Author: Kamrul Hasan Noor

-

What is the Financial Accounting Standard?

Financial Accounting Standards are rules and guidelines that govern the preparation of financial statements. These standards ensure consistency and transparency in financial reporting, helping stakeholders make informed decisions. Financial Accounting Standards promote accountability and accuracy in financial reporting by setting

-

Outsource Bookkeeping for Small Business: Save Time & Money

Outsource bookkeeping for small businesses to save time and reduce costs. It ensures accuracy and compliance with financial regulations. Outsourcing bookkeeping allows small business owners to focus on core operations while experts manage their financial records. It provides access to

-

What is the Key Financial Reporting Components?

Key financial reporting components include the income statement, balance sheet, cash flow statement, and statement of shareholders’ equity. These elements provide a comprehensive view of a company’s financial health. Financial reporting is crucial for assessing the financial performance and position

-

What are the Legal Requirements of Financial Reporting for Nonprofits

Financial reporting for nonprofits involves adhering to a variety of legal requirements. These requirements vary depending on factors such as the organization’s size, revenue, and specific state regulations. Not fulfilling them puts an organization’s legal status, transparency, and stakeholders’ trust

-

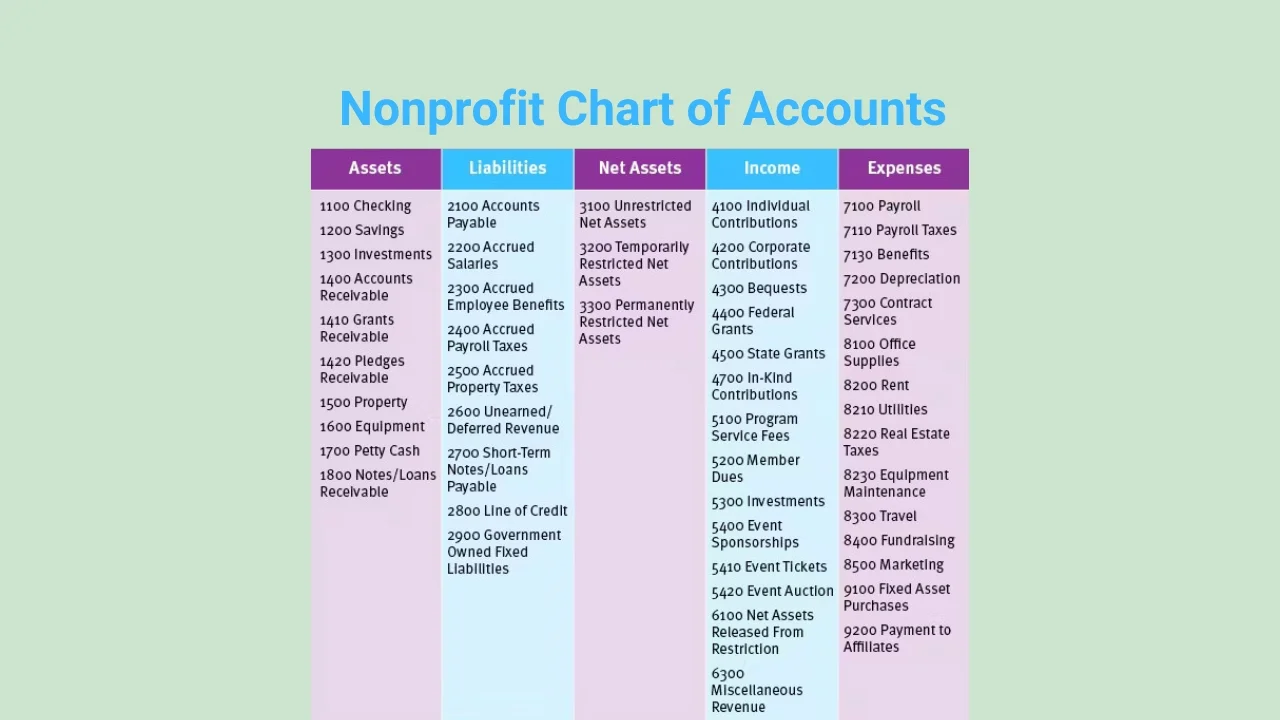

Nonprofit Chart of Accounts – Components, Purposes, Example

A nonprofit chart of accounts (COA) is a comprehensive list of financial accounts and ledgers that a nonprofit organization uses to categorize and track its financial activities. It serves as the backbone of all accounting procedures and helps in organizing

-

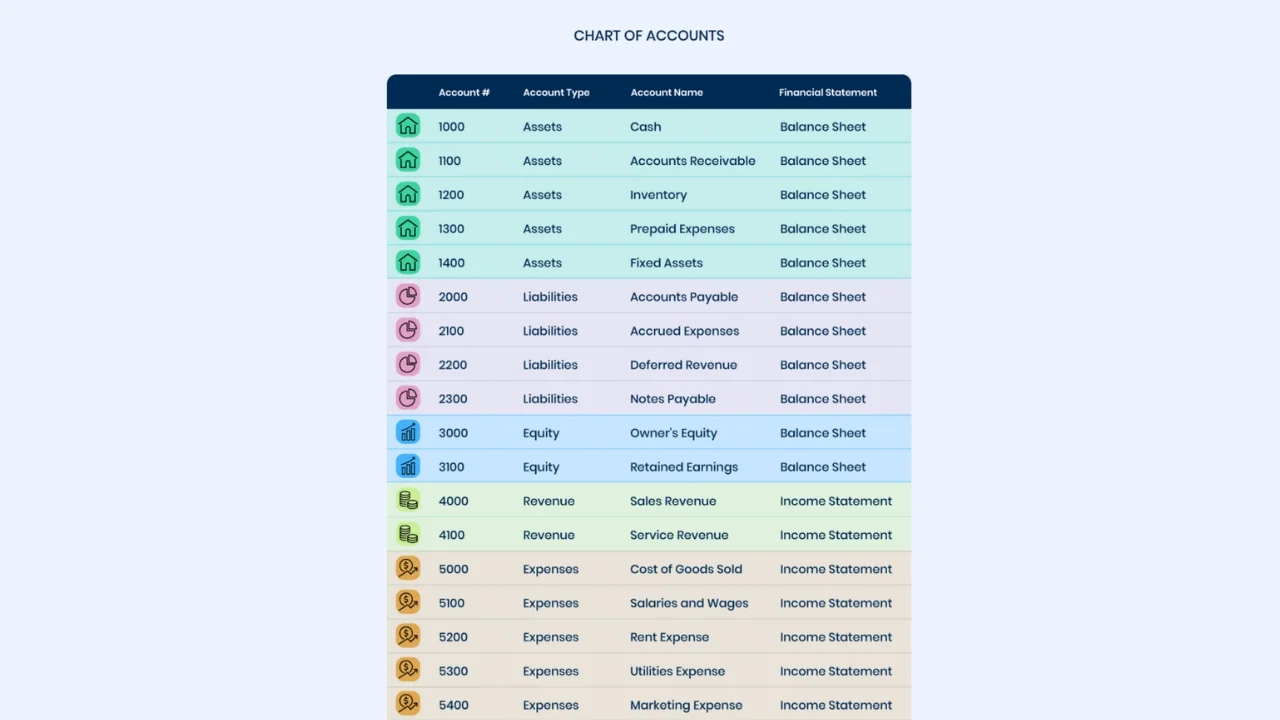

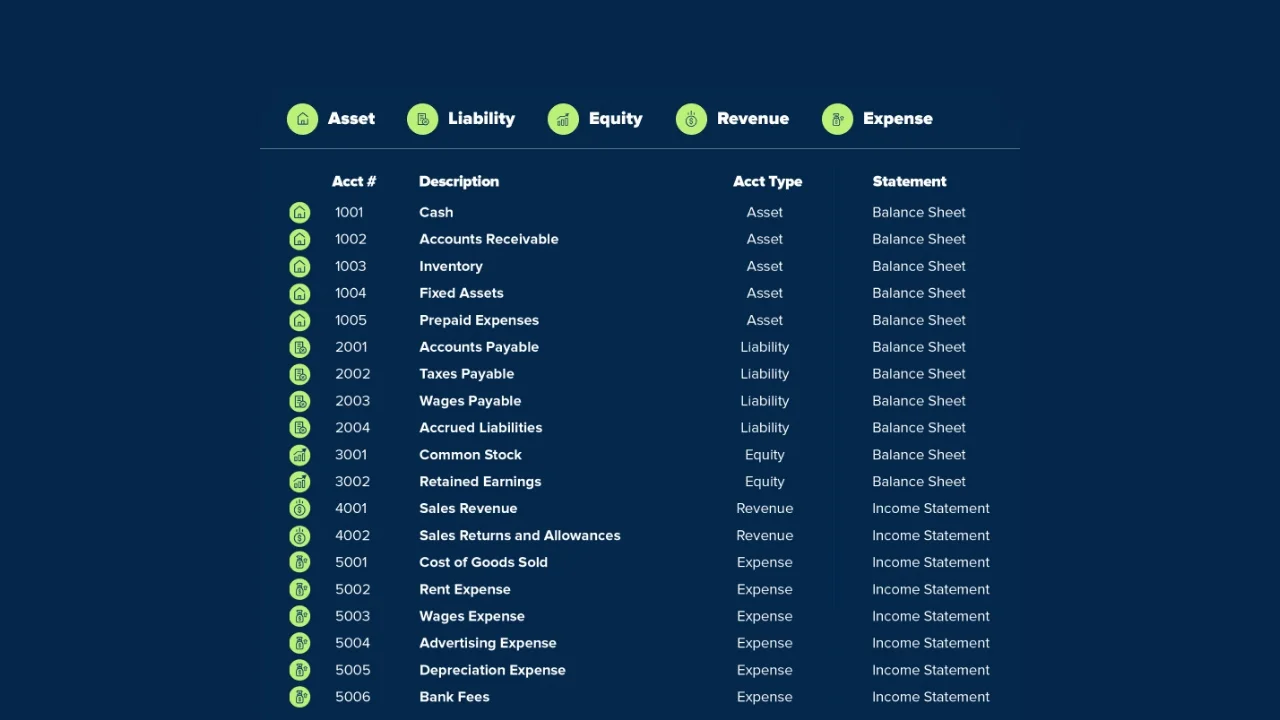

Sample Chart of Accounts

A well-structured financial framework is essential for the success of any business. The Chart of Accounts (COA) acts as the cornerstone of this framework, offering a precise and comprehensive structure for documenting all financial activities. However, there is no unified

-

Chart of Accounts – How to Create, Categories

Managing finances efficiently is crucial for any business, and a well-structured Chart of Accounts (COA) is a key tool in achieving this. Understanding how to use and categorize your COA can simplify your accounting processes and provide clear insights into

-

What statement is accurate regarding double entry bookkeeping?

In the world of finance and accounting, precision matters. In the modern age, most businesses and organizations follow double entry accounting systems for maintaining accurate and organized financial records. Double entry bookkeeping stands as the cornerstone of this financial record-keeping

-

Limitations of Double Entry Accounting

The key limitations of double entry accounting are its complexity and missing key non-financial data. Double Entry Accounting is the cornerstone of financial management, offering a clear picture of your business’s financial health. Similar to how a coin has heads

-

Advantages of Double Entry Accounting

The advantages of double entry accounting include enhanced accuracy, completeness, consistency, and transparency in financial records. Double entry accounting is the backbone of modern accounting practices. In the previous post, we have discussed about details of double entry accounting including