Finding the best accounting software for small retail business is imporatnt in the fast-paced world of retail.

Financial management is one of the most crucial factors in any business venture. Most small business owners or retail owners manage all the activities, including accounting for their business. In this case, accounting software is the best practice to monitor the business’s sales, expenses, and cash flow. Besides, recent accounting software provides all business management features including inventory management, accounts payable and receivable management, and keeping up with taxes and financial reports preparations.

In this guide, I’ll explain the details of top accounting software designed specifically for small businesses in retail. Besides, this guide helps you to provide a complete guide of which key features and factors you consider while you are choosing your accounting software. To discover the best accounting software and the benefits of using accounting software for small business below.

Benefits of Using Accounting Software

Small business accounting is possible without using accounting software. However, the advantages of using accounting software in small retail business are:

Time-saving Features

Time-saving features in accounting software are crucial for small business. These features help reduce manual work, allowing business owners to focus on growth. Here are some key time-saving features:

- Automated Data Entry: Minimizes errors and speeds up the process.

- Bank Reconciliation: Quickly matches transactions with bank statements.

- Recurring Billing: Automatically generates and sends invoices.

- Expense Tracking: Easily monitor and categorize expenses.

Automated data entry can save hours each week. Bank reconciliation ensures your books are always accurate. Recurring billing eliminates the need to create invoices manually. Expense tracking helps you stay on top of your finances.

Accurate Financial Reporting

Accurate financial reporting is essential for making informed business decisions. Accounting software provides detailed reports that are easy to understand. These reports can include:

- Profit and Loss Statements: Shows your business’s performance over time.

- Balance Sheets: Provides a snapshot of your financial position.

- Cash Flow Statements: Tracks the flow of money in and out of your business.

- Tax Reports: Helps you prepare for tax season.

Profit and loss statements help you understand your revenue and expenses. Balance sheets give you a clear view of your assets and liabilities. Cash flow statements ensure you know where your money is going. Tax reports simplify tax filing, reducing stress and errors.

Streamlined Invoicing And Billing

Streamlined invoicing and billing are vital for maintaining a healthy cash flow. Accounting software makes this process efficient and error-free. Key features include:

- Customizable Invoice Templates: Create professional-looking invoices.

- Automatic Payment Reminders: Ensure timely payments from clients.

- Online Payment Integration: Allow clients to pay directly through the invoice.

- Invoice Tracking: Monitor the status of sent and received invoices.

Customizable invoice templates save time and enhance your brand. Automatic payment reminders reduce late payments. Online payment integration offers convenience for you and your clients. Invoice tracking keeps you informed about unpaid invoices, helping you manage your finances better.

Key Features to Look for in Accounting Software

Choosing the best accounting software for small retail business can be challenging. The right software can make managing finances easier. It can save time and reduce errors. There are key features to look for in accounting software. These features can help ensure the software meets the needs of your business.

Ease of Use

Ease of use is a crucial feature in accounting software. It ensures that even non-accountants can navigate it easily. A user-friendly interface can save a lot of time and effort. Clear and simple menus make it easier to find what you need.

- Intuitive dashboard: Displays essential information at a glance.

- Simple data entry: Reduces the chances of making mistakes.

- Help and support: Available within the software for quick assistance.

Software that is easy to use can reduce training time. This can be beneficial for small businesses with limited resources. Drag-and-drop functionality can make tasks like uploading receipts straightforward. Mobile access is also a plus. It allows business owners to manage finances on the go.

Customizable Reporting

Customizable reporting allows businesses to generate reports tailored to their needs. This feature helps in making informed decisions. Reports can be adjusted to show specific data. Financial reporting including cash flow reports, and profit and loss statements are some examples.

Having customizable templates can save time. Businesses can create and save their report formats. This makes it easier to generate reports regularly. Visualization tools like charts and graphs can make data easier to understand.

| Report Type | Description |

|---|---|

| Profit and Loss | Shows revenue and expenses over a period. |

| Cash Flow | Tracks cash inflows and outflows. |

| Balance Sheet | Displays assets, liabilities, and equity. |

Customizable reporting can help in identifying trends and making strategic decisions. This can lead to better financial management and growth.

Integration With Banking And Payment Systems

Integration with banking and payment systems is a must-have feature. It simplifies financial processes. Automatic bank feeds can save time. They ensure that your transactions are always up to date. The accounting software reduces the need for manual entry.

Integration with payment gateways can make invoicing easier. It allows customers to pay directly through invoices. The well-structured accounting software can improve cash flow. Reconciliation becomes simpler as transactions are matched automatically. This ensures your accounts are accurate.

- Automatic bank feeds: Keeps your transactions updated.

- Payment gateway integration: Simplifies receiving payments.

- Automatic reconciliation: Matches transactions automatically.

Having this integration can reduce errors and save time. It allows business owners to focus on other important tasks. This feature can improve overall efficiency and accuracy in financial management.

6 Best Accounting Software for Small Retail Business

Choosing the best accounting software for retail business can be tough. There are many options available. We will discuss the top 6 accounting software options for retail business. These are QuickBooks Online, Xero, FreshBooks, Wave Accounting, Odoo, and Zoho Books. Each has its unique features and benefits.

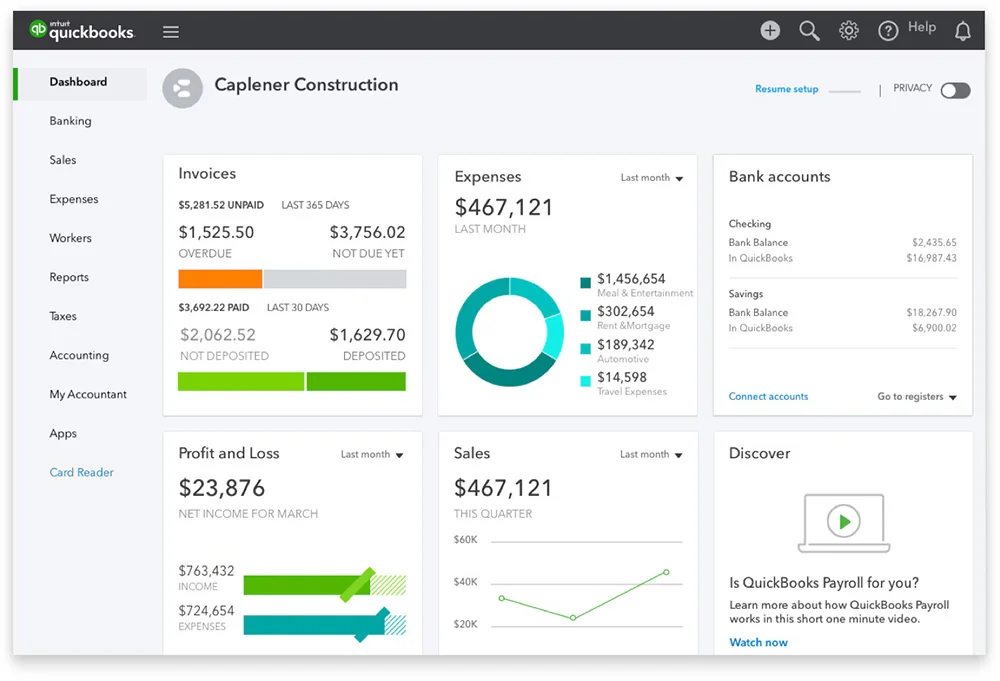

QuickBooks Online: Best Overall

QuickBooks Online is a top choice for small retail businesses. It offers versatile solutions for small business owners. The software includes powerful tools for tracking income. It also helps manage inventory efficiently. Integration with POS systems is another key feature. For retailers, it manages both online and in-store sales smoothly. This makes QuickBooks Online an exceptional choice.

QuickBooks Online includes:

- Invoicing: Create and send invoices quickly.

- Expense Tracking: Keep track of your expenses.

- Bank Integration: Connect your bank account for easy reconciliation.

- Reporting: Generate financial reports with ease.

Pros

Cons

QuickBooks Online offers several pricing plans. This makes it suitable for businesses of all sizes. The plans range from simple start to advanced. Each plan includes different features to meet various business needs.

Xero: Best for Specialty Retailers

If you run a retail business, Xero might be ideal. Whether you’re a bookstore, boutique, or florist, it fits well. Xero is one of the best accounting software for small retail business. It’s simple and flexible for specialty retailers’ needs. Xero provides user-friendly features for managing retail accounting. Small shops can handle finances without complex systems. Xero is cloud-based, so you can access it from any device.

Xero includes:

- Invoicing: Create professional invoices and get paid faster.

- Bank Reconciliation: Connect your bank account and reconcile transactions easily.

- Inventory Management: Keep track of your inventory levels.

- Financial Reporting: Generate detailed financial reports.

Pros

Cons

Xero offers various pricing plans, each with different features, so you can choose one that fits your business needs. The plans range from starter to premium.

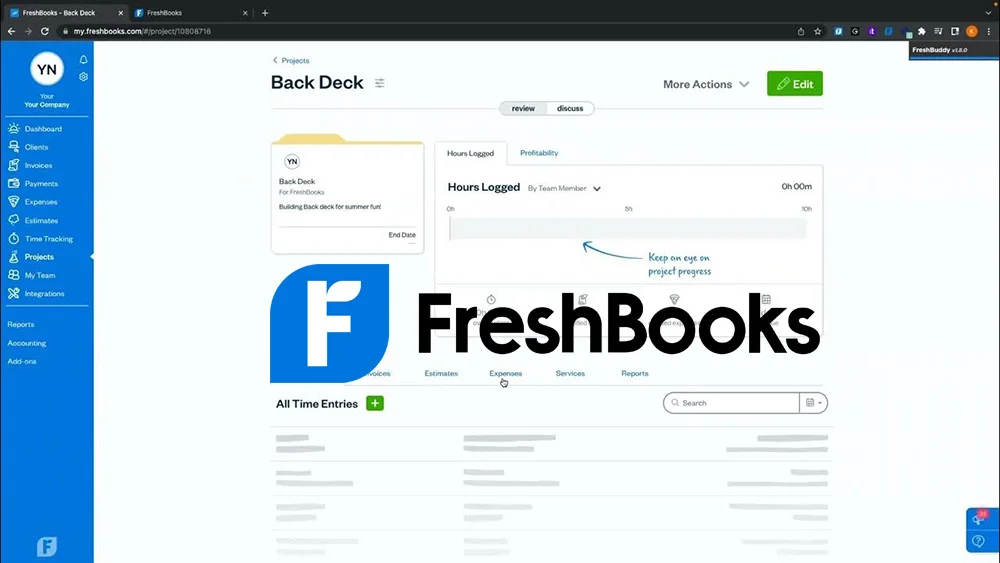

FreshBooks: Best for Ease of Use

For small retail businesses, FreshBooks is an ideal accounting solution. It stands out for its simplicity and ease of use. Designed with non-accountants in mind, FreshBooks offers an intuitive interface. Retailers can manage their finances with minimal effort. This user-friendly design appeals to small business owners. It’s perfect for those without an accounting background.

FreshBooks includes:

- Invoicing: Create and send professional invoices.

- Expense Tracking: Track your business expenses.

- Time Tracking: Log your work hours and bill clients accordingly.

- Financial Reports: Generate detailed financial reports.

Pros

Cons

FreshBooks offers different pricing plans. This allows you to choose one that fits your business needs. The plans range from lite to premium, each with different features.

Wave: Best Free Software

For small retail businesses with tight budgets, Wave is a great option. It provides a free accounting solution for essential financial needs. There are no monthly fees, making it budget-friendly. Wave is ideal for sole proprietors and small retailers. It works well for those who don’t need features like inventory tracking or payroll. With Wave, you can manage finances efficiently and focus on growing your business.

Wave Accounting includes:

- Invoicing: Create and send invoices for free.

- Expense Tracking: Track your business expenses easily.

- Bank Reconciliation: Connect your bank account and reconcile transactions.

- Financial Reports: Generate detailed financial reports.

Pros

Cons

Wave Accounting is free to use. There are no hidden costs or fees. This makes it a great choice for small businesses on a budget.

Zoho Books: Best for Automation

If you want to reduce manual data entry, Zoho Books is a great choice. It helps small retail businesses streamline accounting processes. Zoho Books offers powerful automation features. It automates tasks like invoicing, payment reminders, and tax calculations. This saves time and improves efficiency. It’s an ideal solution for retailers with frequent transactions.

Zoho Books includes:

- Invoicing: Create and send professional invoices.

- Expense Tracking: Track your business expenses.

- Inventory Management: Keep track of your inventory levels.

- Financial Reports: Generate detailed financial reports.

Pros

Cons

Zoho Books offers various pricing plans. This allows you to choose one that fits your business needs. The plans range from basic to professional, each with different features.

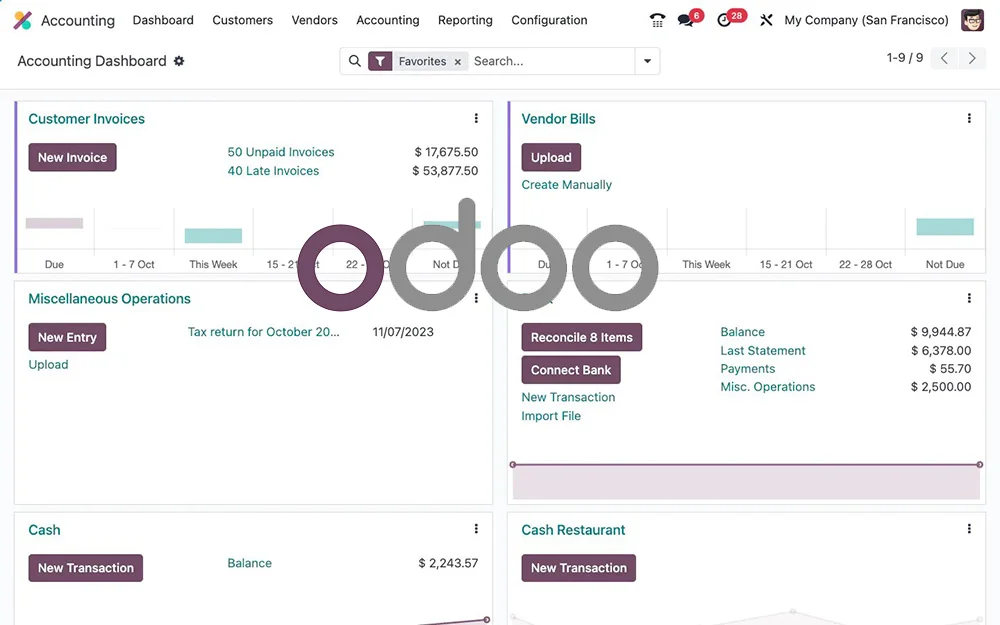

Odoo: Best for Customization

For retail businesses needing flexibility, Odoo is a great choice. It shines because it can be tailored to specific needs. Odoo stands out with its modular design. Businesses can pick and customize the features they need. Whether you’re small or growing, Odoo adapts. Its customization fits businesses that want scalable accounting software.

Odoo includes:

- Modular Design: Choose and customize apps as your business needs.

- Integrated System: Connect accounting with CRM, inventory, and sales.

- User-friendly Interface: Navigate easily with a simple and intuitive design.

- Automation: Automate invoicing, reconciliation, and tax tasks.

- Open-source Flexibility: Customize fully with access to source code.

Pros

Cons

Odoo offers flexible pricing plans. You can select the one that suits your business needs. The plans range from basic to advanced, each offering different features.

Factors to Consider When Choosing Accounting Software

Choosing the best accounting software for small retail business can be a daunting task. With numerous options available, selecting a solution that meets specific needs is crucial. Small businesses must consider various factors, including cost, customer support, and mobile accessibility. These elements ensure that the chosen software provides the tools for efficient financial management.

Cost and Scalability

Small businesses often operate on tight budgets. Cost is a significant factor when choosing accounting software. It is essential to find a solution that offers value for money. Some software options provide basic features at a lower cost, while others offer comprehensive tools at a higher price.

- Free or low-cost options: Ideal for startups and very small businesses.

- Mid-range options: Suitable for growing businesses that need more features.

- Premium options: Best for established businesses requiring advanced functionalities.

Scalability is another critical consideration. The software should grow with the business. It should accommodate more users, transactions, and data as the business expands. Look for solutions that offer different plans or modules to add features as needed.

| Plan Type | Cost Range | Features |

|---|---|---|

| Basic | $0 – $20/month | Invoicing, Expense Tracking |

| Standard | $20 – $50/month | Payroll, Inventory Management |

| Premium | $50+/month | Advanced Reporting, Multiple Users |

Customer Support

Reliable customer support is crucial for small businesses using accounting software. Issues can arise, and timely assistance is necessary to resolve them. Look for providers that offer multiple support channels, such as phone, email, and live chat.

24/7 support is beneficial for businesses that operate outside standard hours. It ensures help is available whenever needed. Support should also be knowledgeable and responsive to provide effective solutions quickly.

- Phone Support: Direct and immediate assistance.

- Email Support: Documented communication for detailed issues.

- Live Chat: Quick responses for minor queries.

- Help Center/Knowledge Base: Self-service for common issues and tutorials.

User reviews and testimonials can provide insights into the quality of customer support. It is advisable to choose a provider with positive feedback in this area. Good support can save time and prevent disruptions to business operations.

Mobile Accessibility

In today’s digital age, mobile accessibility is a must-have feature for accounting software. Business owners and employees need access to financial data on the go. Mobile apps or mobile-friendly websites enable users to manage finances from anywhere.

Key features to look for in mobile accessibility include:

- Real-time data synchronization: Ensures consistency across devices.

- User-friendly interface: Easy navigation on smaller screens.

- Security features: Protects sensitive financial information.

Mobile notifications can also be beneficial. They alert users about important activities, such as incoming payments or overdue invoices. The accounting software ensures timely action can be taken, even when away from the office.

Consider the compatibility of the software with various devices and operating systems. It should work seamlessly on both iOS and Android platforms. This ensures all team members can access the software, regardless of their device preference.

FAQs

Do I need accounting software for my small business?

Accounting software for my small business assists in easily managing accounts, reducing errors, and tracking financial status.

What is the best accounting software for a sole trader?

The best accounting software for a sole trader typically includes QuickBooks, Xero, or FreshBooks, as they offer easy-to-use features for managing income, expenses, and taxes.

What is the best accounting method for retail business?

The best accounting method for a retail business accrual basis accounting. Because it provides more accurate financial data by recording when it occurs rather than cash exchange.

Is there free accounting software for retail businesses?

Yes, Wave offers free accounting software that includes invoicing and basic financial tracking, but it lacks inventory management features.

Concluding Words

Selecting the right software transforms how you manage your business. Assess your needs and budget carefully. The right tool simplifies your financial management. It also boosts efficiency and accuracy. Invest in the best software to help your business grow.

QuickBooks Online is a top choice for many. It offers a wide range of features. It’s perfect for retailers who need strong sales tracking. It also provides great inventory management tools. For niche markets, Xero is a good option. It offers features tailored for specialty retailers. If customization is your priority, consider Odoo. Its modular design lets you build as you grow. However, if you have used any software other than the software mentioned in this list, then share your experience with us.

Leave a Reply