet Free

I have discussed the complete process of creating twelve week cash flow forecast spreadsheet. I hope anyone can create their cash flow forecast spreadsheet by following the above steps. However, if you face any difficulties or still become confused about the structure of 12 week cash flow forecast spreadsheet, you can download the sample. The cash inflow and cash outflow items vary from business to business, so after downloading the cash flow forecast spreadsheet, you may need to slightly change the cash inflow and outflow items.

12 Week Cash Flow Forecast Spreadsheet

Download this spreadsheet and optimize your business cash flow.

FAQs

How often should I update my cash flow forecast?

It’s best to update your cash flow forecast weekly. This allows you to compare your projected cash flows with actual results. Regular updates help you spot trends and make timely adjustments.

What is a good cash flow reserve?

A common recommendation is to maintain a cash reserve of three to six months’ worth of expenses. This buffer can help you manage unexpected downturns and ensure you can cover costs during lean periods.

Can I use a 12-week cash flow forecast for personal finance?

A 12-week cash flow forecast is a powerful tool. It helps manage personal finances effectively. You can track income and expenses easily.

Concluding Words

This article discusses the benefits of using a financial tool for twelve week cash flow forecast. In this article, I will provide a step-by-step guide to creating 12 week cash flow forecast spreadsheet. In addition, I have included a sample template for your convenience.

Moreover, I will also cover how to optimize cash flow. This discussion aims to help small business owners. Accounting professionals will find this information valuable, too. Personal finance managers can also benefit from these insights.

If you have questions or recommendations about this article, please share your thoughts. Besides, share it with others, If you find this article helpful. Your fellow professionals can benefit from this knowledge as well.

Leave a Reply