A Chart of Accounts (COA) is a tool that construction businesses use to track money. It is a list of all accounts in the company’s books. Each account has a name and a number. This list helps you see where money comes from and where it goes. For construction, a COA is very important. It keeps your financial records organized.

In this article, I will explain how to create a COA for a construction company. You will learn step-by-step how to set it up. At the end, you can also download a free Chart of Accounts Excel Template to make things easier.

What is a Chart of Accounts?

A Chart of Accounts is like a map of your finances. It is a list of categories to organize every transaction. These categories are called “accounts.” Each transaction in your business, like buying materials or paying workers, fits into an account.

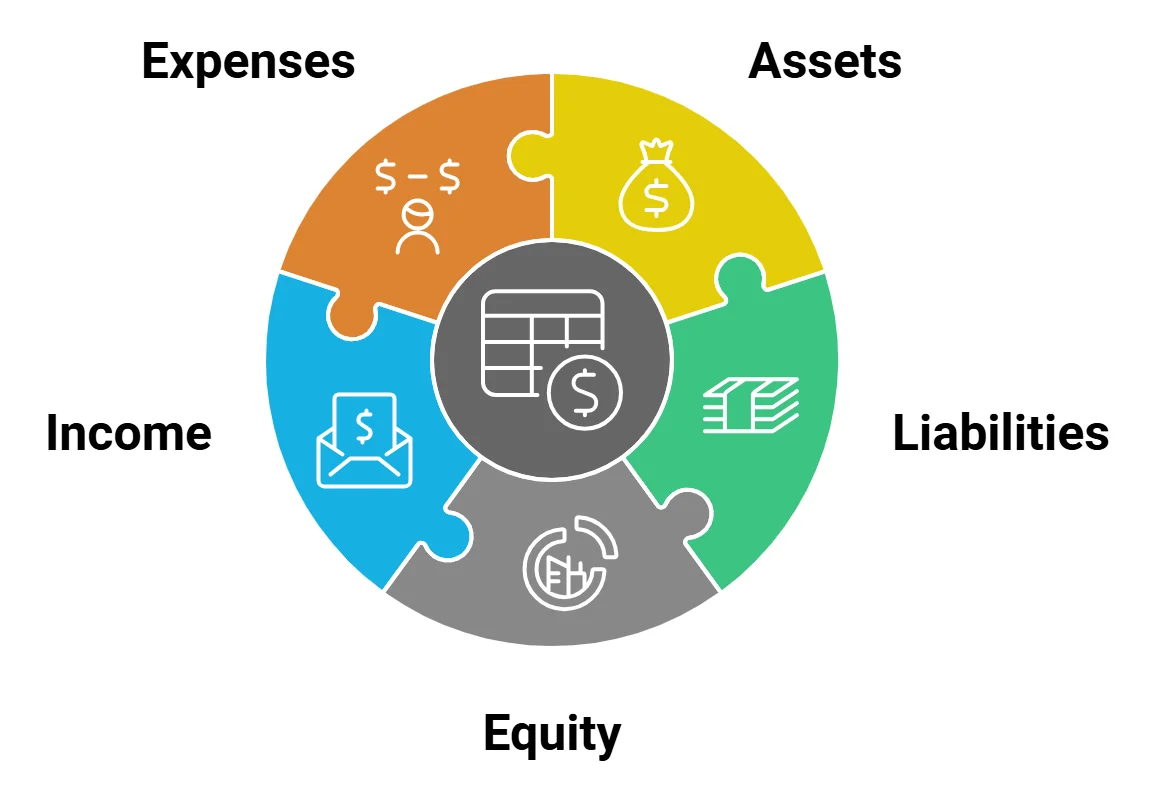

The accounts are divided into sections. Common sections include:

- Assets (what your business owns)

- Liabilities (what your business owes)

- Equity (the owner’s investment)

- Income (money earned)

- Expenses (money spent)

This structure helps you see how your money is moving. It is easy to make reports when you use a good COA.

Why Construction Companies Need a Chart of Accounts

Construction businesses have many costs. They buy materials, pay workers, and rent equipment. Keeping track of all this money is hard without a COA. Here are three reasons why a chart of accounts for construction is important:

1. Organize Financial Information

A COA makes it easy to organize your finances. Every expense has a place. This keeps your records clean and easy to read.

2. Create Accurate Reports

With a COA, you can create accurate financial reports. You will know how much you spend on each project. This helps you manage your budget and make smart decisions.

3. Make Better Business Decisions

A well-organized COA helps you see the big picture. You can easily see which projects are profitable and which are not. This helps you decide where to spend money and where to save.

Basic Parts of a Chart of Accounts

Let’s look at the basic parts of a COA. Every construction business needs these categories:

1. Asset Accounts

These are the things your business owns. They include:

- Cash in Bank – The money you have in your business accounts.

- Accounts Receivable – Money your clients owe you.

- Inventory – Materials and supplies you have not used yet.

- Equipment – Tools and machinery you own.

2. Liability Accounts

These are the debts your business has. They include:

- Accounts Payable – Bills you need to pay to suppliers.

- Loans – Money you borrowed.

- Accrued Expenses – Costs you owe but have not yet paid, like wages.

3. Equity Accounts

These show the value of your business. They include:

- Owner’s Equity – The money the owner has invested.

- Retained Earnings – Profits you keep in the business instead of paying out.

4. Income Accounts

These accounts track the money your business earns. They include:

- Project Income – Money from construction projects.

- Service Income – Fees you charge for consulting or other services.

5. Expense Accounts

Expenses are the costs of running your business. They include:

- Materials Costs – Money spent on buying materials for projects.

- Labor Costs – Wages paid to workers.

- Office Rent – The cost of renting an office.

- Insurance – Costs for protecting your business, like liability or worker’s comp.

How to Create a Chart of Accounts Step-by-Step

Creating a chart of accounts for your construction business takes a few steps. Let’s go through them one by one.

Step 1: Think About Your Business Needs

Every business is different. Think about what your business does. Are you a contractor? Do you provide construction materials? Write down what makes your business unique. This will help you decide what accounts you need.

Step 2: Choose the Main Categories

Start by setting up the main categories: Assets, Liabilities, Equity, Income, and Expenses. These categories will cover most of your transactions.

Step 3: Add Sub-Categories

Each main category can have sub-categories. For example, under Assets, you might have “Cash” and “Equipment.” Under Expenses, you might have “Rent” and “Utilities.” Keep it simple at first. You can always add more sub-categories later.

Step 4: Use Account Numbers

Give each account a number. This helps keep things organized. Here’s a basic example:

- 1000 – 1999: Assets

- 2000 – 2999: Liabilities

- 3000 – 3999: Equity

- 4000 – 4999: Income

- 5000 – 5999: Expenses

Use numbers that make sense to you. Some companies use three digits. Others use four. Pick what works best for your business.

Example of a Simple Construction COA

Here is a simple example of what a chart of accounts for construction might look like:

- 1000 – Cash in Bank

- 1100 – Accounts Receivable

- 1200 – Equipment

- 2000 – Accounts Payable

- 2100 – Loans Payable

- 3000 – Owner’s Equity

- 4000 – Project Income

- 5000 – Materials Costs

- 5100 – Labor Costs

This is just a start. You can add or change accounts to fit your needs.

How to Set Up a Chart of Accounts for Construction Business

Let’s go deeper into how to set up a COA for a construction company. Follow these simple steps to get started.

Step 1: Use a Template for Guidance

Many accounting software programs have COA templates. These templates are helpful if you don’t know where to start. They give you a basic structure. You can change and customize them to fit your needs.

Step 2: List Your Accounts

Write down the accounts you need. Start with the main categories: Assets, Liabilities, Equity, Income, and Expenses. Then add sub-categories. Think about the transactions you make every day. Do you buy materials often? Do you rent equipment? Add accounts for these things.

Step 3: Organize Your Accounts by Number

Use numbers to keep your accounts in order. Here’s a simple numbering system for construction:

- 1000 – Cash and Bank Accounts.

- 1100 – Accounts Receivable (Money clients owe you).

- 1200 – Inventory (Materials you have on hand).

- 2000 – Accounts Payable (Bills you need to pay).

- 2200 – Loans (Debt your business owes).

- 3000 – Owner’s Equity.

- 4000 – Revenue (Money you earn from jobs).

- 5000 – COGS (Cost of Goods Sold).

- 6000 – Expenses (Office costs, insurance, etc.).

This structure helps you see how your business is doing at a glance.

Step 4: Keep It Simple

Don’t make your COA too complicated. It is tempting to create many accounts. But if you have too many, it’s hard to manage. Start with the basics. You can always add more accounts later if needed.

Step 5: Double-check with an Accountant

After setting up your COA, ask an accountant to review it. An accountant can spot errors you might miss. They also make sure your accounts are set up to follow tax rules.

Using Software to Manage Your Chart of Accounts

Managing a COA manually can be tough. Many businesses use software to make it easier. Here’s why software is helpful:

1. Automation

The software can automatically enter transactions into the right accounts. This saves time and reduces mistakes.

2. Templates

Most software includes templates for different businesses. You can use a construction template as a starting point. This saves you from creating everything from scratch.

3. Simple Reports

The software lets you create financial reports with one click. You can easily make balance sheets, income statements, and cash flow reports. These reports help you understand your financial situation better.

Recommended Software for Construction COA

Here are some popular accounting tools that work well for construction companies:

1. QuickBooks

QuickBooks is great for small and medium-sized businesses. It has templates for contractors and builders. You can track expenses, send invoices, and create reports easily.

2. Sage 100 Contractor

Sage 100 Contractor is a powerful tool for larger construction companies. It has advanced features for project management and accounting. You can handle bids, budgets, and jobs all in one place.

3. FreshBooks

FreshBooks is easy to use. It’s best for small contractors who want a simple solution. You can track expenses, create invoices, and set up a basic COA.

4. CoConstruct

CoConstruct is perfect for home builders and remodelers. It has accounting and project management tools in one. You can track job costs, manage schedules, and keep financial records.

The Importance of Reviewing Your COA Regularly

A COA is not something you set up once and forget. Your business will change over time. You may take on bigger projects or buy new equipment. This means you need to update your COA. Here’s why regular reviews are important:

- Catch Mistakes – You may have recorded something in the wrong account. Reviewing your COA helps you find and fix these errors.

- Adjust for Growth – As your business grows, you might need new accounts. A review helps you see if your COA still fits your needs.

- Stay Compliant – Tax rules can change. Regular reviews help you stay up-to-date and follow the law.

Tips for Maintaining an Accurate Chart of Accounts

A clear Chart of Accounts is key to good financial management for construction companies. It shows where your money comes from and where it goes. Keeping your COA accurate makes decision-making easier and helps avoid mistakes. This guide shares simple tips to keep your COA organized and up-to-date, so your business runs smoothly.

How to Keep Your Chart of Accounts Accurate

Maintaining an accurate COA is crucial for construction companies. A clean and up-to-date COA helps you understand your finances clearly. Here are some tips to keep your COA accurate:

1. Enter Data Consistently

Always enter transactions in the same way. Use clear rules for data entry. This keeps your records consistent and easy to understand. For example, if you list equipment expenses under “5000 – Equipment Costs,” always use that category.

2. Update Accounts as Needed

Businesses change. Sometimes, you need to add or remove accounts. Maybe you start renting equipment instead of buying it. You may need a new account for rental costs. Review your COA regularly and make updates if needed.

3. Close Unused Accounts

Do not keep too many accounts. If an account is no longer needed, close it. This keeps your COA simple and clear. Make sure to transfer any remaining balances to a new account before closing.

4. Use Reports to Spot Errors

Run monthly or quarterly reports using your COA. Look for accounts with strange numbers or unexpected amounts. If you spot an error, go back and fix it. This keeps your financial data accurate.

Common Mistakes to Avoid When Creating a COA

It’s easy to make mistakes when setting up a COA. Here are some common errors and how to avoid them:

1. Too Many Accounts

Having too many accounts can make your COA confusing. Keep it simple. Only create accounts that you need. For example, instead of having separate accounts for “Nails” and “Screws,” use one account called “Construction Supplies.”

2. Using Vague Names

Names like “Miscellaneous” or “General Expenses” do not give clear information. Be specific. Instead of “General Expenses,” use a name like “Office Supplies” or “Equipment Rental.” This makes your COA clearer.

3. Not Numbering Accounts

Without account numbers, it’s hard to organize your COA. Use a numbering system to keep everything in order. This makes tracking transactions easier. If you want to add new accounts later, the numbering helps keep them in the right spot.

4. Skipping Reviews

Don’t skip regular reviews of your COA. Mistakes can happen, and financial needs change. Reviewing your COA helps you keep it up-to-date. Make it a habit to check your COA every month or quarter.

How to Adjust Your Chart of Accounts Over Time

Your construction business will change as it grows. Your COA should change too. Here are some situations where you may need to adjust your COA:

1. Adding New Services

If you start offering new services, you might need new accounts. For example, if you start doing electrical work, add accounts like “Electrical Supplies” and “Electrical Income.”

2. Buying New Equipment

If you buy expensive equipment, you may want separate accounts to track these costs. Create an asset account like “Heavy Equipment” to monitor the value.

3. Opening New Locations

If you open a new office or expand to a new city, consider adding location-specific accounts. This helps you track how each location is performing.

4. Changing Accounting Methods

Sometimes, you may want to switch accounting methods. For example, moving from cash basis to accrual accounting. This might require new accounts. Work with an accountant to make these changes smoothly.

Final Tips for Creating a Construction COA

Creating a chart of accounts for the construction business takes time, but it’s worth it. Here are some final tips:

- Start Simple – Use a basic structure and add accounts as needed.

- Be Consistent – Always use the same names and numbers for accounts.

- Seek Help – Don’t hesitate to ask an accountant for guidance.

- Use Software – Accounting software can save you time and effort.

How to Use Your COA for Better Business Decisions

A good COA is not just for recording transactions. It helps you make better business decisions. Here are some ways you can use your COA to improve your construction business:

1. Track Project Costs

Use your COA to see how much you are spending on each project. If you have accounts like “Materials Costs” and “Labor Costs,” you can see which projects cost more. This helps you find ways to save money.

2. Compare Income and Expenses

With a COA, you can easily compare income and expenses. Look at your reports regularly. Are your costs going up? Is income staying the same? This can help you decide when to raise prices or cut costs.

3. Create Accurate Budgets

Your COA helps you make accurate budgets. You can use past data to see what your business usually spends. This helps you set a realistic budget for future projects.

4. Analyze Profitability

Not all projects are profitable. Use your COA to analyze which projects make the most money. If you see that some projects cost more than they earn, you can decide if they are worth doing in the future.

Using Your Chart of Accounts to Create Financial Reports

A COA is not just a list. It is the foundation for all your financial reports. These reports help you see the financial health of your construction business. Here are the main reports you can create using your COA:

1. Balance Sheet

A Balance Sheet shows what your business owns (assets) and what it owes (liabilities). It also shows the owner’s equity. It is a snapshot of your business’s financial position at a specific time.

- Assets: Cash, equipment, accounts receivable.

- Liabilities: Loans, accounts payable, customer deposits.

- Equity: Owner’s investment, retained earnings.

The formula for the Balance Sheet is simple:

Assets = Liabilities + Equity

Use your COA to make sure each category is accurate.

2. Income Statement

An Income Statement shows how much money your business made and spent over a period of time. It is also known as a Profit and Loss (P&L) Statement.

- Income: Money earned from projects, rentals, and other services.

- COGS: Cost of Goods Sold, including materials and labor.

- Expenses: Office rent, utilities, insurance, and other costs.

The formula for the Income Statement is:

Net Income = Income – COGS – Expenses

Use your COA to get a clear view of profits and losses.

3. Cash Flow Statement

A Cash Flow Statement shows the money flowing in and out of your business. It tracks cash from operating, investing, and financing activities.

- Operating: Money from day-to-day operations (projects, sales).

- Investing: Cash spent on buying or selling assets (equipment, property).

- Financing: Money from loans or owner’s investment.

This report helps you see if you have enough cash to pay bills and run your business smoothly.

How to Analyze Your Financial Reports

Once you have your reports, you need to understand them. Here are some tips for analyzing your financial data:

1. Look for Trends

Review reports monthly or quarterly. Look for trends. Is your income growing? Are expenses getting higher? This helps you see if your business is moving in the right direction.

2. Check for Errors

Mistakes can happen. Use your COA to make sure everything is correct. If a number looks wrong, go back and check the account. Correct any errors to keep your data accurate.

3. Compare Projects

Use your reports to compare different projects. Which projects are most profitable? Which ones cost the most? This helps you decide what types of projects to focus on in the future.

4. Create a Budget

Your reports are a great tool for budgeting. Use past data to set realistic spending limits. This helps you plan for future projects and avoid overspending.

Download Your Free Chart of Accounts Template

To make it easy, we have a free template of chart of accounts for construction companies. This template includes common accounts that many businesses use. You can download it and customize it for your needs.

Download the Free COA Template Here

This template is a great starting point. It covers the basics for a small or medium construction business. You can add or remove accounts as your business grows.

How to Track Indirect Costs in Construction

Indirect costs are expenses that support your business but are not tied to a single project. These costs can include:

- Administrative Salaries – Pay for office staff who manage multiple projects.

- Office Rent – The cost of your office space.

- Utilities – Costs for electricity, water, and internet.

- Vehicle Expenses – Costs for company cars or trucks.

Tracking indirect costs helps you see the full picture of your business expenses. Make sure you have separate accounts for these costs in your COA.

Tips for Training Your Team on the COA

If you have a team, make sure they know how to use the COA correctly. Here are some tips for training your staff:

1. Hold a Training Session

Take the time to train your staff. Go over the COA and explain how to use it. Show them how to record transactions correctly.

2. Create a Simple Guide

Write a guide that explains each category and account. Use simple words. This will help staff remember how to use the COA.

3. Check Their Work

First, review your team’s entries regularly. Make sure they are using the right accounts. Give feedback if they make mistakes.

4. Keep It Consistent

Make sure everyone follows the same rules. Use the same names and numbers for each account. This keeps your records clean and easy to read.

Frequently Asked Questions

Can I change my COA after I set it up?

Yes, you can change your COA. Just make sure to keep records of any changes. It’s best to make major changes at the start of a new fiscal year to avoid confusion.

How often should I review my COA?

Review your COA at least once a quarter. Regular reviews help you catch errors and make sure the COA still fits your business needs.

Do I need a professional accountant to set up my COA?

An accountant is not required, but it’s a good idea. An accountant can help you follow tax laws and make sure your accounts are accurate. They can also offer advice on best practices for construction businesses.

Final Words

Ready to get started? Download our free Chart of Accounts for construction business template now. It’s easy to customize and will save you time. Take the first step to simplify your finances and grow your construction business today!

If you find this article helpful, share this with your fellow members. Moreover, if you find any difficulties with your business bookkeeping feel free to contact me. Me and my team are available to make your accounts useful.

Leave a Reply