Running a small business requires smart financial management, and a reliable business savings account is one of the most crucial tools in your financial arsenal. A small business savings account offers a safe place to store extra funds, earn interest, and prepare for unexpected expenses. Now the question is which are the best small business savings accounts in the USA?

In this article, I will explore why small business savings accounts matter, key features to consider, and the top options available in the USA. If you are a small business owner and still facing problems managing your business cash. This article guides you make the smart decision for managing business finances. Keep reading to discover smart solutions for securing your business’s financial future!

Why Small Business Savings Accounts Matter

According to recent financial research, 82% of small businesses fail due to cash flow problems. This staggering statistic underscores the critical importance of maintaining a dedicated business savings account. These accounts aren’t just a luxury—they’re a necessity for sustainable business growth.

Key Benefits of Business Savings Accounts

Every business faces ups and downs. You may experience slow sales, delayed payments, or sudden expenses. A savings account helps cushion these financial shocks. Here are the key reasons why having one is smart:

1. Emergency Preparedness

Small businesses face numerous uncertainties. Whether it’s a sudden equipment breakdown, unexpected tax liability, or a temporary dip in revenue, a well-funded savings account provides a critical financial buffer. Financial experts recommend saving approximately 10% of monthly profits and maintaining six months of operating expenses in reserve.

2. Opportunity Fund

Growth opportunities rarely announce themselves with advance notice. A robust savings account allows businesses to:

- Invest in new marketing initiatives

- Expand to new locations

- Purchase essential equipment

- Hire additional staff

- Develop new product lines

3. Tax Planning

Keeping business and personal finances separate is not just a best practice—it’s a strategic necessity. A dedicated business savings account helps:

- Streamline accounting processes

- Simplify tax preparation

- Provide clear financial documentation

- Reduce the risk of personal liability

Understanding Business Savings Accounts

Not all savings accounts are created equal. Modern entrepreneurs have multiple options, ranging from traditional bank offerings to innovative online banking platforms.

Traditional Banks vs. Online Banking Platforms

Traditional Banks

- Physical branch locations

- In-person transaction capabilities

- Often more complex account requirements

- Potentially lower interest rates

Online Banking Platforms

- 100% digital experience

- Lower fees

- Higher interest rates

- More flexible account management

- Advanced digital features

Risks of Not Having a Business Savings Account

Skipping a business savings account might seem like a way to simplify finances, but it can lead to problems. Here’s why it’s risky:

1. Cash Flow Problems

Without savings, you might struggle to cover expenses during slow periods. This can force you to take loans, leading to debt.

Logic: A savings buffer protects your cash flow, allowing you to handle downturns without external help.

2. Missed Opportunities

Opportunities often require quick decisions and funds. If you don’t have savings, you might miss out on growth prospects.

3. Tax Penalties

If you fail to save for taxes, you could face penalties and fines. Proper planning helps avoid these costs.

Factors to Consider When Choosing a Business Savings Account

When choosing a small business savings account, not all options are created equal. Here are some factors to keep in mind:

1. Interest Rates (APY)

Look for accounts with high Annual Percentage Yields (APY). A higher APY means your money grows faster. Even small differences can add up over time.

Pro Tip: Online banks often offer higher APYs than traditional banks because they have lower overhead costs.

2. Fees

Hidden fees can eat into your savings. Watch out for monthly maintenance fees, ATM fees, and transaction limits. Some banks waive fees if you maintain a minimum balance.

3. Minimum Balance Requirements

Some accounts require you to keep a certain amount of money to avoid fees or earn interest. Choose an account with a balance requirement that matches your cash flow.

4. Accessibility and Convenience

Online banking platforms offer convenience. You can manage your funds from anywhere. However, if you prefer face-to-face service, a traditional bank might be a better fit.

5. FDIC Insurance

Make sure your chosen account is FDIC-insured. This protects your deposits (up to $250,000) if the bank fails.

5. Digital Integration

Modern businesses need banking solutions that integrate seamlessly with accounting software like QuickBooks and Xero.

How to Open a Small Business Savings Account

Opening a business savings account is easier than you might think. The process can vary depending on the bank, but the steps are generally straightforward.

Step 1: Choose the Right Bank

Start by comparing different banks. Look for one that offers the features you need, like high interest rates, low fees, and ease of access.

Pro Tip: Online banks often offer better rates, but traditional banks might be more convenient if you need in-person services.

Step 2: Gather Your Documents

Most banks will ask for the following:

- Your business license or registration.

- Employer Identification Number (EIN) or Social Security number (SSN).

- Photo ID (like a driver’s license).

- Proof of address (utility bill or lease agreement).

Step 3: Complete the Application

You can usually apply online or in person. Follow the instructions provided by the bank, fill in the necessary information, and upload your documents if needed.

Step 4: Deposit Funds

Some banks require a minimum deposit to open an account. Make sure you have enough funds ready to meet this requirement.

Step 5: Start Saving

Once your account is open, set up regular transfers from your business checking account to your savings account. Automating this process can help you save consistently without much effort.

Top 5 Small Business Savings Accounts in the USA

The ideal small business savings account meets your unique needs. I’ve researched and compiled a list of the top options to help you choose wisely. Let’s get started!

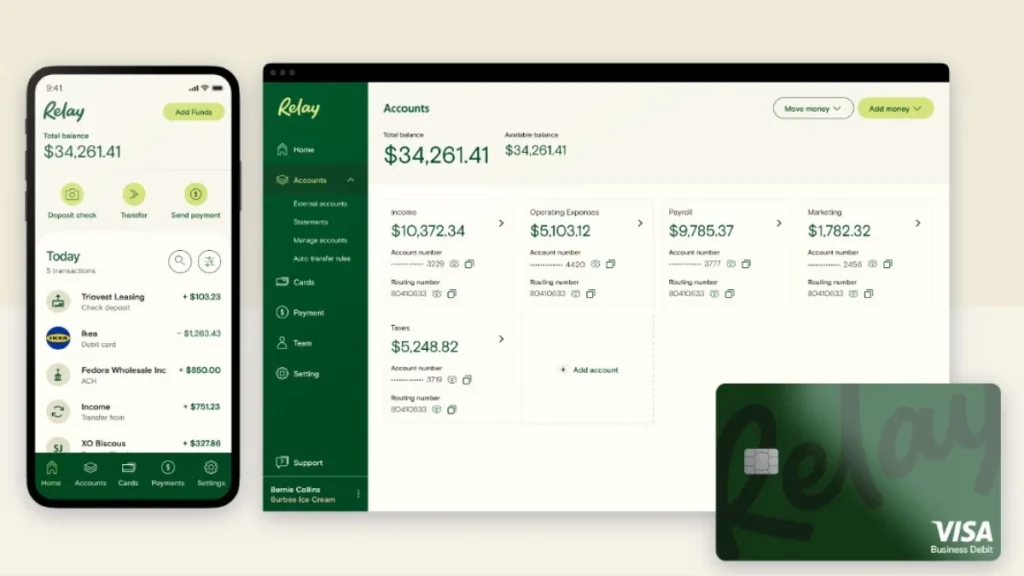

Relay: The Digital Banking Innovator

Relay emerges as a standout option for modern small businesses, offering a comprehensive digital banking solution that addresses multiple financial management needs.

Key Features:

- 20 free business checking accounts

- 2 business savings accounts

- No minimum balance requirements

- Competitive APY ranging from 1% to 3%

- Up to 50 virtual and physical debit cards

Pricing Structure:

- 1% APY for savings under $50,000

- 1.5% APY for savings between $50,000-$250,000

- 2% APY for savings between $250,000-$1,000,000

- 3% APY for savings over $1,000,000

Pros

Cons

Wells Fargo: Traditional Banking Approach

Wells Fargo is a trusted, nationwide bank offering flexible business banking solutions tailored to small businesses. Known for its wide range of financial products and physical branch access, Wells Fargo provides convenience and reliable support for business owners.

Key Features:

- Multiple business savings account options, including market rate and platinum savings.

- Competitive APY: Ranges from 0.15% to 2.5%, depending on the account type.

- Low Minimum Opening Deposit: As low as $25 for basic savings accounts.

- Fee Waivers: Monthly fees can be waived by meeting minimum balance requirements.

- Branch Access: In-person banking at thousands of locations nationwide.

- FDIC Insurance: Protects deposits up to $250,000.

Business Market Rate Savings:

- $25 minimum opening deposit

- $5 monthly service fee (waivable)

- 0.15% APY

- Ideal for businesses just starting their savings journey

Business Platinum Savings:

- $25 minimum opening deposit

- $15 monthly service fee

- APY ranges from 0.25% to 2.5%

- Better for businesses with higher account balances

Pros

Cons

Live Oak Bank: High-Yield Online Option

Live Oak Bank is a high-yield online bank known for offering competitive savings account options with no fees and no minimum balance requirements. Perfect for small businesses looking to maximize their savings with higher interest rates, Live Oak Bank provides an efficient, fully digital banking experience.

Key Features:

- 4.0% APY: Exceptional interest rates to grow your savings faster.

- No Minimum Balance Requirement: Start saving with any deposit amount.

- No Monthly Fees: Enjoy fee-free banking with no maintenance charges.

- FDIC Insurance: Deposits are protected up to $250,000.

- Digital-Only Platform: Manage your business finances anytime, anywhere through online banking.

Pros

Cons

Capital One: Flexible Savings Solutions

Capital One offers simple and flexible banking solutions for small businesses, combining ease of use with competitive rates. Known for its strong online presence and user-friendly services, Capital One provides an accessible platform for business owners looking to streamline their finances.

Key Features:

- Business savings account with promotional APY for the first 12 months.

- Low Minimum Balance Requirement: Waivable $3 monthly service fee with a $300 minimum balance.

- Up to Six Free Withdrawals per monthly statement cycle.

- FDIC Insurance: Protects deposits up to $250,000.

- Digital Features: Access accounts online or via mobile app, making banking convenient and on-the-go.

Pros

Cons

Axos Bank: Strategic Savings

Axos Bank is an online-only bank that offers business savings accounts with competitive interest rates and no physical branch limitations, making it a strong option for small business owners looking for convenience and high returns.

Key Features:

- APY: 0.2%, offering a solid interest rate for business savings.

- Minimum Opening Deposit: $1,000 to open a business savings account.

- Fee Waivers: Monthly service fees can be avoided by maintaining a $2,500 minimum daily balance.

- Digital Banking: 100% online account management with easy access to funds.

- FDIC Insurance: Ensures your deposits are protected up to $250,000.

- Limited Physical Access: As an online-only bank, there are no physical branches, but 24/7 online customer support is available.

Pros

Cons

Comparative Analysis of Top Savings Accounts

A critical consideration for small business owners is the potential earnings from their savings accounts. Here’s a comparative overview:

| Bank | APY Range | Minimum Deposit | Monthly Fees |

|---|---|---|---|

| Relay | 1% – 3% | $0 | $0 |

| Wells Fargo | 0.15% – 2.5% | $25 | $5 – $15 |

| Live Oak Bank | 4.0% | $0 | $0 |

| Capital One | 0.2% | Varies | $3 |

| Axos Bank | 0.2% | $1,000 | Conditional |

What is the Best Small Business Savings Account?

The best small business savings account makes managing your finances easier while earning interest on your savings. It also offers the convenience of managing your account from anywhere. That’s why I believe Relay offers the top savings accounts for small businesses. With Relay, you can open 2 business savings accounts, earn 1-3% APY* on your extra funds, and take advantage of automated savings features to grow your money effortlessly.

FAQ

Are Business Savings Accounts Tax-Deductible?

No, the money you save is not tax-deductible. However, the interest earned may be taxable.

Can I Open Multiple Savings Accounts?

Yes! Some businesses open multiple accounts for different purposes, like taxes, emergencies, and growth projects.

What Happens If My Bank Fails?

If your bank is FDIC-insured, your deposits are protected up to $250,000 per account. This provides peace of mind.

Final Thoughts

A small business savings account is not just a smart financial tool—it’s a necessity. It provides security, helps grow your funds, and positions your business for long-term success.

By understanding your options and following best practices, you can maximize the benefits of a savings account. Whether you choose a traditional bank or an online platform, the key is to start saving today.