Feeling overwhelmed by your finances? Ever wondered where it is all going? Here’s a comprehensive guide on how to make a budget spreadsheet to manage your finances effectively.

A budget spreadsheet is your way to take control of your finances and meet your financial goals. This guide will walk you through the process from choosing the right tools to looking at ways you spend money. Moreover, We’ll cover everything you need to know to build a personalized budget tracker and take charge of your financial future.

Why Use a Budget Spreadsheet?

Budgeting may seem tedious, but a well-crafted spreadsheet offers a wealth of benefits:

- Visibility: Track your income and expenses in one, organized location.

- Control: Identify areas where you can cut back and allocate funds more effectively.

- Planning: Set some realistic financial goals and see how far you have gone in realizing your dreams.

- Debt Management: Develop an action plan that would lead to the elimination of debt and give one financial freedom.

- Peace of Mind: Know you are managing your money wisely.

Choosing Budget Spreadsheet Software

The beauty of budget spreadsheets is that there are so many options to choose and each has some advantages. Here is the list of budget spreadsheets that help you make a budget perfectly.

- Microsoft Excel: This is an industry standard, and it offers several features and functions for advanced customization.

- Google Sheets: Free, cloud-based application, and accessible from any device with an Internet connection. In the case of budgeting with a partner, there are facilities for collaboration.

- Free Spreadsheet Templates: There are so many free, pre-built budget spreadsheet templates available at various online sources that you can download and make use of. Search the internet for “free budget spreadsheet templates” and find many more options. However, some templates are paid versions.

- Budgeting Apps: This implies applications that can integrate with budgeting spreadsheets, ensure expense tracking, and support the automation of categorization.

How to Make a Budget Spreadsheet: A Step-by-Step Guide

Here is the step-by-step for making a budget spreadsheet:

1. Gather Your Information

- Income: List all your income sources, including salary, bonuses, and investment returns. Give as much detail as possible.

- Expenses: Keep track of where your money goes. Categorize them into needs like rent, food, utilities, etc.

- Financial Accounts: Linking of checking and bank accounts, savings accounts, credit cards, and loans.

2. Setting Up Your Spreadsheet

- Layout: Divide your spreadsheet into categories for income, expenses, and a budget.

- Headers: Clearly head each column with “Date”, “Description”, “Amount”, and “Category”.

- Formatting: The conditional formatting in this will highlight a particular area where overspending has taken place, based on the requirements.

3. Income Section

- List each source of income on separate lines.

- Specify the expected amount for each source of income, be it a monthly salary or quarterly bonus.

- Formulas automatically work out a total of the monthly income.

4. Expenses Section

- Dedicate a section to track your expenses.

- Include columns for “Date”, “Description”, “Amount”, “Category”, and potentially “Payment Method”.

- You can either manually add your expenses or import bank statements to fill in the values.

5. Classify Your Expenses

Create categories for expenses that mirror your spending habits. Some common categories include:

- Housing

- Utilities

- Groceries

- Transportation

- Entertainment

- Debt Payments

- Savings

- Miscellaneous

You can further sub-categorize for a more detailed breakdown (e.g., groceries can be subdivided into “pantry staples” and “fresh produce”)

6. Budget Section

- Create a realistic budget for each category of expenses, considering your income and spending history.

- Use the formula to calculate the difference between what you budgeted for and what you actually spent, which is called variance.

- It will show variances where you are overspending or underspending in your budget.

7. Formula and Functions

- Use built-in formulas and functions to build in calculation capabilities that will save time.

- Common formulas include SUM, AVERAGE, and IF statements. Most spreadsheet applications include tutorials and guides on how to effectively use formulas.

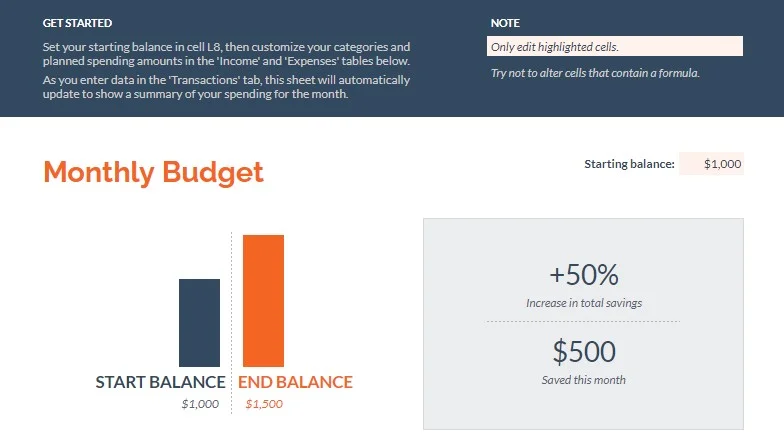

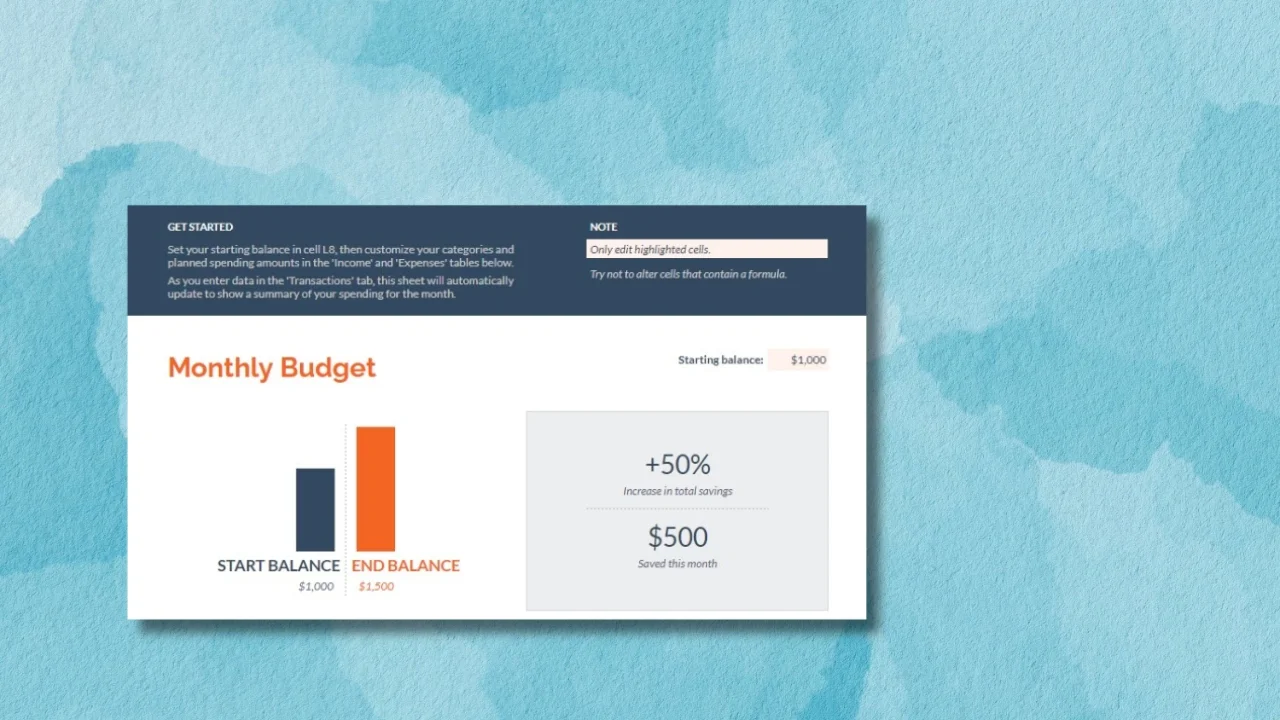

8. Visualizations

- Consider using charts and graphs for putting your data into a graphic form.

- This will give you an easier budget to read and the capability of finding trends in your spending.

- Bar graphs can compare your budgeted expenses versus actual expenses; pie charts can be used to show how income is allocated.

9. Track and Maintain Your Spreadsheet

- Keep an update of your income and expenditure in your spreadsheet quite regularly.

- Review your budget variances and adjust your budget allocations if necessary.

- Schedule budget reviews regularly to stay disciplined and analyze how close to meet your financial goals.

Budget Spreadsheet Templates

Managing your finances with a budget spreadsheet can be a smart move. You can find many options for making budget spreadsheets for free or paid. However, the budget spreadsheet template free option is good enough for preparing the basic budget. Here are some options you can explore:

Microsoft Office Excel Templates

Microsoft offers customized budget Excel templates for monthly and annual budgets, and budget templates for personal, event, food, trip, etc. To download the budget spreadsheet Excel template free go to the Microsoft 365 Excel template page and search “budget” or access it directly by clicking this link.

Google Sheet Templates

Similar to Microsoft Excel, you can also use the Google Sheet budget template for free. For this open Google sheet and go to New > From template gallery. Here you find pre-made monthly and annual budget Google sheet templates. Open this budget spreadsheet template and customize it as you need.

Bottom Line

Building and maintaining a budget spreadsheet requires discipline and commitment. To unlock financial mastery, you have to know how to make a budget. This article guides you on the reasons to make a budget, how to find the exact tools for managing a budget, and how to make a budget spreadsheet. Overall this article is all in one solution for creating a budget spreadsheet.

However, if you want to learn more about budgeting or any other accounting basics, feel free to share with us. Simply you can comment on our comment box and we will reach or notify with you within a short period. Finally, do not forget to bookmark this article for further references.

Leave a Reply