Author: Kamrul Hasan Noor

-

Top 7 Best Payroll Software for Small Business

The 7 best payroll software for small businesses are Gusto, QuickBooks Payroll, Paychex, Justworks, Patriot Software, ADP, and Wave. These solutions offer user-friendly interfaces and robust features. Small businesses need efficient payroll software to manage employee payments and compliance. Choosing

-

Top 5 Affordable Accounting Solutions for Small Business

Many small business owners struggle with bookkeeping, tax filing, and staying compliant with laws. This is where affordable accounting solutions come in. Did you know that 60% of small business owners say they don’t have enough time to handle their

-

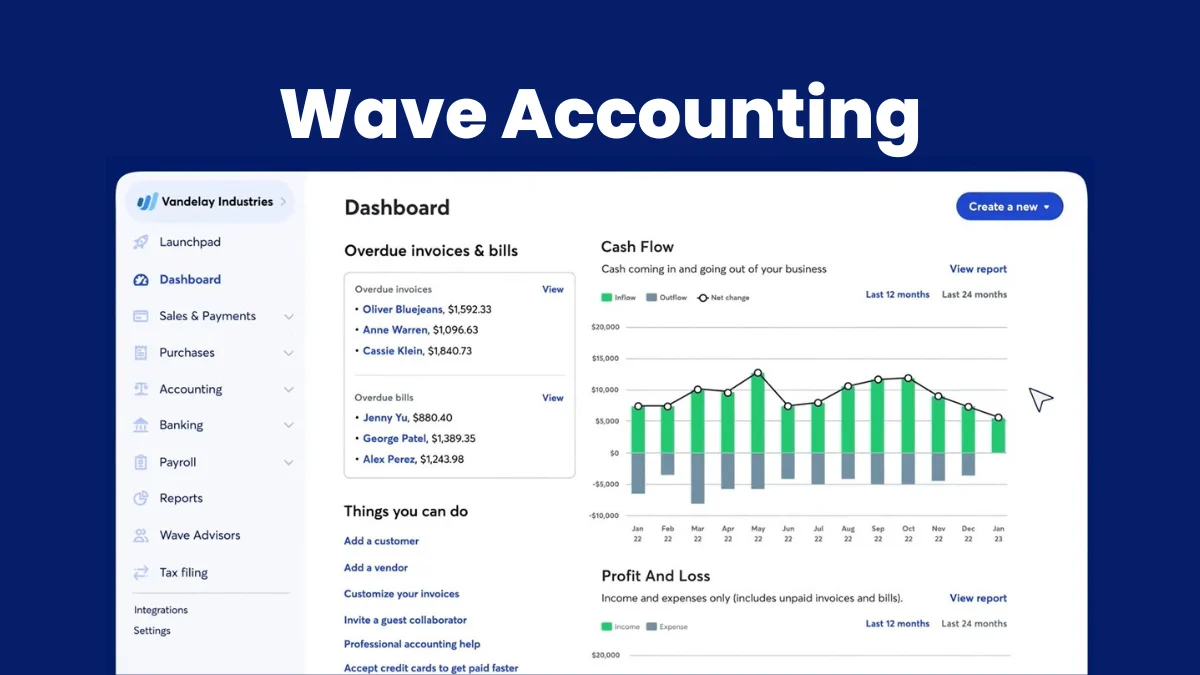

Wave Accounting Reviews: Features, Pricing, Pros & Cons

Running a business is no small task, especially for freelancers and small business owners. Wave Accounting reviews show how it makes tracking your income and expenses easy. Wave is a free, cloud-based accounting software that makes handling finances simpler. Whether

-

Top 7 Best AI Tools for Accounting 2025

In today’s world, artificial intelligence (AI) is changing how we work. Accounting is no exception. AI tools for accounting transform hours of tedious financial work into just minutes. AI tools for accounting are software programs that help manage financial tasks

-

Wave vs QuickBooks: Which Accounting Software is Best for Small Business?

Wave offers free accounting tools, while QuickBooks provides comprehensive paid accounting solutions. Both cater to small businesses but differ in features and pricing. Wave and QuickBooks are popular accounting software options for small businesses. Wave is known for its free

-

Who is the Richest Person in the World 2025?

Who is the richest person in the world? This question fascinates people worldwide because wealth represents not just money but power, influence, and innovation. In 2025, the global billionaire rankings show a world where some individuals own more wealth than

-

How to Use Quickbooks for Personal Finance

Using QuickBooks for personal finance helps streamline budgeting and track expenses efficiently. It offers robust tools for financial management. QuickBooks is a powerful software designed for financial management. It allows individuals to monitor expenses, create budgets, and generate financial reports.

-

Top 10 Best Bookkeeping Services for Small Business 2025

Managing your business finances doesn’t have to be a headache. But with the best bookkeeping services for small business, 2025 brings many easy and affordable options to help you stay organized and save time. Today, small businesses have many ways

-

Top 10 Best Law Firm Bookkeeping Services in Fiverr 2025

Are You a Lawyer Struggling with Finances? Explore the Top 10 best law firm bookkeeping services on Fiverr. Legal bookkeeping is not easy for law firms. It requires accurate bookkeeping to track money, manage accounts, and comply with legal financial

-

10 Reasons QuickBooks is the Best Accounting Software for Small Business

Are you ready to boost your bottom line? Find out 10 Reasons QuickBooks is the Best Accounting Software for Small Business. Managing money is very important for any small business. Business owners need to know how much money is coming