Outsourcing accounting services is becoming essential for small business looking to optimize business. Small business owners often face the challenge of managing financial operations alongside core business activities. This often slows down the business or creates missed opportunities. By outsourcing, businesses can outsource some of the most important yet time-consuming tasks like bookkeeping, payroll, and financial reporting to freelance professional accounting firms.

So finding the best outsourcing accounting services for small business is important. Choosing the right provider can reduce overhead, improve accuracy, and offer access to specialized financial guidance not so readily available from within an organization. Outsourcing allows you the possibility of scaling efficiently without necessarily hiring full-time, as you can either outsource a full-service accounting firm or find freelance accountants with various platforms at your disposal, such as Fiverr or Upwork.

This guide will outline the pros and cons of outsourcing accounting services, what types of services you can outsource, and how much money you should expect to pay for those services. I’ll also cover how to evaluate different outsourcing providers to make sure you find the best outsourcing fit for your business.

Why You Should Consider Outsourcing Accounting Services

Outsourcing accounting services for small businesses has recently been proven to be one of the best decisions. The pros and cons of outsourcing accounting services must be carefully evaluated to understand how this may affect your business, both in the short and long term.

Pros of Outsourcing Accounting Services:

- Cost Savings: One of the most significant advantages is cost savings. Assuming you hire an accountant, there are the expenses for salary, benefits, and overhead. Outsourced services offer flexible pricing, allowing businesses to pay for only what they would need. Basic bookkeeping, for example, can be done for as low as $250 a month.

- Access to Expertise: Outsourced accountants possess professional expertise that small businesses cannot afford to employ. They get updated about the latest tax regulations and the changing laws on finance to ensure compliance and minimize risk.

- Time-Saving: It saves the business owner’s time by outsourcing regular tasks related to core operations, such as bookkeeping and payroll, and leaves financial management in the hands of specialists.

- Scalability: Outsourced services grow with your business. As your accounting needs become more complex, these services can be scaled without the hassle of hiring new staff.

Cons of Outsourcing Accounting Services:

- Loss of Control: Some business owners may feel like they are losing direct control of their financial operations. This could easily be overcome by making sure there is clear communication and choosing a reliable partner.

- Data Security Risks: Sharing sensitive financial information with an outsourced provider presents a security risk. It is paramount to select such a provider that has stringent measures for data protection.

- Potential Hidden Costs: Since outsourcing is generally cheaper, other extra services like financial analysis or tax preparation may entail unexpected charges. Clarifying this aspect when starting the service agreement is essential.

Types of Accounting Services Available for Small Businesses

When exploring how to find the best outsourcing accounting services for small business, it’s crucial to understand what specific tasks you can delegate to an outsourced accounting partner. Outsourced accounting services offer a wide variety of options, allowing small businesses to pick and choose according to their needs and budget.

Outsourced Bookkeeping and Payroll Management

Bookkeeping is one of the most common services small businesses outsource. In-house accounting tasks, such as reconciliation, expense tracking, and payroll management, take a lot of time and resources. Outsourced accounting firms or freelancers can manage such tasks with effective efficiency and keep you free to focus on growing your business.

Additionally, payroll services make sure that your employees are paid with accuracy and on time so that you will not be prone to some of the errors or costly penalties.

CFO Services and Financial Strategy

For businesses experiencing rapid growth, outsourced CFO services can be invaluable. An outsourced CFO is strategic in financial advice, cash flow management, and the ability to forecast future business trends. This expertise surely helps small businesses that lack the budget to afford a full-time CFO through a challenging phase of their life cycle.

Tax Compliance and Financial Reporting

Outsourced accounting firms also handle complex tax compliance issues and keep your business updated on current tax laws. They may also provide financial statements about profit and loss statements or balance sheets, which are considered extremely important to understanding the financial health of your business.

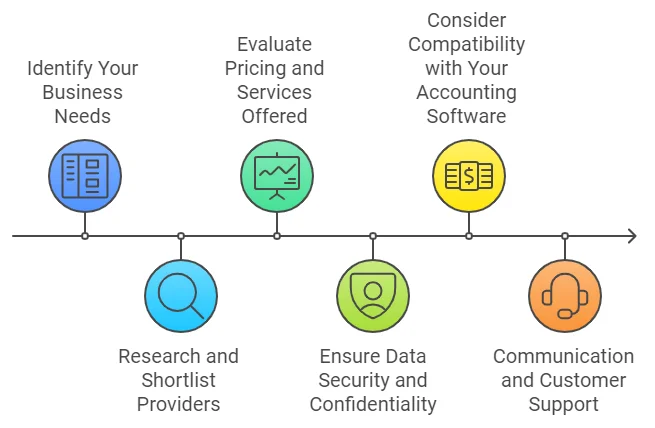

Steps to Finding the Right Accounting Services for Small Business

Finding the best outsourcing accounting services for small business can seem overwhelming, but with the right approach, you can make an informed decision that saves time, money, and effort. Here’s a step-by-step guide to ensure you choose the best accounting partner for your business.

1. Identify Your Business Needs

Before searching for outsourced accounting services that best suit your needs, you need to define what your business needs. Are you looking for basic bookkeeping services, or does the requirement encompass advisory needs at a higher level, such as tax compliance or CFO-level advisory? The more specific you are about what you want, the easier it will be to identify a service provider that fits your requirements.

These might include anything from a growing business that can leverage scalable services offered by a firm, to a startup needing guidance on better ways to manage its cash flows and financial reporting.

2. Research and Shortlist Providers

When searching for the right provider, consider both traditional accounting firms and freelance platforms like Fiverr and Upwork. These freelancing sites offer a wide range of services, from basic bookkeeping to high-level CFO consultancy. Look for freelancers or firms that specialize in your industry because that will understand better the specific financial challenges your business faces.

You can even check for reviews, client testimonials, and case studies that will enable you to analyze the credibility or performance power of the provider.

3. Evaluate Pricing and Services Offered

One of the most common questions small business owners ask is, how much should an accountant cost for a small business? Pricing can vary widely depending on the services you need. Basic services like bookkeeping may start at $250 per month, whereas more comprehensive packages, including financial forecasting and CFO-level guidance, may cost $750 or more. Be sure to clarify the provider’s pricing structure and check for any hidden fees.

4. Ensure Data Security and Confidentiality

Outsourcing accounting involves sharing sensitive financial data, so it’s critical to ensure that your provider has robust data security protocols in place. The firm or freelancer should be assuring their usage of encryption, secured servers, and whatever a specific industry might require compliance. You will then take the next step to ask them how potential data breaches could be handled.

5. Consider Compatibility with Your Accounting Software

It’s essential to choose a provider that can seamlessly integrate with your current accounting software. Most small businesses use QuickBooks or Xero. Before onboarding, make sure the outsourcing service provider is experienced with your software of choice, which will prevent many issues and ensure easier collaboration.

6. Communication and Customer Support

Lastly, effective communication is vital for a successful partnership. Make sure the provider offers multiple communication channels, such as phone, email, or video conferencing, and has a reputation for being responsive. Regular updates and proactive communication can help prevent any potential risk.

How Much Should an Accountant Cost for a Small Business?

One of the most frequently asked questions by small business owners is, how much should an accountant cost for a small business? The cost of outsourcing accounting services varies significantly based on the scope of services you require and the provider you choose. Understanding the pricing structure can help you make informed decisions and get the best value for your investment.

Basic Bookkeeping Services

The basic bookkeeping requirements for small business include recording transactions, bank reconciliations, accounts payable and receivable management, and payroll management. The average starting cost for small businesses is around $250 per month. However, if you can hire a bookkeeper and freelancing sites like Fiverr and Upwork for just $5, you can still manage your monthly bookkeeping for less than $5. Still, you take quick service for particular recordings or reconciliations.

Many freelance accountants available on platforms like Fiverr, Upwork, Toptal offer competitive rates for bookkeeping services, which can be ideal for startups or businesses looking for a budget-friendly solution.

Full-Service Accounting

If you require more complex accounting services, such as tax return preparation, financial reporting, or strategic counselling, you need to hire a full-service accounting firm. The cost of these services can range from $500 to $1,000 per month.

These packages commonly include quarterly tax planning, preparation of financial statements, and cash flow analysis, which may help keep your business compliant with regulations while maintaining its financial health.

CFO-Level Advisory Services

For businesses experiencing rapid growth, outsourcing CFO-level services is an option. This type of service includes high-level financial strategy, forecasting, and budgeting. An outsourced CFO might charge anywhere from $1,500 to $5,000 per month, depending on the complexity and size of your business.

This will potentially have a much greater outcome with advisory services in financial management, capital raising, and long-term planning.

Freelancing Platforms as a Cost-Saving Option

Platforms like Fiverr, Upwork, and Toptal offer access to freelance accountants who can provide many of the same services at lower rates. You can hire experts on these platforms for bookkeeping, tax preparation, or even CFO-level advice on a project basis or a monthly retainer basis. This may be one inexpensive method of accessing special services without being obliged to pay higher fees related to traditional firms.

Best Platforms for Finding Outsourcing Accounting Services for Small Business

Every small business owner is looking for ways to save money and manage accounting by maintaining compliance. Yes, hiring a CPA is a good choice, but it’s not always the most cost-effective choice. Here, I’ll highlight the best platforms for finding outsourced accounting services, including their features, pros and cons, and pricing so that you can make the correct decision to choose the right fit for your business.

1. Bench

Bench is an excellent choice for small businesses for full bookkeeping and tax preparation. It is a Canadian-based accounting service platform that provides month-end financial reports, tax advisory services, and monthly bookkeeping. The business owner enjoys an intuitive and easy-to-use platform to manage finances on Bench’s proprietary software.

Key Features:

- Monthly bookkeeping, tax preparation, and financial reporting.

- Easy-to-navigate proprietary software.

- Unlimited communication with a dedicated bookkeeper via phone and messaging.

- Premium plans include income tax filing for both individuals and businesses.

Pros

Cons

Price:

- Bench offers services starting at $299/month, with premium plans available for those requiring additional tax services.

2. QuickBooks Live

QuickBooks Live is a top choice for businesses already using QuickBooks. It connects you with a live bookkeeper who provides hands-on support, making it easy to address bookkeeping issues in real time.

Key Features:

- Seamlessly integrates with the QuickBooks platform.

- Access to live bookkeepers for immediate assistance.

- Tailored for small businesses, with intuitive navigation.

- Regular financial insights and reporting.

Pros

Cons

Price:

- Starting at around $200/month, QuickBooks Live offers personalized bookkeeping support, with costs varying based on your business’s specific needs.

3. Bookkeeper360

Bookkeeper360 is designed for small businesses seeking affordable accounting solutions. It supports various accounting software programs and offers flexible plans that can grow with your business.

Key Features:

- Provides bookkeeping, payroll, and financial reporting.

- Compatible with major accounting software like QuickBooks and Xero.

- Scalable services with options for weekly financial reports.

- Add-on services for HR, tax filing, and invoicing.

Pros

Cons

Price:

- Bookkeeper360 services start at $399/month, with the ability to add on extras based on your business’s needs.

4. Paro

Paro offers a unique approach to outsourced accounting by connecting businesses with a network of experienced financial professionals. It’s ideal for businesses whose specialized accounting needs require expert-level service without the commitment of a full-time hire.

Key Features:

- Access to U.S.-based accounting professionals, including tax experts and bookkeepers.

- Tailored services that meet specific business needs.

- Flexible hiring options for short- or long-term projects.

Pros

Cons

Price:

- Paro’s pricing is project-specific, typically starting around $75/hour, depending on the expertise required and the project’s complexity.

5. Upwork

Upwork is a global marketplace for freelance talents where you get various types of services, including accounting. This is an excellent option for small business owners to hire an international accountant. The best part of this site is that you can hire a freelance accountant for a specific project. Besides, you can enjoy the flexibility of hiring the talent and budget.

Key Features:

- Access to a global pool of freelance accountants and bookkeepers.

- Robust filtering options to help you find the right fit for your business needs.

- Ability to review freelancer profiles, portfolios, and feedback before hiring.

Pros

Cons

Price:

- Rates vary, with accounting services typically starting at around $5/hour. The overall cost depends on the freelancer’s expertise and the project’s scope.

6. Fiverr

Fiverr is similar to Upwrok marketplace. However, the fundamental difference is that you can quickly pick a freelance accountant after reviewing the freelancer profile and gig. In this marketplace, the freelancer advertises their service as gigs. You browse freelancer profiles and find services that fit your business needs.

Key Features:

- Competitive pricing, with services starting as low as $5.

- A broad range of freelancers offering various accounting and bookkeeping services.

- Easy-to-navigate platform with transparent pricing and reviews.

Pros

Cons

Price:

- Fiverr offers services starting at just $5, with pricing dependent on the freelancer and the complexity of the project.

FAQs

How do I find the best outsourced accounting service for my small business?

Look for firms with industry-specific experience, good client reviews, and strong data security protocols. Consider platforms like Fiverr and Upwork for affordable options.

Are online accounting services reliable?

Yes, many online accounting services offer reliable, cost-effective solutions for small businesses. They also provide flexibility and scalability to suit your needs.

Final Thoughts

Outsourcing accounting services can significantly benefit small business. It helps save time and reduce costs. You can also access specialized financial expertise without hiring in-house staff. This guide provides steps to help you find the best accounting outsourcing services for your small business. Take these steps towards finding the right accounting expert matching your needs, industry experience, and budget.

If you find this article helpful, please share it with your other business partners so that they benefit. Moreover, if you have any suggestions or queries feel free to write down your thoughts in the comment box.