Author: Kamrul Hasan Noor

-

2026 IRS Tax Bracket Changes

Wondering how next year’s tax changes will affect your wallet? The IRS has rolled out major updates for 2026, including brand new tax brackets, increased standard deductions, and sweeping reforms from the “One, Big, Beautiful Bill” (OBBB). Whether you file

-

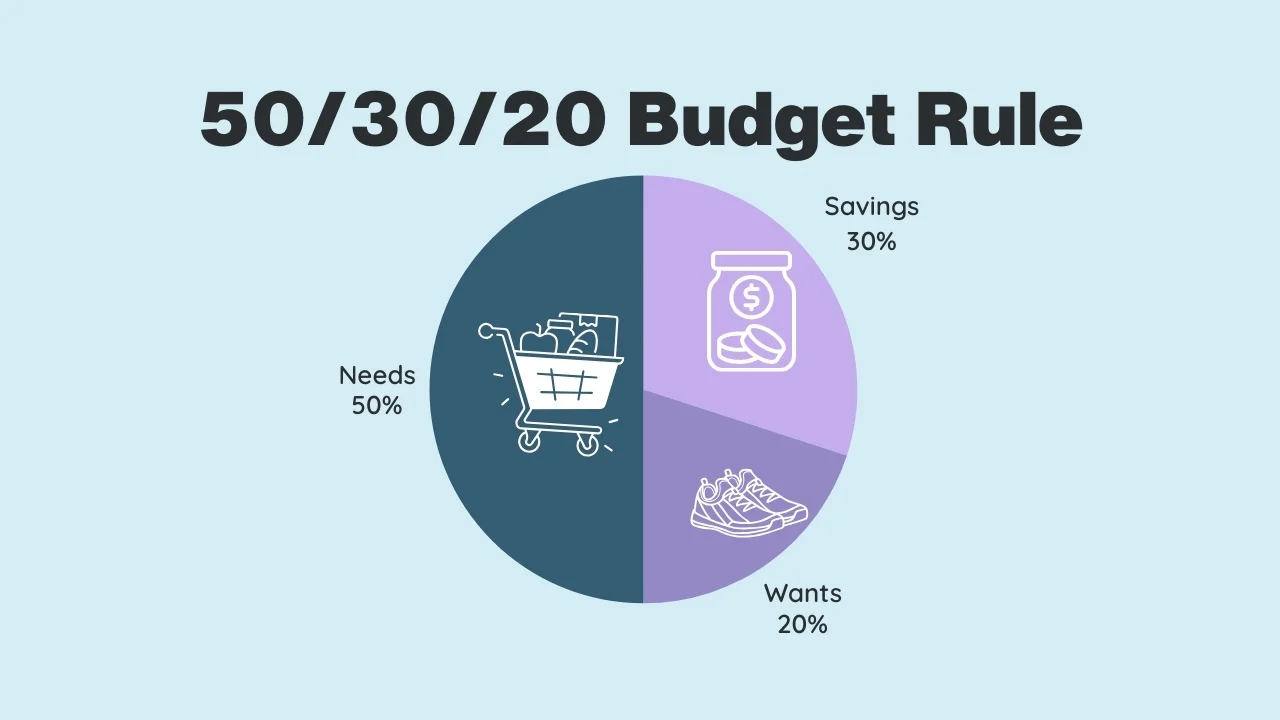

50/30/20 Budget Rule: Smart Money Management

Have you heard of the 50/30/20 budget rule? It’s a simple way to manage your money better and reach your goals. This budgeting method helps you plan how to allocate your income most effective way Do you feel like your

-

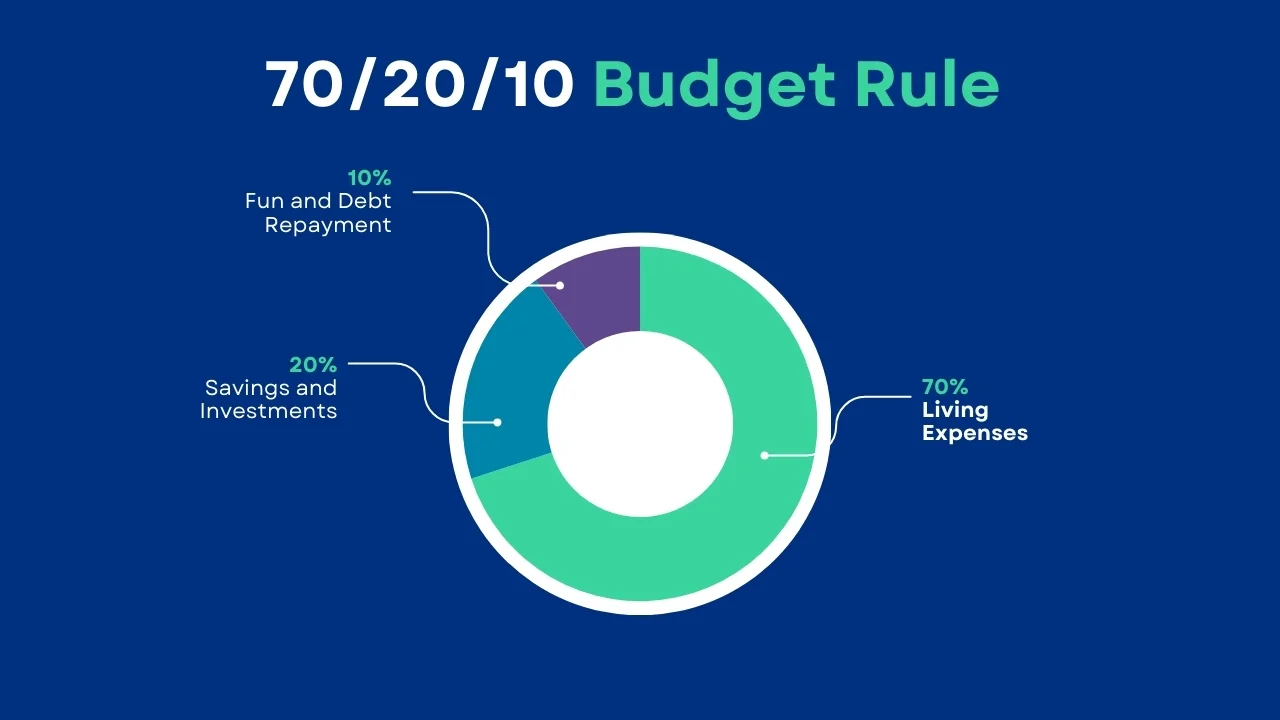

How 70/20/10 Budget Rule Works

Budgeting is the safety net that ensures you have control over your finances, and one of the simplest yet most effective budgeting methods is the 70/20/10 budget rule. The 70/20/10 budget rule is a simple yet powerful framework that offers

-

Top 5 Accounting Software for Mac 2025

Looking for the Best Accounting Software for Mac? Here’s What You Need to Know! Managing your finances on a Mac? You need the right accounting software to track expenses, send invoices, and generate reports effortlessly. But with so many options,

-

12 Actionable Money Saving Tips to Reduce Expenses

Saving money doesn’t have to be overwhelming. With the right money saving tips, you can cut expenses effortlessly and grow your savings without sacrificing your lifestyle. The key to saving money is being intentional with your spending. By tracking expenses,

-

15 Essential Tax Deductions for Self-Employed Professionals 2025

Did you know that many self-employed professionals pay more taxes than they should? Understanding tax deductions for self-employed individuals can help you reduce your taxable income and keep more of your earnings. The right deductions can make a big difference

-

Top 10 Tax Deductions for Small Business 2025

Did you know that many small business owners overpay their taxes simply because they miss out on key deductions? Understanding tax deductions for small business can help you lower your taxable income and keep more of your hard-earned money. Every

-

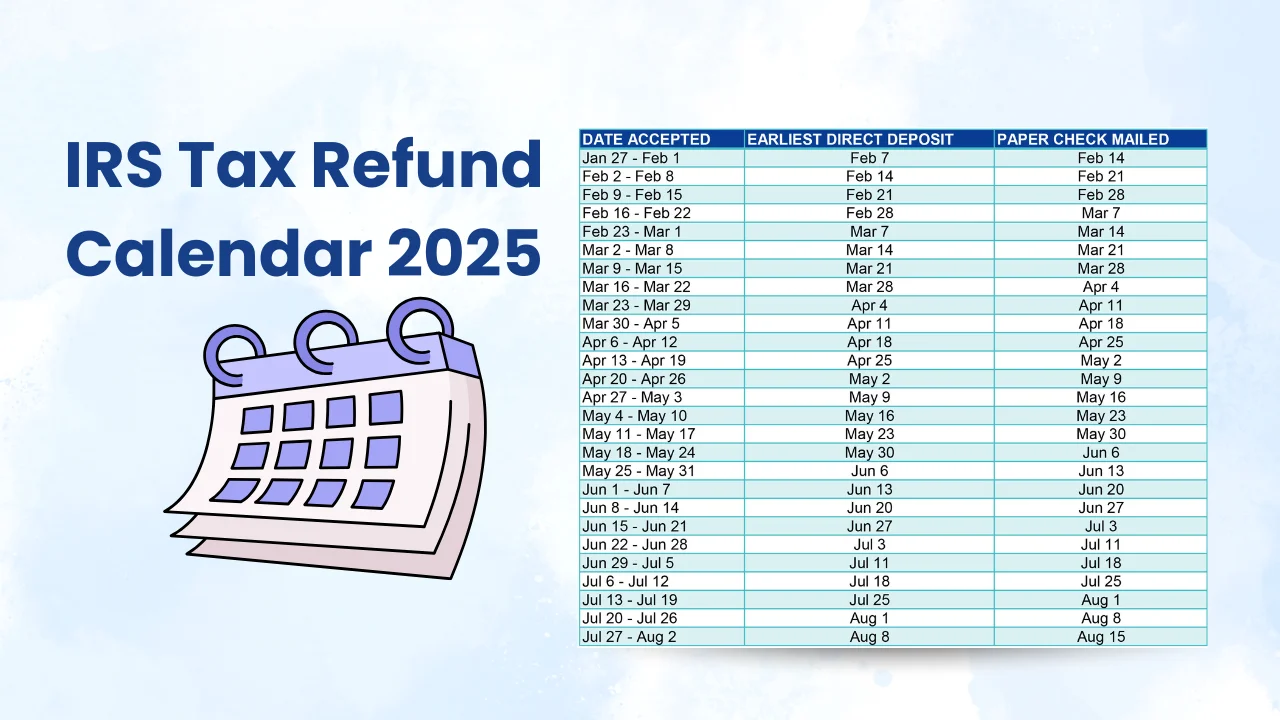

IRS Tax Refund Calendar 2025

As the new year approaches, millions of taxpayers eagerly await their refunds. Knowing the IRS tax refund calendar 2025 can turn this waiting game into a well-planned financial strategy. A tax refund is the IRS returning overpaid taxes from the previous year,

-

How to Use IRS2Go App to Track Tax Refund Status 2025

Imagine the anticipation of waiting for your tax refund, that little boost to your finances. Are you wondering how to use the IRS2Go App to track tax refund status 2025? You’re not alone. Everyone wants to know when their money

-

H&R Block Review 2025: Features, Pricing, and User Experience

Tax season can be stressful, but the right software can make it easier. In this H&R Block review, we’ll explore whether this popular tax filing service is the right choice for you. Filing taxes correctly is essential to avoid penalties