Cost of Goods Sold (COGS) is one of the most essential financial metrics in any business. It helps determine the direct costs related to producing goods or services sold by a company. Whether you are a small business owner, accountant, or just someone wanting to improve your financial literacy, understand how COGS are calculated.

This article covers everything you need to know about COGS, including its definition and a step-by-step guide on how to calculate it. Besides, you learn how to interpret the cost of goods sold, avoid common mistakes in calculating COGS, and learn strategies for the implementation of COGS to reduce costs. So read the full article to become the master cost of goods sold and save your business money.

Understanding Cost of Goods Sold

The Cost of Goods Sold (COGS) is an essential indicator in any financial analysis. It helps us to identify the direct costs related to the production of goods or services sold by a company during a specific period. Moreover, It is a crucial component of the income statement and is used to calculate the gross profit of a business. COGS is one of the most important financial indicators to determine how a business or company is performing. This data helps make informed decisions.

Definition of Cost of Goods Sold

The cost of Goods Sold refers to the direct expenses incurred in producing goods or services sold by a company. These costs typically include the cost of raw materials, direct labor, and manufacturing overhead. In essence, COGS details the value of what a company has spent to develop its goods for sale during a certain period.

Importance of Calculating Cost of Goods Sold

Calculating COGS is crucial for several reasons. Firstly, it is a key factor in determining a company’s gross profit, which is the difference between its revenue and the direct costs of producing the goods or services sold. Additionally, COGS is also required to analyze the profitability of particular products or services, understand how well an organization is managing its inventory, and set prices.

Relationship between Cost of Goods Sold and Business Profitability

The relationship between COGS and business profitability is straightforward. A lower COGS relative to revenue results in a higher gross profit margin, indicating better efficiency in production and potentially higher profitability. Conversely, a higher COGS can decrease the gross profit margin, impacting overall profitability. Therefore, understanding and effectively managing COGS is critical for maintaining and improving a company’s financial performance.

Components of Cost of Goods Sold

Cost of Goods Sold (COGS) is the direct costs related to the production of goods sold by a company. Understanding its components is essential for accurately calculating gross profit and managing business profitability. The primary components of COGS include:

Direct Costs Included in Cost of Goods Sold

Direct costs included in COGS are expenses that directly connected the production of goods or services. These costs typically encompass the cost of raw materials, direct labor wages, and manufacturing overhead directly associated with production activities.

Indirect Costs Excluded from Cost of Goods Sold

Indirect costs, also known as overhead costs, are all other costs not included in COGS. These costs are related to the general operation of a business and are not directly connected to the production of specific goods or services. Examples of indirect costs include rent, utilities, administrative salaries, and marketing expenses.

Cost of Goods Sold Examples

Examples of costs included in COGS are the cost of raw materials used in production, direct labor wages for assembly line workers, and the cost of utilities directly related to manufacturing processes. These costs are directly connected with the production of goods and are essential for calculating the cost of producing the items sold by a company.

Methods for Calculating Cost of Goods Sold

Several methods can be used to calculate COGS, each with its own advantages and implications. The four primary methods are:

FIFO (First-In, First-Out) Method

The FIFO method assumes the inventory items that we purchased or produced first are to be sold accordingly. This method results in the most recent costs being assigned to closing inventory, and the oldest costs being assigned to COGS.

LIFO (Last-In, First-Out) Method

Conversely, the LIFO method assumes that the most recent inventory items purchased or produced are the first to be sold. This results in the most recent costs being assigned to COGS, and the oldest costs being assigned to closing inventory.

Weighted Average Method

The weighted average method calculates a weighted average cost per unit of inventory and then allocates this weighted average between closing inventory and COGS.

Specific Identification Method

The specific identification method involves individually tracking the cost of each item in inventory and matching the actual cost to the items sold.

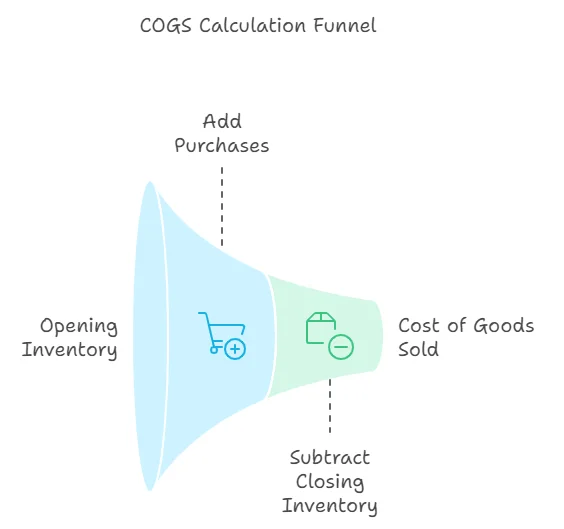

Cost of Goods Sold Formula Explained

The Cost of Goods Sold is an important line item in the income statement and is used to calculate the gross profit of a business. It is calculated by subtracting the cost of goods sold from the total sales or revenue. The Cost of Goods Sold formula is:

COGS = Opening Inventory + Purchases – Closing Inventory

Components of the COGS Formula

Previously, we have learned about the cost of goods sold formula. If we break down the COGS formula we will get three main components in the Cost of Goods Sold:

- Opening Inventory: The value of inventory at the beginning of the accounting period.

- Purchases: The total cost of inventory purchased during the accounting period.

- Closing Inventory: The value of inventory at the end of the accounting period.

Step-by-Step Guide to Calculating Cost of Goods Sold

We now have a clear understanding of the cost of goods sold and their components. Let’s go through the steps to calculate the cost of goods sold:

1. Gathering Necessary Financial Information

To calculate COGS, gather financial information including beginning inventory, purchases made during the accounting period, and closing inventory.

2. Calculating Beginning Inventory

Determine the value of the inventory at the beginning of the accounting period. This typically involves taking a physical count of the inventory and assigning a cost to each item.

3. Adding Purchases During the Accounting Period

Sum the cost of all purchases made during the accounting period, including the cost of raw materials, production supplies, and any other direct costs, such as shipping cost, freight and handling costs, etc, related to inventory.

4. Subtracting Closing Inventory from the Total

Calculate the value of the closing inventory and subtract it from the sum of the beginning inventory and purchases made during the accounting period to arrive at the COGS.

Example of Cost of Goods Sold Calculation

Let’s go through an example to demonstrate how to calculate COGS:

Assume the following for a manufacturing company:

- Beginning Inventory: $50,000

- Purchases during the period: $200,000

- Ending Inventory: $30,000

- Direct Labor: $80,000

- Manufacturing Overhead: $50,000

Step 1) Calculate the Cost of Goods Available for Sale:

Cost of Goods Available=Beginning Inventory+Purchases=50,000+200,000=250,000

Step 2) Apply the COGS Formula:

COGS=Cost of Goods Available−Ending Inventory=250,000−30,000=220,000

Step 3) Add Direct Labor and Manufacturing Overhead:

COGS=220,000+80,000+50,000=350,000

Therefore, the total Cost of Goods Sold for the period is $350,000.

Interpreting Cost of Goods Sold

Interpreting the Cost of Goods Sold (COGS) is key to understanding a company’s financial health and operational efficiency. Here I point out some financial tools to analyze the cost of goods sold.

Cost of Goods Sold Journal Entries

The journal entry is not part of the financial analysis but you have to know to get the actual result of the financial analysis. It is the initial step of the accounting cycle. To record the correct cost of goods sold journal entries reflect the expenses incurred from selling inventory.

Example Journal Entry

Assume the following:

- Beginning Inventory: $4,000

- Purchases: $1,000

- Ending Inventory: $1,500

Calculating COGS:

COGS=4,000+1,000−1,500=3,500

The journal entry would look like this:

| Date | Account | Notes | Debit | Credit |

|---|---|---|---|---|

| XX/XX/XXXX | COGS Expense | Cost of goods sold | 3,500 | |

| Inventory | Decrease in inventory | 3,500 |

In this entry, you debit the COGS Expense account to reflect the expense incurred and credit the Inventory account to reduce the inventory balance by the cost of the goods sold during the period

Analyzing the Cost of Goods Sold Ratio

The COGS ratio, calculated by dividing COGS by total revenue, provides insights into the efficiency of a company’s production and inventory management processes.

For instance, if a company has a COGS of $50,000 and total net sales of $60,000, the COGS ratio would be calculated as follows:

COGS Ratio=(50,000/60,000)×100=83.3%

This means that 83.3% of the company’s sales revenue is used to cover the costs of goods sold.

Comparing the Cost of Goods Sold to Industry Averages

Comparing COGS to industry averages provides valuable insights into a company’s financial health and operational efficiency. By monitoring this metric, businesses can identify areas for improvement. This tool also helps to optimize business cost structures and enhance profitability in a competitive landscape.

Understanding the Impact of Cost of Goods Sold on Financial Statements

COGS directly impacts a company’s gross profit and, consequently, it effects directly to net income. This financial data is important for financial analysis and decision making. By managing COGS effectively, businesses can enhance profitability, optimize pricing strategies, and ensure accurate financial reporting. This ultimately supports better decision-making and strategic planning.

Common Mistakes to Avoid When Calculating COGS

Businesses often make common mistakes when calculating the Cost of Goods Sold (COGS). These errors can result in inaccurate financial reporting and misguided decision-making. Here are the key pitfalls to avoid:

Incorrect Inclusion of Expenses

The most common mistake is including costs that do not have any direct link to the production or acquisition of goods. For example, administrative costs or marketing expenses should not be included in COGS, as this inflates the value and results in an inaccurate gross profit margin. Only direct costs such as raw materials, labor, and manufacturing overhead should be considered.

Inaccurate Inventory Valuation Methods

Using incorrect inventory valuation methods, such as FIFO (First In, First Out) or LIFO (Last In, First Out), can lead to inaccurate COGS calculation and misrepresentation of financial statements. For instance, switching from FIFO to LIFO without proper adjusting can result in wrong COGS and have impacts on gross profit margins. Moreover, regular physical inventory counts and reconciliations with accounting records are essential for maintaining accurate valuations.

Ignoring the Impact of COGS on Pricing and Profitability

Failing to recognize the significance of COGS in pricing decisions and profitability analysis can result in suboptimal pricing strategies. This can ultimately reduce profitability.

Failing to Account for Inventory Adjustments

If you forget to adjust for inventory factors such as spoilage or shrinkage, your COGS will potentially be incorrect. So you need to regularly monitor inventory levels and adjust COGS. This adjusting COGS to reflect any losses ensures financial accuracy.

Strategies to Reduce Cost of Goods Sold

Reducing the Cost of Goods Sold (COGS) is crucial for enhancing profitability and maintaining competitiveness in any business. Here are several effective strategies to achieve this:

Implementing Efficient Inventory Management Systems

Efficient inventory management systems help reduce carrying costs, minimize stockouts, and optimize inventory turnover. This ultimately leads to lower COGS.

Negotiating Better Pricing with Suppliers

Negotiating favorable terms with suppliers, bulk purchasing, and seeking discounts can help reduce the cost of inventory. These strategies also contribute to lowering the overall COGS. Explore alternative suppliers who may offer lower costs or higher quality materials.

Regularly Monitor and Analyze Costs

Regularly review and analyze COGS to identify trends and areas for improvement. Setting performance benchmarks can help in tracking progress over time. Besides, use cost-effective marketing strategies, such as digital marketing, to reduce overall expenses while effectively reaching target audiences.

Leverage Technology

There are many inventory management software that help you to optimize inventory control processes, reduce costs, and improve overall efficiency. Fishbowl, Zoho Inventory, and Katana are some of them mostly used inventory management software. If you have the budget or your business is growing installing inventory management software in your business is a smart decision.

FAQs

How often should I calculate COGS?

It’s typically calculated on a monthly, quarterly, or annual basis, depending on your reporting period.

Is the cost of goods sold an expense?

Yes, it is classified as an expense in accounting.

How do you calculate cost of goods sold?

To calculate the Cost of Goods Sold (COGS), use this formula: COGS = Beginning Inventory + Purchases – Ending Inventory

Does COGS affect gross profit?

Yes, gross profit is calculated by subtracting COGS from total revenue.

What happens if COGS is miscalculated?

Miscalculating COGS can lead to incorrect financial statements and tax filings.

Final Thoughts

Calculating COGS is an important part of running a successful business. It will give you insights into your financial health and will also be important for pricing strategy setting and tax planning. Make sure you calculate your COGS accurately to ensure long-term business success.

So, in this article, I have covered everything related to the cost of goods sold and hope you will get a clear idea of COGS. Whether you are an accountant, business owner, or accounting student everyone will be benefited from this article. Bookmark this page for further reference and share it with your friends and colleagues. Moreover, drop your question in the comment box, I will reply to your question.

Leave a Reply