Find 7 best free budgeting apps to manage their finances by tracking income, expenses, and savings.

Budgeting apps have revolutionized the way people manage their finances. With the advent of technology, tracking expenses, setting financial goals, and saving money have never been easier. This article delves into the best free budgeting apps available today, offering a comprehensive guide to help you choose the right tool for your financial needs.

Benefits of Using Budgeting Apps

We will explore the benefits of using budgeting apps and how they can help you achieve your financial goals, improve your spending habits, and reduce financial stress.

Convenience and Accessibility

Budgeting apps allow users to track their finances on the go. With just a few taps, the user can log expenses, check their budget status, and make informed decisions in financial dealings.

Real-time Expense Tracking

These apps offer real-time updates on spending, ensuring users are updated at any instance concerning their financial situation. This helps in not overspending and living within one’s means.

Financial Goal Setting

Most of these budgeting apps have personal goal-setting features that allow their users to be well-placed in keeping track of their financial objectives, such as saving for a vacation, an automobile, or even emergency funds.

Alerts and Reminders

The budgeting apps nearly always incorporate warning systems that remind users about upcoming bills, low balances, or overspending in a particular area. This helps in maintaining financial discipline.

Data Security and Privacy

Modern budgeting apps prioritize data security and privacy, encryption in data storage, and proper login options are guaranteed to the user for protection from any kind of theft or misappropriation.

Key Features to Look for in a Budgeting App

Here we point out the key features you should look for in a budgeting app to ensure it meets your needs and helps you achieve your financial goals.

User-friendly Interface

A good budgeting app will be very easy and give an intuitive interface so that any user can easily manage their finances.

Customizable Categories

Users must be enabled to create and further customize their spending categories according to their personal needs and habits.

Bank Account Integration

Bank accounts and credit card integration are smooth, providing an automated import of transactions to eliminate manual entries and bring in accuracy.

Expense Tracking and Categorization

This helps the user track and categorize expenses, understand where their money is going, and identify areas of potential savings.

Budgeting Tools and Calculators

It has different tools and calculators that help users create realistic budgets based on their income and expenses.

Reports and Analytics

In-depth reporting and analytics on spending patterns and financial health help in better decision-making.

Multi-device Synchronization

Synchronization between all the devices makes sure that the financial data is accessible to users at any time and from any location.

7 Best Free Budgeting Apps

You may find many budgeting apps in the app store but all do not offer free services. Here we have introduced 7 best budgeting apps whose basic functions are free to use. If you do not have enough budget or before purchasing a paid version of the budgeting app you can use any of the following apps.

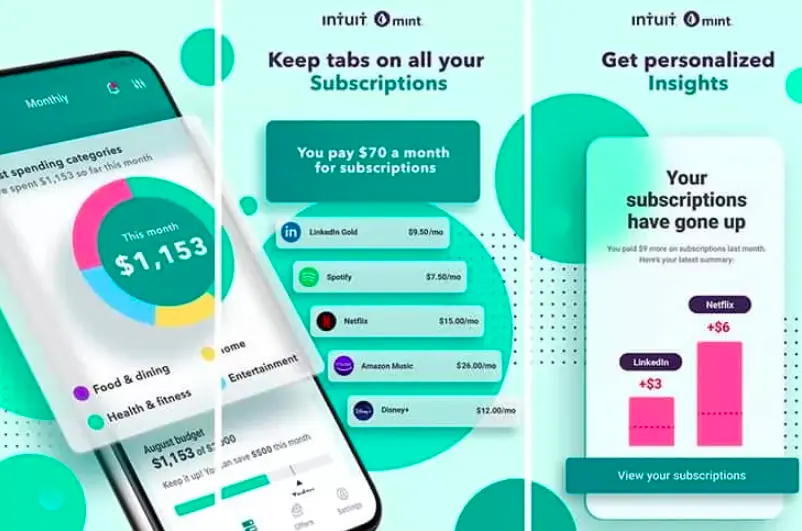

1. Mint

Mint is a free money manager and financial tracker budgeting app that brings all your finances together in one place. It is developed by Intuit, the same company behind TurboTax and QuickBooks. Mint is one of the best free budgeting apps that has gained popularity due to its wide range of features and user-friendly interface. With its ability to connect to multiple financial institutions, Mint gives an overview of a person’s financial situation.

Key Features

- Automatic transaction import

- Customizable categories

- Bill tracking and payment reminders

- Financial goal setting

- Free credit score monitoring

Pros:

- Easy to use

- Comprehensive financial overview

- Free credit score

Cons:

- Ads and promotional offers

- Occasional synchronization issues

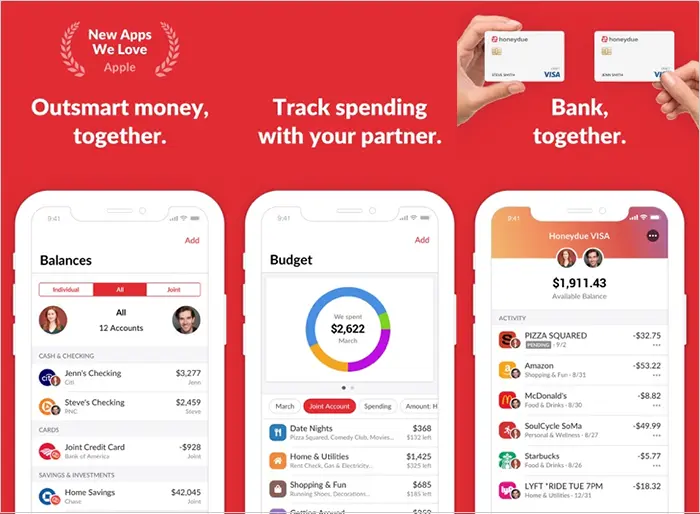

2. Honeydue

Honeydue is a budgeting app built for couples. Share and manage your household finances easily with your partner, from bills to savings goals. It’s free to use but will accept a one-time or recurring tip if you’d like to support the product.

Key Features

- Shared budgeting and expense tracking

- Bill payment management and reminders

- Debt reduction and goal setting

- Spending alerts and notifications

Pros:

- Ideal for couples and households

- Streamline shared finances

- Simplify bill and debt management

Cons:

- Offers limited financial insights for individuals

- Fewer bank integrations compared to other apps

3. PocketGuard

PocketGuard simplifies budgeting by showing how much disposable income users have after accounting for bills, goals, and necessities. It is ideal for those who prefer a more straightforward approach to managing their finance. Although PocketGuard is FREE, the following features, such as individual debt payoff plans, unlimited category budgets, goals, and custom categories, can be found under the PocketGuard Plus plan. If you need a basic budgeting app, PocketGuard is your bucket list.

Key Features

- Automatic transaction categorization

- Bill tracking

- Goal setting

- Insights and reports

Pros:

- Simple and intuitive user interface

- Smart alerts, and powerful debt tools

Cons:

- Limited customization

- Ads in the free version

4. Goodbudget

Goodbudget is a budgeting app that digitizes the classic envelope system. It allows users to digitally place money into categories in digital envelopes, such as “Taxes,” “Holidays,” and “Clothing.” It gives a very visual and hands-on feel to handling one’s money. Goodbudget has an entirely free version of its budget features. They also offer a paid version at $70 a year.

Key Features

- Envelope budgeting system

- Manual transaction entry

- Budget sharing

- Debt tracking

Pros:

- Easy to understand

- Suitable for couples and families

Cons:

- No automatic transaction import

- Limited features in the free version

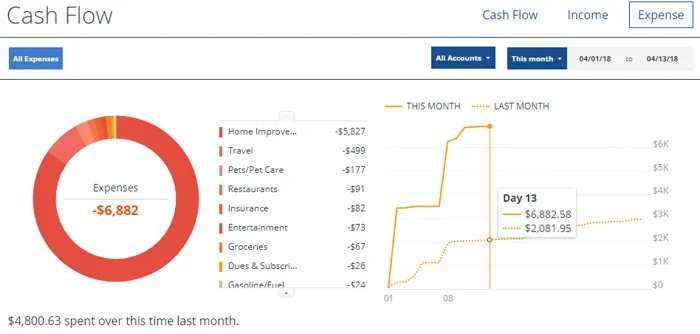

5. Personal Capital

Personal Capital does most of what all the other budgeting apps do and some more. It offers robust budgeting tools alongside investment tracking, making it ideal for users looking to manage both their day-to-day expenses and long-term investments. Personal Capital is a free personal finance app that combines account aggregation and budgeting features with investment tracking and retirement planning tools.

Key Features

- Budgeting and expense tracking

- Investment portfolio tracking

- Retirement planner

- Net worth calculator

Pros:

- Comprehensive financial management

- Expert financial advice customized to your goals

- Create a personalized financial roadmap for your future

Cons:

- More complex interface

- Focus on investment features

6. Wally

Wally is a straightforward budgeting app that offers essential features for tracking expenses and managing budgets. Wally connects 70 countries with over 15,000 financial accounts. While Wally offers three premium plans, if you don’t use one, you can have unlimited free access to the service.

Key Features

- Expense tracking

- Budgeting tools

- Multi-currency support

- Bill reminders

Pros:

- Simple and user-friendly

- Identify and eliminate unnecessary spending

- Monitors and provides insights on credit score

Cons:

- Limited advanced features

- Occasional bugs

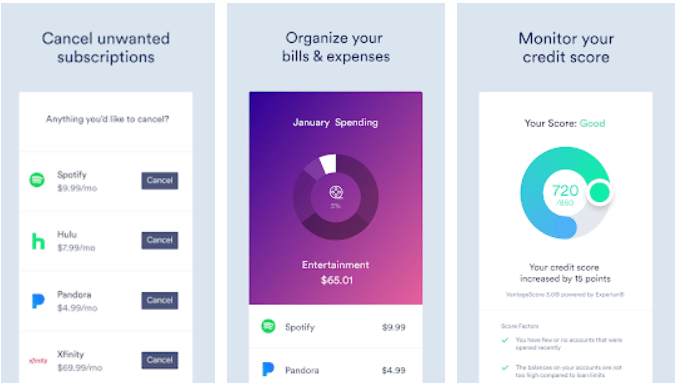

7. Clarity Money

Take control of your finances with Clarity Money. It is one of the best free budgeting apps that helps you identify and cancel unnecessary expenses, lowers your bills, identifies better deals, and manages your overall financial health. Clarity Money is a holistic view of users’ finances because it tracks spending, manages subscriptions, and offers personalized financial insights.

Key Features

- Subscription management

- Expense tracking

- Budget creation

- Financial insights

Pros:

- Subscription management

- Credit scoring tracking

- Provides a comprehensive view of spending habits

Cons:

- Limited customization

- Ads in the free version

How to Choose the Right Budgeting App

Every budgeting app has some unique features. So it is difficult to choose the right one for the user. Here we provide guidelines and pro tips to consider while you are going to choose the right budgeting app for you.

Assessing Your Financial Needs

First, figure out what you’re looking for in a budgeting app. Will this be used for daily expense tracking, investment management, or setting financial goals? All these would guide your choice.

Considering the App’s Features

Compare all apps concerning their features to find out which of them best fits your financial goals. Look for essential features: expense tracking, budget creating, and goal setting.

User Reviews and Ratings

You should read the reviews written by customers and the given star rating to understand the reliability of the app or satisfaction from the user’s side. Check both positive and negative feedback.

Security and Privacy Concerns

When choosing, the app must have specific features that safeguard financial information. Look for features like encryption and secure login methods.

Our Recommendation

Each app offers unique features tailored to different financial needs. Mint is ideal for those seeking an all-in-one solution, while Honeydue is perfect for couples. PocketGuard is for users who only intend to view available disposable income, and Goodbudget is for enthusiasts of the envelope budgeting method. The items on the top list also include Personal Capital as an excellent investment tracker, Wally for straightforward and easy budgeting, and Clarity Money for perfect subscription management.

Final Thoughts

Budgeting apps are one of the most effective tools to help any given individual keep their personal finances. They offer convenience and real-time tracking, among other benefits, to stay on top of financial goals. Hope this article will help you find the best free budgeting apps for you.

Moreover, A step-by-step guide to making a budget can be incredibly useful in this process. Choose the right budgeting app; use it well – the key to greater financial health and security.

Leave a Reply