The accounting cycle is the backbone of financial record keeping. It provides a structured approach to processing all transactions and producing accurate financial statements. Whether you’re managing a small business or a large corporation, understanding and applying full cycle accounting is essential.

In this guide, we will explain each step of the accounting cycle, from transaction analysis to closing and reversing entries. Additionally, I will discuss the challenges of maintaining the accounting cycle and tips for successfully implementing it.

This comprehensive explanation is perfect for business owners, accounting professionals, and students alike who want to grasp the fundamentals of financial management.

What is the Accounting Cycle?

The accounting cycle is the foundation of all financial reporting processes. It is a systematic series of steps that businesses follow to ensure their financial transactions are accurately recorded and reflected in financial statements like the income statement and balance sheet. The process, known as full cycle accounting, begins when a financial transaction occurs and concludes with the preparation of statements and closing of accounts for the period.

So, we can conclude that the accounting cycle encompasses everything from recognizing a transaction to closing entries to resetting for the next period. The accounting cycle plays a crucial role in maintaining consistency and ensuring that companies comply with regulatory standards like Generally Accepted Accounting Principles (GAAP).

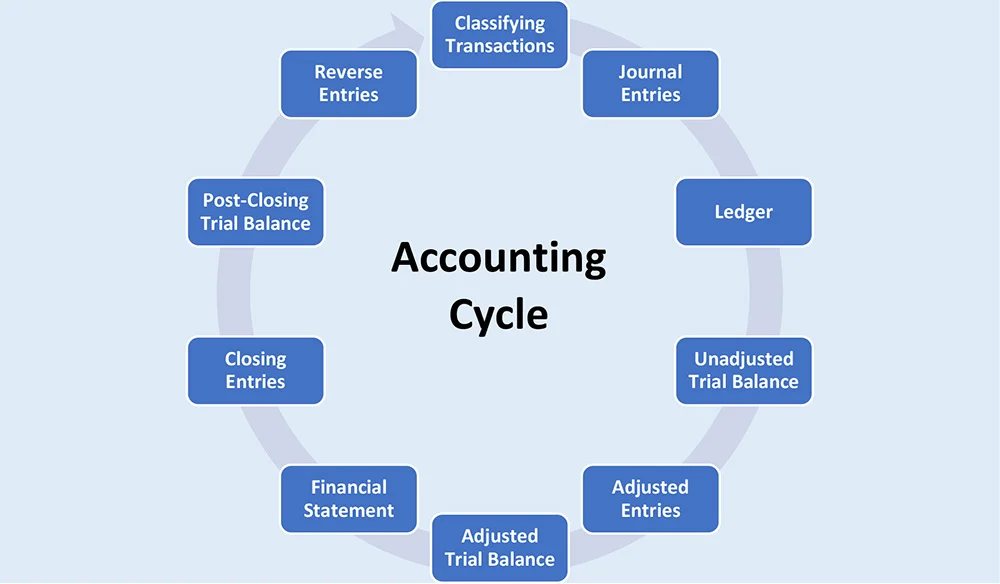

List of Accounting Cycle Steps in Order

10 steps need to be completed for the full cycle accounting process. Here I list the accounting cycle steps in proper order and explain each one in detail. Whether you’re a small business owner or a student studying accounting, understanding the 10 steps of the accounting cycle is essential for accurate financial reporting.

Step 1: Analyzing and Classifying Transactions

The first step in the accounting cycle is to analyze and classify each financial transaction that takes place during the accounting period. This initial step is critical because it ensures that all transactions are accurately identified and prepared for recording.

In this step, accountants evaluate documents such as invoices, receipts, bank statements, and purchase orders to determine how a transaction impacts the financial accounts. For instance, a sale of goods would increase revenue while also impacting cash or accounts receivable. Similarly, purchasing equipment might affect both the asset and expense accounts.

Accurately classifying each transaction into debits and credits ensures that the financial statements later reflect the true financial health of the business. This step is essential in full cycle accounting as it sets the stage for the rest of the accounting cycle.

Step 2: Recording Journal Entries

After analyzing and classifying transactions, the next step in the accounting cycle is to record them in the accounting journal. This process, known as journalizing transactions, involves documenting each financial event in chronological order. The journal serves as the official record of every transaction during the accounting period.

Each entry in the journal is made up of debits and credits, following the double entry accounting system. For every transaction, there must be at least one debit and one credit entry to ensure that the books remain balanced. For example, if a business purchases office supplies, the supplies account is debited, and the cash account is credited.

This step is essential because it lays the foundation for future steps in the accounting cycle, such as posting to the ledger and preparing trial balances. It’s crucial to accurately record every transaction to avoid errors that could disrupt the entire full cycle accounting process.

Step 3: Posting to the Ledger

Once transactions are journalized, the next step in the accounting cycle is to post them to the general ledger. The general ledger is a master record that organizes all transactions by account types – such as assets, liabilities, revenues, and expenses. It provides an overall view of the company’s financial situation.

Posting to the ledger involves transferring each journal entry into its respective ledger account. For instance, a purchase of office supplies in the journal will be posted to both the supplies account and the cash account in the general ledger. This process ensures that all financial data is appropriately categorized. If financial data is properly categorized, it becomes possible to generate accurate financial statements.

Ledger posting is a crucial step because it serves as the foundation for preparing the trial balance, which checks the accuracy of the financial entries. Failing to post journal entries correctly can lead to errors that affect the entire accounting process, impacting financial reporting and decision-making.

Step 4: Preparing the Unadjusted Trial Balance

The next step in the accounting cycle is to prepare the unadjusted trial balance. This step is important for ensuring that the debit and credit totals from all ledger accounts are balanced, as required by the principles of double-entry accounting. The unadjusted trial balance lists all the accounts in the general ledger with their balances at a specific point in time, usually at the end of the accounting period.

To create the unadjusted trial balance, the debit and credit balances of each account are summed. If the total debits equal the total credits, the transactions have been accurately recorded and posted. However, if there’s a discrepancy, it signals that errors in journal entries or ledger postings need to be corrected before moving on.

Step 5: Recording Adjusting Entries

After preparing the unadjusted trial balance, the next step in the accounting cycle is to record adjusting entries. These entries are crucial for ensuring that the revenue recognition and matching principles are followed, which means that revenues and expenses are recorded in the correct accounting period.

Adjusting entries account for items like accrued expenses (e.g., unpaid wages) or deferred revenues (e.g., advance payments for services not yet rendered). These adjustments are necessary because certain transactions may span multiple accounting periods. For example, if rent is paid for six months in advance, an adjusting entry is needed at the end of each month to recognize that portion of the rent as an expense.

Adjusting entries also involves non-cash transactions, such as depreciation or amortization, where the value of assets is systematically reduced over time. By recording these adjustments, businesses ensure that financial statements reflect the accurate financial condition of the company.

Step 6: Preparing the Adjusted Trial Balance

Once the adjusting entries are recorded, the next step in the accounting cycle is to prepare the adjusted trial balance. This document serves as a check to ensure that all journal entries, including the adjustments, have been properly posted to the ledger and that the debit and credit totals still match.

The adjusted trial balance lists all account balances, including those affected by the adjusting entries. Its primary purpose is to ensure that the books are balanced before moving on to preparing the financial statements.

By preparing the adjusted trial balance, businesses confirm that all necessary adjustments, such as depreciation or accrued expenses, have been made. This step ensures that the financial statements will accurately reflect the company’s financial position, aligning revenues and expenses with the appropriate accounting period.

Step 7: Preparing Financial Statements

Once the adjusted trial balance is finalized, the next step in the accounting cycle is to prepare the financial statements. Financial statements provide an organized summary of a company’s financial performance and position for a specific accounting period. There are three key financial statements prepared in this step: the income statement, balance sheet, and cash flow statement.

- Income Statement: This document reports the company’s revenues, expenses, and profits or losses during the accounting period. It answers questions like “How profitable was the business?” by summarizing operational efficiency and profitability.

- Balance Sheet: This statement provides a snapshot of a company’s financial position at a specific date. It lists assets, liabilities, and equity, giving a comprehensive overview of the company’s financial health.

- Cash Flow Statement: The cash flow statement tracks how cash moves in and out of the business, showing how well the company manages its cash to fund operations, investments, and financial activities.

These statements are critical because they provide insights into a company’s performance and are used by stakeholders – such as investors, managers, and regulators to make informed decisions. Preparing accurate financial statements is essential for reflecting the true financial condition of the business and adhering to regulatory requirements.

Step 8: Recording Closing Entries

The next step in the accounting cycle is to record closing entries. This process is essential for resetting temporary accounts, such as revenue, expense, and dividend accounts, to prepare for the next accounting period. Temporary accounts accumulate transactions over the accounting period, but in the end, their balances need to be transferred to permanent accounts, such as retained earnings, to show the company’s accumulated profits or losses.

The last step in the accounting cycle is to close these temporary accounts so they start fresh in the new period. For instance, the total revenues earned during the period will be transferred to the retained earnings account, and all expense accounts will be zeroed out. This ensures that the next accounting period begins with clean accounts, unaffected by prior transactions.

Recording closing entries is a key part of full cycle accounting as it helps ensure the financial statements reflect the correct period’s activity. Once these entries are made, the company’s financial records are ready for the next step in the cycle.

Step 9: Preparing the Post-Closing Trial Balance

After recording the closing entries, the next step in the accounting cycle is to prepare the post-closing trial balance. This document ensures that the ledger is balanced and that all temporary accounts (such as revenues and expenses) have been closed properly. The post-closing trial balance contains only permanent accounts such as assets, liabilities, and equity. This is because all temporary accounts, like revenue, expenses, and dividends, are reset to zero during the closing process. As a result, only the balances of accounts that carry over to the next accounting period are included in the post-closing trial balance.

The purpose of the post-closing trial balance is to verify that the debits and credits in the remaining accounts are equal, ensuring the books are balanced and ready for the new accounting period. If any discrepancies are found, adjustments must be made before moving forward.

Step 10: Recording Reversing Entries

The final step in the accounting cycle is to record reversing entries. This step is optional, but many businesses use it to simplify their accounting for the next period. Reversing entries are made at the beginning of the new accounting period to reverse certain adjusting entries made in the previous period, such as accrued revenues or expenses.

For example, if a business recorded an accrued salary expense at the end of the last period, a reversing entry would be made at the start of the new period to eliminate that accrual. This prevents the salary expense from being double-counted when the actual payment is made.

The purpose of reversing entries is to streamline the recording of transactions in the new period, reducing the chance of errors. This final step ensures that the accounting cycle resets correctly, allowing for smooth and accurate financial reporting in the new period.

Common Challenges in the Accounting Cycle

The accounting cycle is a systematic process that involves recording, classifying, and summarizing financial transactions. However, various challenges have to be faced to maintain the accounting cycle effectively. Here are some of the most prevalent issues faced by accounting professionals:

1. Data Entry Errors

Manual processes and inconsistent data formats can lead to frequent issues such as typos, duplications, and missing entries. These bookkeeping errors can disrupt the entire cycle, leading to inaccurate journal entries and financial reports. Using cloud accounting software like Quickbooks, Xero, Freshbooks, Sage, etc can minimize these errors.

2. Reconciliation Issues

One of the most critical steps in the accounting cycle is reconciliation, especially for bank statement reconciliations and account balances. Discrepancies often arise due to timing differences, unidentified transactions, or mismatches between systems. These issues can prolong the closing process and impact the accuracy of financial statements.

3. Keeping Up with Regulatory Changes

Adhering to evolving accounting standards, such as updates to IFRS and GAAP, and keeping track of changing tax laws are constant challenges for businesses. Ensuring compliance requires continuous monitoring, training, and adapting to new regulations. Failure to do so can lead to penalties and inaccurate financial reporting.

4. System Limitations and Integration Challenges

Outdated accounting systems or a lack of integration with other business tools, such as CRM or inventory management systems, can hinder the efficiency of the accounting cycle. These limitations can lead to data silos, making it harder to access comprehensive financial information.

5. Maintaining Data Security and Integrity

Protecting sensitive financial data is critical for maintaining the integrity of financial records. As businesses handle increasing amounts of digital financial information, implementing strong cybersecurity measures is essential. Data security challenges, such as unauthorized access or data breaches, can disrupt the accounting cycle and lead to severe consequences.

6. Talent Recruitment Challenges

The success of the accounting cycle heavily depends on having skilled accounting professionals. However, a shortage of talent and frequent staff turnover can disrupt the process. Ongoing training and investment in accounting personnel are necessary. However, you can also outsource bookkeeper services for consistent expertise and a smooth, accurate accounting cycle.

Tips for Successfully Maintaining the Accounting Cycle

Maintaining an efficient accounting cycle is essential for accurate financial reporting and effective business management. Here are key strategies to ensure success:

1. Embrace Automation

Automating routine tasks within the accounting cycle is essential for improving efficiency and reducing manual errors. Use accounting software like Quickbooks, Xero, Freshbooks, Bill to automate invoicing, bill payments, and financial reporting. By leveraging cloud-based platforms, you gain real-time financial data and integration with other tools like CRM, keeping your business agile and accurate.

2. Standardize Processes

Establishing standardized procedures for recording transactions and closing the books is critical for maintaining consistency within the accounting cycle. Use detailed checklists for monthly closings to ensure all steps, from journal entries to reconciliations, are completed accurately. Maintaining clear documentation of workflows also ensures compliance with GAAP or IFRS standards.

3. Regular Reviews and Reconciliation

Performing regular reviews and reconciliations is vital for catching errors early in the accounting cycle. Frequently reviewing financial statements and conducting bank statement reconciliations ensures the accuracy of transactions and balances. Additionally, using financial performance ratios or benchmarks can help measure the company’s overall health.

4. Continuous Training and Development

Investing in continuous training for your accounting team ensures they stay updated on the latest regulations, technologies, and best practices in bookkeeping. Encourage your staff to participate in online courses or workshops that focus on bookkeeping, tax regulations, or emerging trends in financial reporting, which enhances their ability to manage the accounting cycle efficiently.

FAQs

What is full cycle accounting?

Full cycle accounting refers to the complete process of the accounting cycle, from analyzing transactions to preparing financial statements and closing the books for the accounting period.

What is the first step in the accounting cycle?

The first step in the accounting cycle is to analyze and classify transactions to determine how they impact the accounts.

What is the last step in the accounting cycle?

The last step in the accounting cycle is to record reversing entries, and prepare the business for the next accounting period.

Final Words: Why the Accounting Cycle Matters

The accounting cycle is essential for business because it ensures that the accounting information of any particular business is accurate and valid. By following the 10 steps of the accounting cycle, businesses can record, adjust, and summarize the recorded financial transactions in a much more orderly manner, which provides them with a clear picture of their financial health. Each step helps ensure that the records are updated with accurate information that stakeholders use to make an accurate decision.

Completing the full cycle accounting process ensures that financial statements reflect the correct revenues, expenses, assets, and liabilities for the period. This cycle also helps businesses to comply with regulatory requirements, like GAAP, and make informed decisions based on reliable data. To comply with this cycle is mandatory for all businesses. I have tried to explain the accounting cycle in detail. However, if you have any questions related to this issue, feel free to put them down and put your thoughts in the comment box.

Leave a Reply