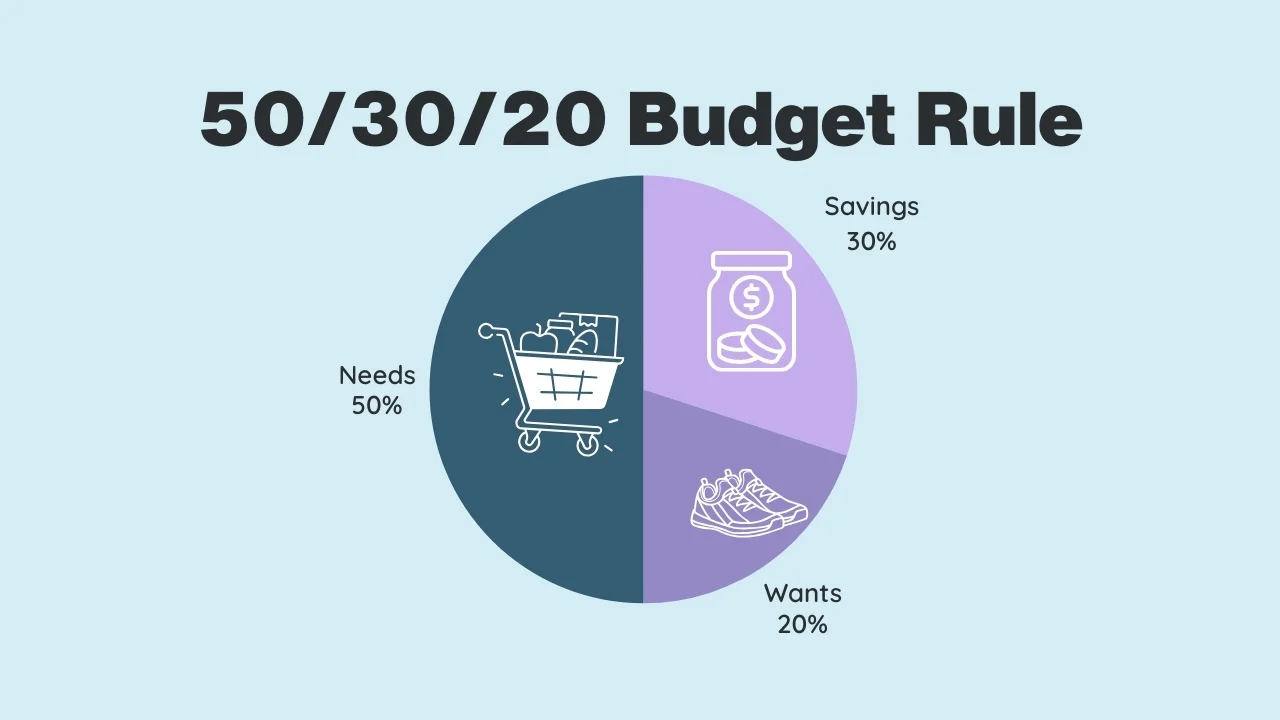

Have you heard of the 50/30/20 budget rule? It’s a simple way to manage your money better and reach your goals. This budgeting method helps you plan how to allocate your income most effective way

Do you feel like your budgeting finances are out of control? Having a hard time saving and still enjoying life? The 50/30/20 rule might help you. It gives a clear way to manage finances, balance spending, and build retirement savings. This smart plan makes your financial planning easier and less stressful.

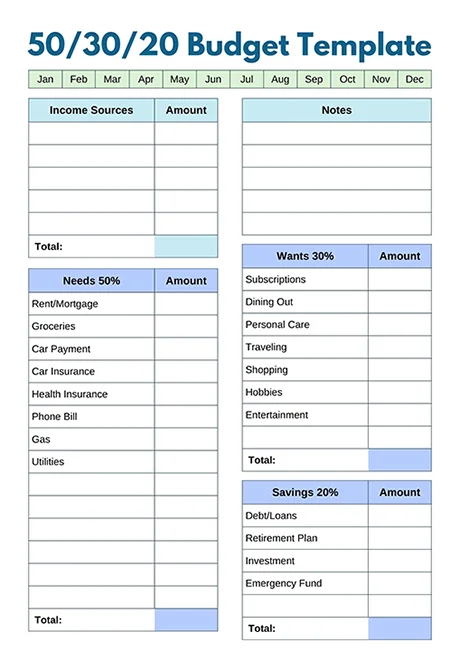

Here, I’ll explain how the 50/30/20 rule works and why many people follow it. You’ll see how to break your income into percentages 50% for needs, 30% for wants, and 20% for savings or investing. I’ll also share some common problems you might face and how to fix them. At the end, you’ll find a printable budget template based on this rule. You can use it like a budget calculator to plan better and reach your goals.

What is the 50/30/20 Budget Rule?

The 50/30/20 budget rule is a well-known financial planning tip that helps you manage your finances. It breaks your income into three parts: needs, wants, and saving or debt payments. This helps you stay balanced and make smart money choices.

For example, if your total income is $3,000, use $1,500 for budgeting for daily necessities like rent, groceries, and bills, $900 for fun & entertainment like dining out, shopping and travels, and $600 for retirement savings or loans. A budget calculator or a simple pie chart can help you track this easily.

Why the 50/30/20 Rule is Effective

The 50/30/20 rule works well because it makes budgeting simple and balanced. It helps cover your basic costs, limit spending on wants, and focus on saving or debt. This budgeting method lets you see where your money goes and plan better.

Using the 50/30/20 rule is one key step toward financial planning and growth. With this rule, you can manage your finances better, feel less stress, and move closer to your financial goals with more control and clarity.

The Breakdown of 50 30 20 Budget Rule

The 50/30/20 budget rule provides a simple framework for allocating your after-tax income into three main categories:

50% for Needs: Essential Expenses

This portion of your income is dedicated to covering essential expenses that are necessary for survival and maintaining your lifestyle. These expenses are things like rent, utilities, food, and car costs. These include:

- Housing: Rent or mortgage payments, property taxes, homeowners insurance

- Utilities: Electricity, gas, water, internet, and phone bills

- Groceries: Food and household supplies

- Transportation: Car payments, fuel, public transportation, car insurance

Tracking your essential costs closely and using the 50/30/20 rule helps you balance spending. This budgeting method supports your financial health and builds a solid base for managing your money well.

30% for Wants: Discretionary Spending

This category covers expenses that are not essential like eating out, fun activities, travel, and hobbies, but enhance your quality of life. It’s important to balance your needs and wants for good budgeting and financial planning. Some examples include:

- Dining out: Restaurants, cafes, and takeout

- Entertainment: Movies, concerts, subscriptions, hobbies

- Shopping: Clothing, accessories, electronics

- Vacations: Travel, accommodations, and activities

- Personal care: Gym memberships, haircuts, beauty products

Finding the right balance between needs and wants lets you live well and stick to your 50/30/20 budget. This way, you can reach your financial goals.

20% for Savings and Debt Repayment

The “20%” part of the 50 30 20 budget rule is for saving and paying off debt. It’s a key way to build financial security. The more you can save in this part, the more secure the future. It includes:

- Emergency fund: Saving for unexpected expenses

- Debt repayment: Credit card balances, student loans, personal loans

- Retirement savings: 401(k), IRA, or other investment accounts

- Other financial goals: Down payment for a house, education savings, or major purchases

Saving and paying off debt are key to smart money management. Using 20% of your income this way is wise. By setting aside 20% for retirement savings and debt, you take charge of your future. This builds a stable and strong financial life.

How to Implement the 50/30/20 Rule for Budgeting

The secret recipe of success behind how well you follow through on the formula. Here’s a step-by-step guide to make budgeting easier with the 50/30/20 rule.

- Calculate Your After-Tax Income: Calculate your income per month or annum after deducting taxes and other deductions.

- Track your spending: It means keeping track of your expenses for a few months so that you can understand your spending habits.

- Allocate Your Income: Divide your income between the three categories in this ratio: 50/30/20.

- Create a Budget: Develop a detailed budget outlining your income and expenses.

- Review and adjust: Look over your budget regularly and accordingly adjust the money spent.

50/30/20 Budget Rule for Different Income Levels

The 50/30/20 rule is a common budgeting method that high earners can use with ease. But low-income households might need to adjust it a bit. Small changes to the formula can help. Let’s see how households of different income levels can adapt to the 50/30/20 budgeting rule.

Adapting the 50/30/20 Rule for Low-Income Households

The 50/30/20 rule needs some tweaking when dealing with low-income groups. They may use a 60/20/20 or even 70/20/10 budget rule. This way, they cover basic needs but still save and pay off debts.

Applying the 50/30/20 Rule for High-Income Earners

A high-income earner has more room to save or spend. They can adjust the percentage split to match their financial planning goals. Some may follow a 40/40/20 or even 45/35/20 rule, adding more to investing, fun, and long-term saving rule goals.

Common Challenges and Solutions

While the 50/30/20 rule makes a good formula, it may not be suitable for everyone or every financial situation. Some common challenges include:

- Overspending in the “wants” category: Set spending limits, use cash instead of cards, and find free or low-cost alternatives.

- Unexpected expenses: Build an emergency fund to shield against unexpected incidences and adjust the budget accordingly.

- Low income: Prioritize needs and cut back on non-essential expenses. Government assistance programs should be considered if one is eligible.

- High debt: Focus on paying off those with the highest interest rates first and create a debt repayment plan.

Flexibility and adaptability are the keys to overcoming these challenges. Keep changing your budget to maintain financial stability whenever needed.

Get 50/30/20 Budget Template Free

Good news for those who stick to following the budgeting rule. I have created a printable 50/30/20 budget template for your convenience. You can modify this template and download it to keep track of your initiative.

Get Access Printable 50/30/20 Budget Template Free!

To get on track to financial freedom grab our free budget template today.

How to Use 50/30/20 Budget Rule Template

The process of using the 50/30/20 budget template is easy.

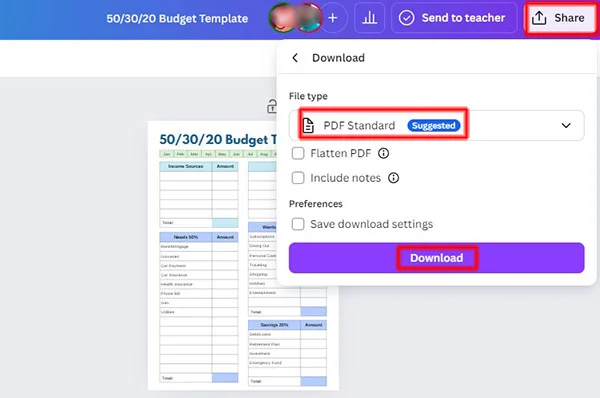

Click on the link given above and download it by clicking on Share button.

Then click on the Download button and choose file type. (by default, PDF standard file will be downloaded). However, if you want you can change the file format to JPG, PNG, SVG.

Moreover, if you want to change the font, text, or color; you can easily do it and then can download your customized budget template.

Download 50/30/20 Budget Rule Template pdf File Free

50/30/20 Budget Calculator

Our 50/30/20 Budget Calculator does the math for you – just enter your income, and it shows how much to put in each category. This tool can help you stay on track, avoid overspending, and save more money with less effort.

👉 Try the 50/30/20 Budget Calculator now and start planning your money with ease!

50/30/20 Budget Planner

Final Thoughts

The 50/30/20 budget rule is a simple way to manage your money. This method works because it helps you balance what you must spend with what you want to enjoy. It also shows you how much to save to secure your future. By sticking to this plan, you can feel more in control of your money and avoid overspending.

The 50/30/20 budget rule is a great tool for taking charge of your finances. It helps you balance what you need, what you enjoy, and how you save for the future. Give it a try and start managing your money in a way that works for you! But keep in mind that budgeting is an ongoing task, so make sure to regularly check and change your plan to match your changing financial goals.

Leave a Reply