Determining whether the Cost of Goods Sold (COGS) is an asset or liability is crucial for businesses seeking clarity in their financial statements. But is Cost of Goods Sold an asset or liability? This question often arises because understanding COGS classification directly affects several key areas. These areas include the accuracy of financial reporting, adherence to tax regulations, and the foundation upon which critical business decisions are made.

In this article, I have explained details about COGS classifications, real examples, and journal entries, and its impact on business profitability. If you read the full article, you will have a clear understanding of COGS, which helps you make informed decisions about pricing, cost management, and resource allocation. So let’s dive into the article and optimize your business gross profit.

Introduction to Cost of Goods Sold

The cost of goods sold (COGS) encompasses all direct expenses associated with producing goods that a company sells during a specific period. All manufacturing costs included in the COGS items, including raw materials, purchase of goods, direct labor, and production-related overhead expenses. The metric COGS is very crucial in the determination of a company’s gross profit by deducting these direct costs from total sales revenue on the income statement.

In accounting, COGS is a key indicator of a company’s operational efficiency. It not only helps to determine the actual cost of production but also plays a crucial role in identifying the major expenses. This COGS calculation is instrumental in devising an effective strategy to minimize production costs and optimize profitability. Furthermore, it is an integral part of inventory management, helping companies maintain optimal inventory levels, avoid overproduction, and manage resources more effectively.

So, we understand that COGS includes only direct costs. It does not include indirect costs such as marketing, distribution, or administrative expenses, which are categorized separately as operating expenses. This clarity makes it easy to understand how different types of costs are organized and what effects such costs have on a company’s profits.

Cost of Goods Sold Examples

From industry to industry the examples of cost of goods sold items vary. Here are some examples of what constitutes COGS across different industries:

- Manufacturing Industry: Costs of raw materials, direct labor, factory overhead, and depreciation of machinery and equipment are included in COGS

- Retail Industry: COGS includes the cost of purchasing goods from suppliers, freight and transportation costs, and any discounts or allowances given to customers

- Online Retailers: In e-commerce business platforms like eBay or Etsy, COGS can include the cost of materials used to create products and the wholesale price of goods resold. However, shipping costs to customers are not included as they are not part of the production costs.

However, when calculating COGS for a specific period to prepare a financial statement, choose a specific inventory management method like FIFO or LIFO. The cost of goods sold varies depending on the inventory management method and affects the income statement.

Is Cost of Goods Sold An Asset?

When evaluating financial statements, many business owners ask, “Is Cost of Goods Sold an asset or liability?” The answer lies in understanding the fundamental difference between COGS and assets. Cost of Goods Sold is not an asset; instead, it is classified as an expense that reflects the direct costs associated with producing goods sold by the company within a particular period.

Assets are resources that provide future economic benefits, such as inventory, cash, and equipment. Before a product is sold, its costs are recorded as inventory (an asset) on the balance sheet. However, once the product is sold, these costs transition from inventory to COGS on the income statement. This shift is essential in accounting because it matches the expense of producing the goods with the revenue generated from their sale, adhering to the matching principle of accounting.

COGS differs from an asset because it does not provide future economic value; instead, it represents past costs incurred to generate revenue. For instance, when a business purchases raw materials, these items initially appear as inventory, an asset. As the company produces and sells products, the value of these materials moves to COGS, reducing the company’s overall gross profit.

Treating COGS as an expense rather than an asset is crucial for accurate financial reporting. This approach ensures that financial statements genuinely reflect the actual cost of generating revenue for the company. With this accurate picture of costs, companies are better equipped to make informed decisions across various areas. This includes optimizing production efficiency, developing effective pricing strategies, and maintaining control over overall cost management.

Therefore, while COGS is critical to calculating profitability, it is not considered an asset. Recognizing this distinction helps businesses maintain accurate financial records and optimize their resource allocation to improve their bottom line.

Is Cost of Goods Sold A Liability?

Continuing with the question, “Is Cost of Goods Sold an asset or liability?”, it’s important to clarify that COGS is neither. While assets represent resources providing future benefits and liabilities reflect obligations to creditors, COGS does not fit into either category. However, the cost of goods sold is considered a liability in the sense that it represents a cost that has been incurred to generate revenue. More accurately, it is classified as an expense, specifically an operational cost tied directly to the production and sale of goods.

Liabilities refer to future obligations that the company must pay, such as loans, accounts payable, or accrued expenses. These represent debts the business must settle in the future. On the other hand, COGS provides information on the costs that have already been spent to produce and sell goods during a certain period. For example, when a company buys materials on credit to manufacture its products, these purchases initially count as liabilities. However, once the goods are produced and sold, the cost transitions into COGS, impacting the income statement instead of the balance sheet.

The confusion arises because, in some contexts, higher COGS can indirectly impact a company’s liabilities by reducing profitability and cash flow. When COGS increases too much, it can minimize gross profit and put tremendous pressure on your financial resources. In this circumstance, borrowing or unpaid obligations increase, which increases liabilities on the balance sheet. This connection highlights the importance of managing production costs efficiently to maintain healthy profit margins and avoid financial strain.

To conclude, COGS affects financial health; it is not considered a liability because it does not represent an owed debt but reflects expenses already paid or incurred in producing sold goods. Accurately classifying COGS as an expense is crucial for maintaining precise financial records. This accuracy provides businesses with a clearer understanding of their cost structure. By analyzing COGS, businesses can make smarter choices about pricing strategies, cost management initiatives, and overall business operations.

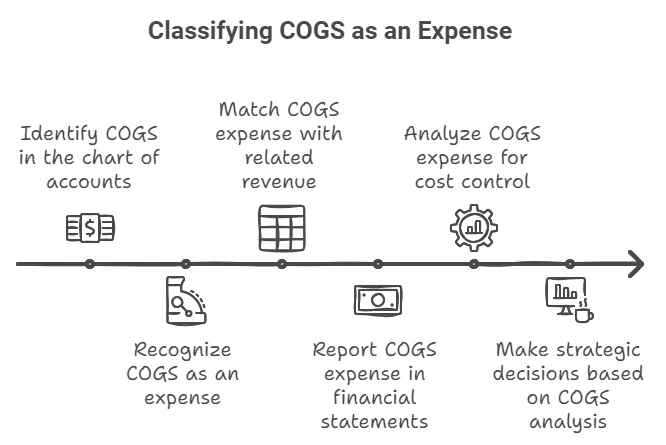

Why Cost of Goods Sold is Classified as an Expense

Cost of Goods Sold is classified as an expense on the income statement, not as an asset or liability. This classification is crucial in accounting because it directly impacts a company’s gross profit, which is calculated by subtracting COGS from total revenue. By accurately reporting COGS as an expense, businesses can better understand their cost structure and evaluate their operational efficiency.

COGS includes all direct costs related to the production of goods sold, such as raw materials, direct labor, and manufacturing overhead. It represents the costs of making a sale – when a company sells its products, the associated costs are moved from inventory (an asset on the balance sheet) to COGS on the income statement. This process aligns with the matching principle in accounting, which states that expenses should be recorded in the same period as the revenues they help generate.

Recording COGS as an expense helps businesses to understand their bottom line clearly and the production cost of generating sales. For example, a lower COGS relative to revenue indicates efficient production and cost management, leading to higher gross profit margins. On the other hand, a high COGS can signal inefficiencies, such as rising material costs or labor expenses, which might require strategic adjustments.

Since COGS is an expense, businesses can focus on optimizing their production processes, managing inventory costs, and making informed decisions about pricing strategies. Accurately accounting for COGS leads to effective financial analysis, higher profits, and more accurate financial statements.

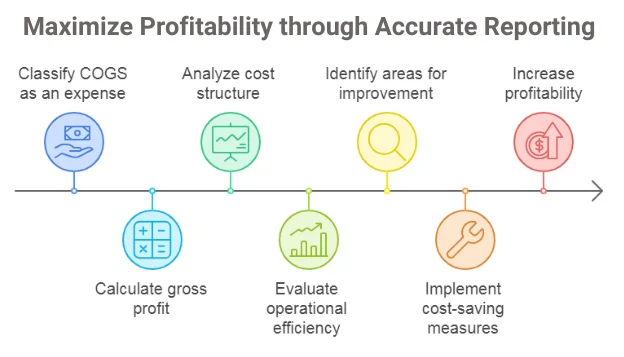

The Impact of COGS on Business Profitability

The cost of Goods Sold (COGS) is one of the key determiners of a company’s profitability. As COGS influences the calculation of gross profit, it enables a business to determine how efficiently it is managing production costs relative to its sales revenue. A well-managed COGS can boost profit margins, whereas high COGS can signal inefficiencies that may reduce profits.

When COGS is high, it reduces gross profit, which is the income left after accounting for the direct costs of producing goods sold. This decrease directly affects the business’s financial performance. The financial scenario helps companies determine which section of manufacturing production cost needs to be controlled and how to negotiate better prices of raw materials and cost-efficient processes. Effective management of COGS can lead to improved pricing strategies, better inventory management, and, ultimately, a stronger competitive position in the market.

On the other hand, reducing COGS can enhance profitability by widening the gap between production costs and sales revenue. Companies often achieve this by adopting efficient production techniques, reducing waste, and optimizing their supply chains. For instance, implementing just-in-time inventory systems or leveraging bulk-purchasing discounts can significantly lower COGS, improving gross margins and overall profitability.

Cost of Goods Sold as Neither an Asset nor a Liability

It’s essential to understand that COGS is neither an asset nor a liability. While it represents the cost of goods that have been sold, it does not meet the criteria to be classified as an asset, as it does not provide future economic benefits. Similarly, it does not meet the definition of a liability, as it does not represent an obligation or debt of the company.

COGS is best understood as a cost of doing business. It reflects the resources consumed in the process of generating revenue and is crucial for determining the true profitability of a company. This distinction has significant implications for financial analysis and decision-making, as it allows for a more accurate assessment of a company’s performance.

Role of Cost of Goods Sold in Representing Direct Costs

The components of COGS typically include the cost of raw materials, direct labor, and manufacturing overhead. These costs are integral to the cost of goods and the prime elements in calculating total production costs.

Accounting for COGS involves calculating and allocating the direct cost of production to each unit of goods sold. This process is crucial for accurately determining the cost of goods sold and, consequently, the gross profit. An accurate representation of COGS is vital for conducting profitability analysis and making informed business decisions.

What Type of Account is Cost of Goods Sold

In the chart of accounts, COGS is classified as an expense account. It is essential to note that COGS is not treated as an asset, as it does not meet the criteria for asset recognition. Instead, it is recognized as an expense in the period in which the related revenue is recognized.

The treatment of COGS in financial statements directly impacts inventory valuation and cost flow assumptions. It influences the carrying value of inventory on the balance sheet and affects the cost of goods sold reported on the income statement.

Cost of Goods Sold Journal Entry

Journal entry is the first step of an accounting cycle. Every transaction is recorded in the journal before it is posted to the general ledger. As COGS directly impacts profit margins, so we should have a clear understanding of the cost of goods sold accounting entry.

Understanding the COGS Journal Entry

The COGS journal entry involves two main accounts:

- Inventory Account: This account reflects the cost of goods that are ready for sale and is considered an asset on the balance sheet.

- Cost of Goods Sold Account: This is an expense account that reflects the cost of inventory that has been sold during a specific period.

When inventory is sold, it moves from being an asset to an expense, impacting the income statement by reducing net income.

Steps to Record a COGS Journal Entry

- Gather Information: Collect details such as beginning inventory balance, purchased inventory costs, and ending inventory count.

- Calculate COGS: Use the formula:

COGS=Beginning Inventory+Purchases−Ending Inventory

This calculation helps determine the total cost of goods sold during the period. - Create the Journal Entry:

Example of a COGS Journal Entry

Suppose a company has a beginning inventory of $4,000, purchases additional materials worth $1,000 during the period, and has an ending inventory of $1,500. The COGS would be calculated as follows:

- COGS = $4,000 (Beginning Inventory) + $1,000 (Purchases) – $1,500 (Ending Inventory) = $3,500

The journal entry would be:

| Date | Account | Debit | Credit |

|---|---|---|---|

| XX/XX/XXXX | COGS Expense | $3,500 | |

| Inventory | $3,500 |

This entry increases the COGS Expense by $3,500 and decreases the Inventory by the same amount

FAQs

What is the primary purpose of Cost of Goods Sold?

The primary purpose of COGS is to measure the direct costs associated with producing goods sold by a company. It helps determine gross profit and assess the efficiency of production and pricing strategies.

Is COGS an expense or a liability?

COGS is classified as an expense on the income statement, not a liability. It reflects the costs of goods sold rather than future obligations, distinguishing it from liabilities.

How does COGS affect a company’s profitability?

COGS directly impacts profitability by reducing gross profit. Lower COGS indicates efficient cost management, while higher COGS can signal inefficiencies that need to be addressed to maintain healthy profit margins.

Can COGS be considered an asset under any circumstances?

No, COGS cannot be considered an asset. Before the sale, costs are recorded as inventory (an asset), but once sold, these costs transition to COGS as an expense.

Is Operational Costs included in Cost of Goods Sold?

No, operational costs are not included in the cost of goods sold (COGS).

Final Thoughts

In conclusion, the question, “Is Cost of Goods Sold an asset or liability?” is best answered by understanding that COGS is neither. Instead, COGS is classified as an expense on the income statement, representing the direct costs of producing goods sold during a specific period. This classification is crucial as it directly impacts a company’s gross profit and overall financial performance.

Accurately identifying COGS as an expense, rather than as an asset or liability, is crucial for businesses. This approach helps maintain precise financial records and supports informed decision-making about pricing and cost management. Recognizing COGS’ role in financial statements allows companies to optimize their operations for better profitability. It also enhances strategic planning, enabling businesses to allocate resources more effectively and improve their gross profit.

Leave a Reply