While managing multiple debts can be complex, a well-crafted strategy can simplify the process and pave the way for financial freedom. The debt snowball method is one such strategy that has helped countless individuals and small business owners take more control over their finances. By focusing on paying off your smallest debts first, you build momentum – like a rolling snowball, until all your debts are cleared.

A free debt snowball spreadsheet can be just your game-changer on this journey. It is designed to make your process of repaying debts that much simpler, making tracking progress all so easy and aid you in staying motivated. In this blog, we will discuss the workings of the debt snowball method, its effectiveness, and how you can use a free Debt Snowball Spreadsheet to fast-track your way to financial freedom.

Whether it’s credit card debt, issues with student loans, or high-interest burdens, all these can be conquered with this approach in order to achieve those financial goals.

Why Debt Snowball Method Works?

The debt snowball method is effective because it’s psychologically motivating. Paying off a debt, even a small one creates a sense of accomplishment that motivates a person to continue. This really helps people who have a problem with staying motivated over the course of paying down their debt.

Some people believe that paying off high-interest debt first, using the debt avalanche method, can save the most money over time. However, the debt snowball method’s focus on achieving quick victories can be more motivating for many people. This method can be an effective tool for small business owners managing multiple debts. It can provide the necessary momentum to improve their overall financial health.

By using a debt snowball calculator or a printable debt snowball worksheet, you can easily visualize your progress and stay on track. These tools simplify the process. They help you organize your debts and track payments. You can see exactly how close you are to achieving financial freedom.

How to Use a Free Debt Snowball Spreadsheet

A free debt snowball spreadsheet is a practical tool that makes easier your debt management process. This spreadsheet helps you stay organized. It tracks your debts, payments, and progress. This keeps you focused and motivated on your journey to becoming debt-free. Whether you’re dealing with a few small debts or a larger mix of obligations, this tool can be invaluable. It’s a great asset for your financial planning.

Step by Step Guide to Using the Spreadsheet

To effectively use a Debt Snowball Spreadsheet, follow these step-by-step instructions:

Step 1: Gather Your Debt Information

Collect all your debt-related bills, including credit cards, student loans, medical bills, and personal loans. Exclude your mortgage if you consider it “good debt.” Highlight the following for each debt:

- Total amount owed

- Minimum monthly payment

Step 2: Create Your Debt Snowball Worksheet

You can use a simple spreadsheet or download a pre-made template. Here’s how to set it up:

- List Your Debts: Write down all your debts in a column, ordered from smallest to largest balance.

- Add Columns: Create additional columns for:

- Minimum monthly payment

- Current payment (the amount you will pay each month)

- Input Your Payments: For all debts except the smallest, set the “Current payment” to match the “Minimum monthly payment.” For the smallest debt, add an extra amount you can afford to pay beyond the minimum.

| Type of Debt | Total Amount Owed | Minimum Monthly Payment | Current Payment |

|---|---|---|---|

| Medical Bill | $1,500 | $50 | $150 (including extra) |

| Credit Card #1 | $4,000 | $160 | $160 |

| Credit Card #2 | $6,000 | $240 | $240 |

| Car Loan | $20,000 | $380 | $380 |

Step 3: Implement the Debt Snowball Method

- Make Payments: Use your worksheet to guide your payments. Pay the minimum on all debts except the smallest, where you will apply any extra funds.

- Celebrate Small Wins: When you pay off the smallest debt, cross it off and move to the next smallest debt, adding the previous payment amount to the next debt’s minimum payment.

- Repeat: Continue this process until all debts are paid off. The momentum builds as you pay off each debt, allowing you to tackle larger debts with more significant payments.

Step 4: Monitor Progress

Regularly check your spreadsheet to track your progress and adjust your payments as necessary. This will help keep you motivated and focused on becoming debt-free.

Download Free Debt Snowball Spreadsheet

You can download free Debt Snowball Spreadsheets from several sources. Here are some options:

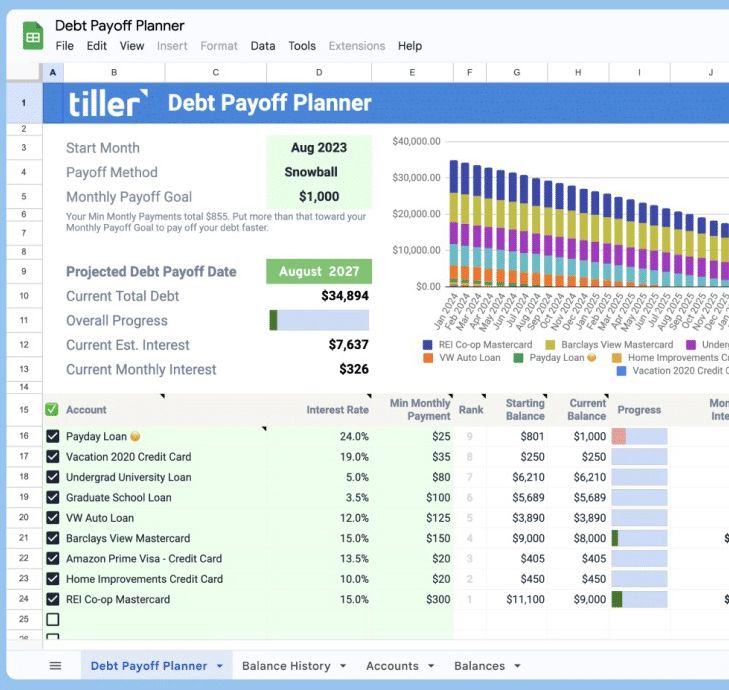

1. Tiller Money: They have developed multiple debt snowball spreadsheets for Google Sheets and Excel. The spreadsheets are highly customizable, making it ideal for those who want a tailored experience. You can download the free debt snowball spreadsheet from here.

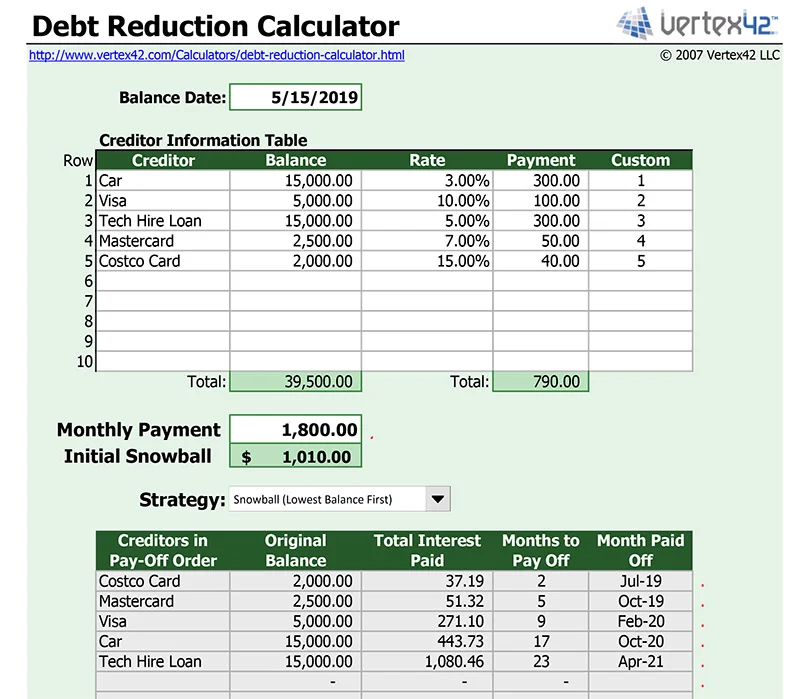

2. Vertex42: Known for its simplicity and ease of use, Vertex42 offers a straightforward debt snowball spreadsheet that’s perfect for beginners. It’s designed to be easy to set up and use, with built-in calculations to help you stay on track. You can download the Debt Snowball Excel (XLS) file or Debt Reduction Calculator Google Sheet

- TemplateLab: Offers various debt snowball spreadsheets and calculators that can be customized according to your needs. You can explore their templates here.

Printable Debt Snowball Worksheet Options

If you find a debt snowball spreadsheet is complex for you, you can use printable debt snowball worksheet. It can complement their digital tools and provide a tangible way to track debt repayment progress. While a free debt snowball spreadsheet offers digital convenience, a printable worksheet can be a useful addition to your debt management toolkit.

Benefits of Using a Printable Debt Snowball Worksheet

Using a printable debt snowball worksheet offers several benefits that can significantly enhance your debt repayment strategy. Here are the key advantages:

- Tactile Motivation: A physical worksheet can serve as a constant visual reminder of your goals. If placed in a visible spot – like on your fridge or desk, it will help you stay motivated toward carrying out the plan for debt reduction.

- Easy Access: The printable debt snowball worksheet will keep your debt repayment plan on hand instead of accessing a computer or your smartphone. This can be particularly useful for quick checks and updates while on the go.

- Visual Tracking: Many printable worksheets can have columns and parts to write debt balance, amount of money paid, and completion date. This visual format will help you track your progress more easily and effectively.

- Customization: Printable worksheets can often be customized to fit your specific needs. You may download a template that best fits your preference or even create one that would include sections you see fit for your financial situation.

Where to Find Printable Debt Snowball Worksheets

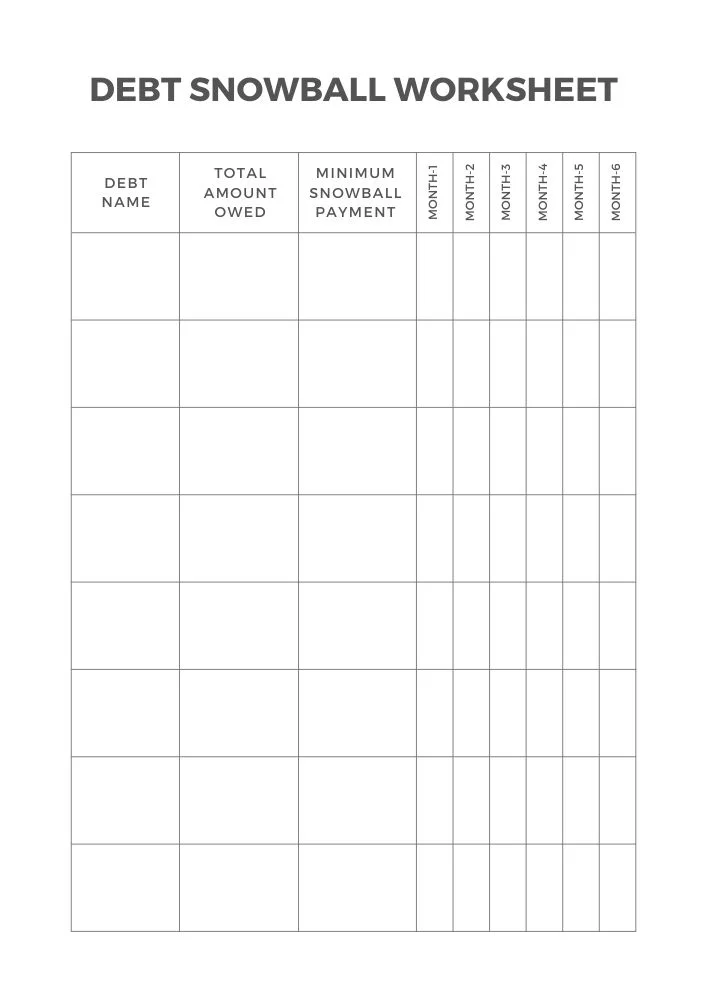

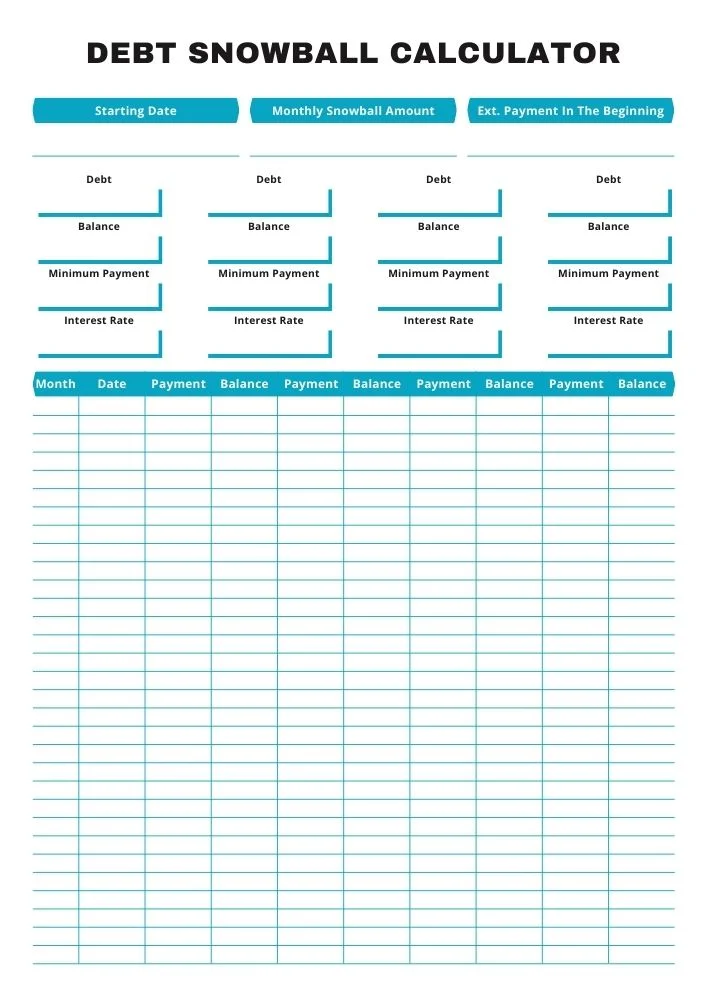

Etsy is a popular e-commerce site for digital products. You can download printable debt snowball worksheets from this website just by spending a small amount. Besides, you can also find many debt snowball templates while searching on the internet. However, I have collected two different types of printable debt snowball worksheets. You can download it free below.

Printable Debt Snowball Worksheet Free!

Download this worksheet and speed up your debt repayment process.

Printable Debt Snowball Worksheet Free!

Download this worksheet and speed up your debt repayment process.

How to Use a Printable Debt Snowball Worksheet

- Fill in Your Debts: Write down all your debts, including the creditor’s name, balance, minimum payment, and interest rate. Arrange them from smallest to largest to align with the debt snowball method.

- Record Payments: Track your payments on the worksheet. Update it regularly as you make extra payments towards your smallest debt. This helps you visualize your progress and stay motivated.

- Review and Adjust: Periodically review your worksheet to ensure it reflects your current financial situation. If your income or expenses change, adjust your plan accordingly to stay on track.

FAQ

What is a debt snowball calculator?

A debt snowball calculator is a tool that helps you visualize your debt repayment journey using the debt snowball method. You can enter your debts, interest rates, and monthly payments to see how quickly you can pay them off.

Can I use a Printable Debt Snowball Worksheet instead of a spreadsheet?

Yes, you can use a Printable Debt Snowball Worksheet instead of a spreadsheet. However, a spreadsheet may offer more flexibility and automation.

Bottom Line

So we can conclude that a free debt snowball spreadsheet simplifies debt management and achieves financial freedom. The cost of using this debt snowball template is almost zero. I suggest you use a debt snowball spreadsheet in Excel or Google Sheet. However, you can use a printable debt snowball worksheet which is more convenient.

Share your experience and suggestions about debt management in the comment section. Moreover, you can also ask any queries about money management. Our expert teams are always happy to assist you.

Leave a Reply