If you get paid twice a month how to save money biweekly? Disclosed the hidden tricks of savings challenges to achieve financial goals.

Saving money can often feel like an overwhelming task, especially if you’re living paycheck to paycheck. However, when you change your strategy and know how to save money biweekly, you can gain better control over your finances and set yourself up for long-term success. The concept of bi-weekly saving seems pretty straightforward: every time you get a paycheck, if possible, save that some portion for your savings.

In this comprehensive guide, I will delve into the world of biweekly saving, exploring its benefits, guidelines on how to meet the biweekly savings challenge, and practical tips to help you succeed. In addition, I have included a biweekly money-saving challenge template in multiple targets. So you can choose your target based on your income level. Good news is you can download this template for free. So let’s drive this article and motivate yourself to on your biweekly saving journey.

What is Biweekly Savings Plan?

A biweekly savings plan is a great way to systematically save money from each paycheck. This plan involves dividing your total monthly savings goal into smaller amount that match up with your pay schedule. For example, if you want to save $400 per month, you would save $200 every two weeks.

One of the main advantages of a biweekly plan is its flexibility. It doesn’t matter whether you receive a biweekly paycheck or not, this method helps you keep up with making regular deposits into your savings account. In contrast to saving monthly, which can feel like a big lump sum, biweekly savings make it easier and more manageable to save consistently.

This system also works well with other financial strategies, such as envelope budgeting or automatic transfers, to make the process of saving easier to manage. You can even use a budgeting app to automate transfers or track your spending every two weeks. At the end of the month, you have saved and you won’t even know it!

Benefits of Saving Money Biweekly

The advantages of implementing a biweekly saving strategy are numerous. Firstly, you’ll be able to build the habit of saving with a lot of discipline and regularity. By automating your savings, you ensure that money is needed before you spend it. Secondly, you can realize your long term financial goals very easily and soon, whether you are going to purchase a home, start a business, or plan a dream vacation. Finally, this biweekly saving can give one a much-needed financial cushion when unexpected emergencies arise.

How to Save Money Biweekly: Step-by-Step Guide

At this point, I hope you understand the concept of saving money biweekly. Now it’s time to draw the complete steps of how you can achieve a biweekly savings challenge. Whether you are aiming to create savings for unexpected expenses or a major buy, following these steps can help make the task simpler..

Now that you understand the concept, let’s explore how to save money biweekly with a practical, step-by-step approach. Whether you’re trying to build an emergency fund or save for a big purchase, following these steps can make the process much easier:

1. Create a Biweekly Budget

First, assess your biweekly paycheck and list your must-have expenses such as rent, utilities, groceries, and others. Then distribute your budgeted expense between the listing expenses. But remember that you need to assign a specific percentage of your income, it may be 10% to 20% and have that go directly into savings every two weeks.

2. Automate Your Savings

Automation is the simplest way to make sure that you actually stick to a biweekly savings plan. Set up automatic transfers from your checking account to your savings account taken out on payday. This way, you won’t have to rely on self-discipline. Many banks or budgeting apps offer free tools for automating this process.

3. Cut Unnecessary Expenses Biweekly

Evaluate your spending every two weeks. Take a look at your recent purchases, noting areas where you might be able to cut back on spending. Small adjustments, like eliminating daily runs for coffee or skipping eating out for dinner, can free up some extra money to put into savings.

4. Use the Envelope Budgeting System

Consider using the envelope budgeting system to manage your biweekly budget. Allocate cash into separate envelopes for each expense category. This physical method will help you stay within the bounds of your budget and ensure that you cannot possibly spend above the amount you have allocated for saving.

Tips for Successful Biweekly Saving

Starting a biweekly saving challenge is a great way to improve your financial health. To maximize your success, consider the following tips:

Set Clear and Achievable Financial Goals

Defining your financial goals will help to keep you motivated. Whether you are trying to build an emergency fund, save for a down payment, or fund a vacation, having a clear goal creates a mindset to achieve the financial goals. Break down larger goals into smaller, achievable milestones so that you can track the progress you are making and celebrate the achievement.

Automate Your Biweekly Savings for Consistency

Consistency is key to building wealth. A big part of it is just creating the habit. Automate your savings with an automatic transfer from your checking account to a separate savings account for each payday. “Paying yourself first” is essential in the order of priorities. You’ll be surprised at just how fast your savings grow with that temptation to spend removed.

Find Accountability Partners to Stay Motivated

Sharing your saving goals with a friend, family member, or online community can provide valuable support and encouragement. To keep you disciplined and focused, you can share with others your progress, challenges, and success. Besides, you can join online forums or social media groups dedicated to saving money to connect with the same mentality group of people.

Overcome Common Saving Challenges

It’s natural to encounter obstacles along your saving journey. Common challenges include unexpected expenses, temptations to spend, and feelings of deprivation. To overcome these challenges you need to create a realistic budget, identify areas where you can cut back, and find alternative sources of income if necessary. Remember, small steps can lead to significant progress.

Celebrate Your Biweekly Saving Milestones

Recognizing your achievements is essential for maintaining motivation. Celebrate each milestone, no matter how small they may seem. Treat yourself to a small reward, such as a night out or a new book, to acknowledge your hard work and dedication. Positive reinforcement is going to help keep you on track and enjoy the process of saving.

Free Biweekly Savings Challenge Printable Template!

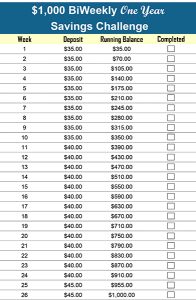

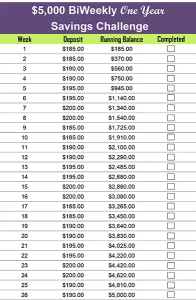

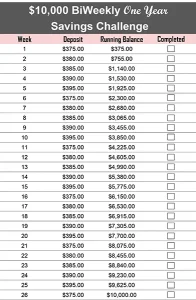

Biweekly savings challenge guidelines and tips have already been discussed. Still you doubt about how to kick off your biweekly savings challenge, then you can maintain a biweekly money saving challenge template. This template helps you to keep track of your money saving challenges. Here I have prepared three different saving challenges biweekly templates. You can follow anyone based on your income or money saving target. Here you will find 1000, 5000, and 10000 bi weekly money challenge for 26 biweekly or one year. However, you can use these 26 bi weekly money challenge printable templates for your requirements.

How to Use Biweekly Savings Challenge Printable

The process is very simple. Download the biweekly money saving challenge template from the download section. It is a pdf formate. You need to print it.

Then hang it in a place on your room or desk where you can notice it easily. The template lets you know how to save for each week or two weeks.

Make your money saving plan based on a weekly target and deposit it to a separate bank account or saving jar at the paycheck day or earlier.

When your weekly deposit is done, you should mark it on the template to track your progress. If you can successfully reach your milestone then you can see your progress.

Download Biweekly Savings Challenge Printable

$1000 BiWeekly 26 Weeks Savings Challenge Printable Template

Download this biweekly savings challenge printable pdf file for free.

$5000 BiWeekly 26 Weeks Savings Challenge Printable Template

Download this biweekly savings challenge printable pdf file for free.

$10000 BiWeekly 26 Weeks Savings Challenge Printable Template

Download this biweekly savings challenge printable pdf file for free.

FAQ about How to Save Money Biweekly

What is the best way to save money biweekly?

The best approach is to create a biweekly budget and automate your savings. Set a specific amount—like 10% of your income—to transfer directly into your savings account every two weeks. This makes it easier to stay consistent and ensures you’re building a habit of saving regularly.

How much can I save with a biweekly challenge?

The amount you can save with a biweekly challenge depends on your income and savings goals. Even small amounts saved consistently can add up to significant savings over time. Many people start with a modest amount and gradually increase their contributions as their financial situation improves.

Can I modify a biweekly challenge to fit my budget?

Absolutely! The beauty of biweekly saving is its flexibility. You can adjust the amount you save to match your financial situation. Start with a small amount and gradually increase it as your income grows. You can also modify the challenge to fit your specific goals, such as saving for a down payment or a vacation.

Final Thoughts

So adopting a biweekly savings plan can simplify and strengthen your financial health. By saving a portion of your income every two weeks, you create a consistent habit that helps build an emergency fund, achieve financial goals, and reduce stress.

Finding the best budgeting app can make this process even easier. Whether you have a regular paycheck, irregular freelance income, or manage a small business, biweekly savings can be tailored to fit your needs. Start small, automate your transfers, and track your progress. With time and discipline, you’ll enjoy greater financial stability and peace of mind.

Start your biweekly savings journey today and watch how this simple strategy can lead to significant financial benefits.

Leave a Reply