As the new year approaches, millions of taxpayers eagerly await their refunds. Knowing the IRS tax refund calendar 2025 can turn this waiting game into a well-planned financial strategy.

A tax refund is the IRS returning overpaid taxes from the previous year, but when that money arrives depends on several variables. From your filing method (e-file vs. paper) to claiming credits like the Earned Income Tax Credit (EITC), each choice impacts the processing timeline. Add in potential delays like errors, fraud checks, or mail slowdowns, and it’s clear why understanding the 2025 refund schedule is essential for avoiding surprises.

In this guide, we’ll break down the IRS tax refund calendar 2025, including critical deadlines, how to track your payment, and proven tips to speed up the process. You’ll also learn why refunds tied to certain credits face mandatory holds, how state timelines differ, and what to do if your refund is late. By the end, you’ll have a clear roadmap to navigate tax season confidently and ensure your refund arrives when you need it most.

How Long Does the IRS Take to Issue Refunds in 2025?

The IRS aims to process 90% of refunds within 21 days for error-free, electronically filed returns. However, your refund method and specific circumstances can affect timing:

| Filing Method | Direct Deposit Timeline | Mailed Check Timeline |

|---|---|---|

| E-file (no errors) | 14–21 days | 21–28 days |

| Paper file | 6–8 weeks | 8–10 weeks |

| E-file with EITC/ACTC | After February 28, 2025 | After March 7, 2025 |

Note: The IRS cannot release EITC/ACTC refunds before mid-February due to federal fraud prevention laws.

How to Track Your 2025 Tax Refund Status

The IRS provides two free tools to monitor your refund:

- Where’s My Refund? (IRS.gov/refunds):

- Updates once every 24 hours.

- Requires your SSN, filing status, and exact refund amount.

- Shows three statuses: Received, Approved, or Sent.

- IRS2Go Mobile App:

- Offers the same features as the online tool.

- Available for iOS and Android.

Pro Tip: Wait 24–48 hours after e-filing to check your status. The tool won’t display updates until your return is fully processed.

Why Your 2025 Tax Refund Might Be Delayed

Even with a perfect return, these factors could slow your refund:

1. PATH Act Holds

If you claim the EITC or ACTC, the IRS legally cannot issue refunds before mid-February. This delay allows the agency to verify income and eligibility, reducing fraud.

2. Errors or Inconsistencies

Common mistakes triggering manual reviews include:

- Mismatched SSNs or dependent information.

- Incorrect direct deposit routing numbers.

- Math errors or unsigned forms.

3. Identity Theft or Fraud Flags

The IRS may freeze refunds if your return shows suspicious activity, such as duplicate filings or unfamiliar dependents.

4. Paper Filing

Paper returns take 6–8 weeks to process, as they require manual data entry.

5. Unpaid Debts

Federal or state agencies can offset refunds to cover unpaid taxes, child support, or student loans.

How to Speed Up Your 2025 Tax Refund

Follow these steps to avoid delays and maximize efficiency:

1. File Electronically

E-filing reduces errors and speeds up processing by 3–4 weeks compared to paper returns. Use IRS Free File if your income is under $79,000 (2025 threshold).

2. Opt for Direct Deposit

Direct deposit is faster and safer than paper checks. You can split your refund into multiple accounts using Form 8888.

3. Verify Documents Early

Double-check W-2s, 1099s, and deduction records before filing. Use IRS guidelines for:

- Child Tax Credit eligibility.

- Student loan interest deductions.

- Charitable contributions (if itemizing).

4. Respond Quickly to IRS Notices

If the IRS requests additional documentation (e.g., Form 8862 for EITC), reply within 30 days to avoid prolonged delays.

5. Avoid Last-Minute Filing

April filers face longer wait times due to peak IRS workload. Aim to submit by early March.

What to Do If Your Refund is Late

If your refund hasn’t arrived within the expected timeframe:

- Check “Where’s My Refund?”: Confirm the IRS has processed your return.

- Review for Errors: Compare your filed return against the original documents.

- Contact the IRS:

- Call 800-829-1040 (7 AM–7 PM local time).

- Visit a Taxpayer Assistance Center (schedule appointments via IRS.gov).

- Hire a tax professional if identity theft or complex issues arise.

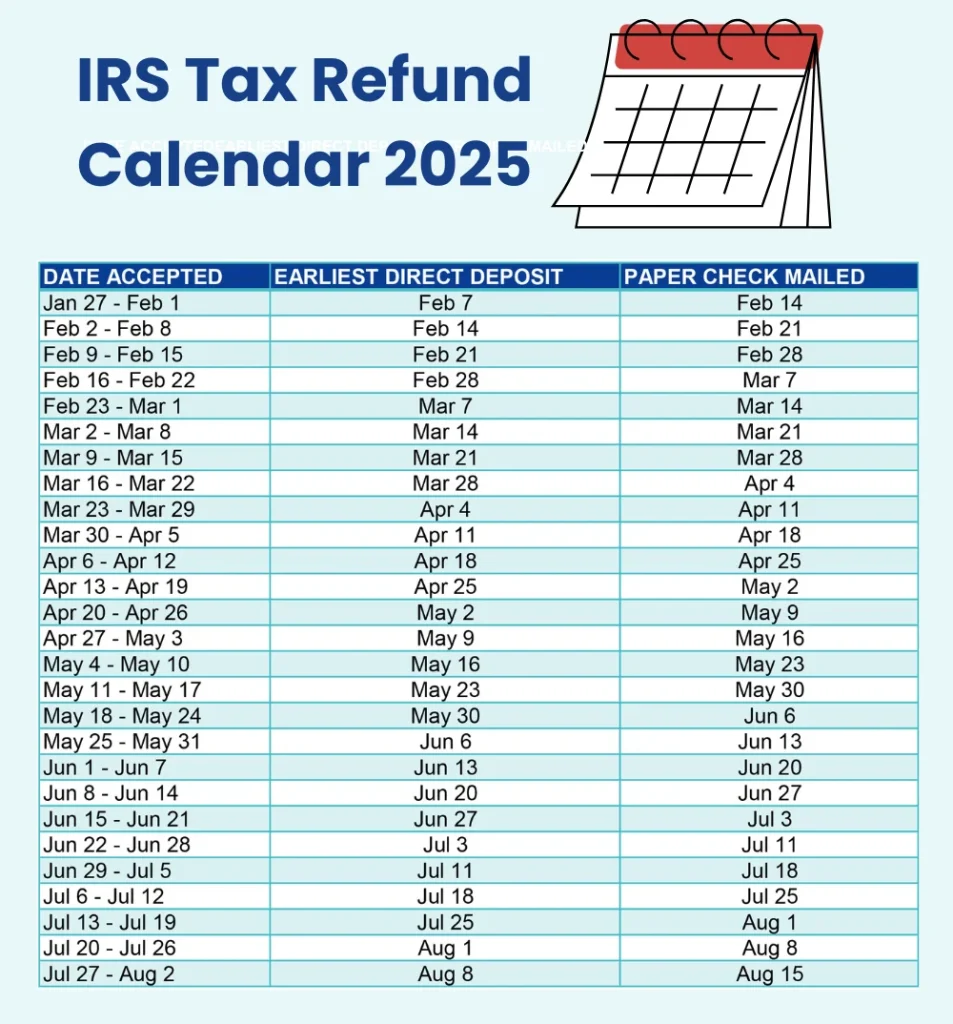

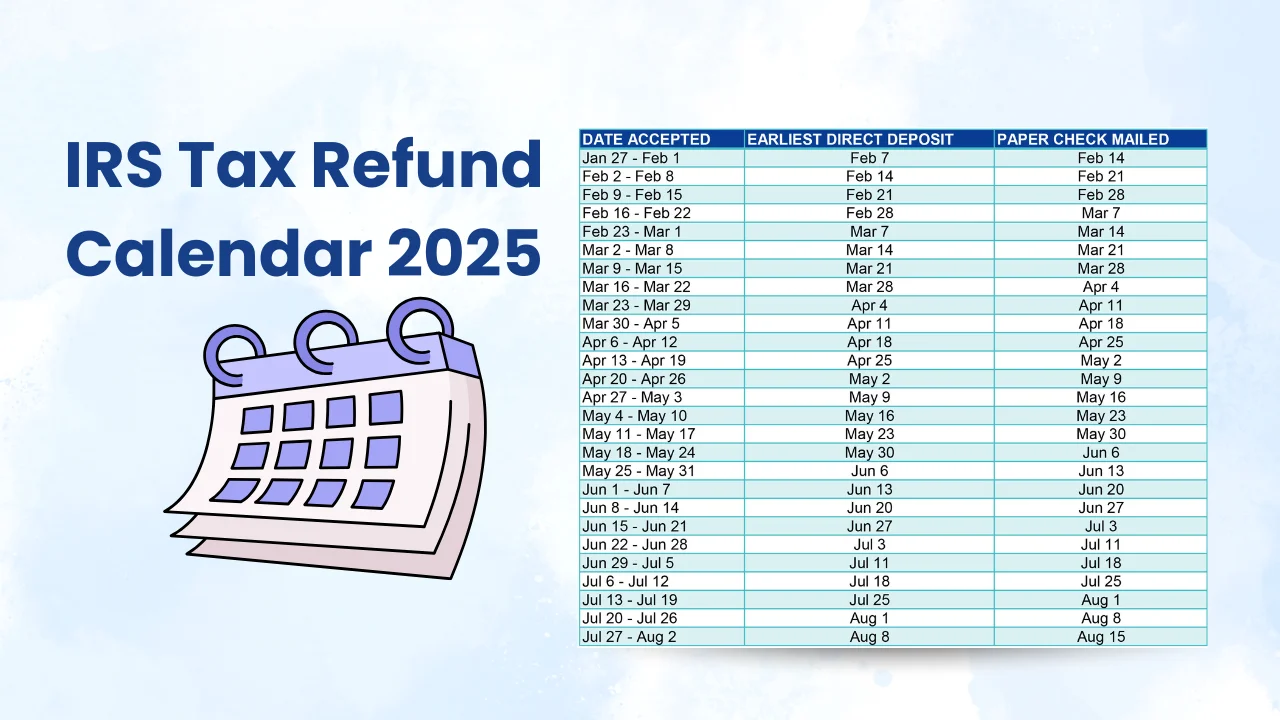

IRS Tax Refund Calendar 2025

While federal refunds follow IRS schedules, state refunds vary. For example:

- California: 2–4 weeks for e-filed returns.

- New York: 3–5 weeks for error-free submissions.

- Texas: No state income tax.

Check your state’s Department of Revenue website for specifics.

2025 Tax Refund Predictions and IRS Updates

The IRS continues to modernize with Inflation Reduction Act funding, aiming to:

- Reduce paper backlog by hiring 10,000+ new agents.

- Enhance fraud detection algorithms.

- Expand customer service hours and online tools.

While no major delays are anticipated for 2025, filers should remain vigilant against scams. The IRS never contacts taxpayers via email, text, or social media about refunds.

Frequently Asked Questions

FWill the IRS notify me if my refund is delayed?

Only if they need additional information. Monitor “Where’s My Refund?” proactively.

Does amended return timing affect my refund?

Yes. Amended returns take up to 20 weeks to process.

What causes IRS tax refund delays?

Common delays occur due to errors in your tax return, IRS backlogs, EITC/ACTC claims, identity verification, or incorrect bank details.

How can I get my refund faster?

E-file your tax return early, opt for direct deposit, and ensure all information is accurate to avoid processing delays.

Can I track my IRS refund if I filed by mail?

Yes, but mailed returns take longer to process. Use the “Where’s My Refund?” tool after at least four weeks of filing.

Final Words

Navigating the IRS tax refund calendar 2025 doesn’t have to feel like a guessing game. By understanding key deadlines—like the February 15 PATH Act hold for EITC/ACTC refunds or the April 15 filing cutoff you can set realistic expectations and plan your finances with confidence. Remember, e-filing with direct deposit remains the fastest way to receive your refund, while proactive tracking through IRS tools helps you spot delays early. Whether you’re earmarking funds for bills, savings, or a well-deserved treat, staying informed ensures you’re in control.

Ready to help others avoid refund headaches? Share this guide with friends, family, or colleagues who could benefit from a clear breakdown of the 2025 tax refund schedule. Knowledge is power, and spreading the word could save someone stress or even money this tax season.

Leave a Reply