Choosing the best bank account for a small business can be hard. Many options feel confusing or not quite right. Relay is a name you might hear a lot. It’s not like a regular bank. Instead, Relay is a financial tool that works with a bank called Thread Bank. Don’t worry – Thread Bank is FDIC-insured, so your money is safe.

This article will help you understand Relay better. I will look at its features, good points, and limitations. By the end, you will know if Relay is the right choice for your small business. Let’s dive in!

What is Relay?

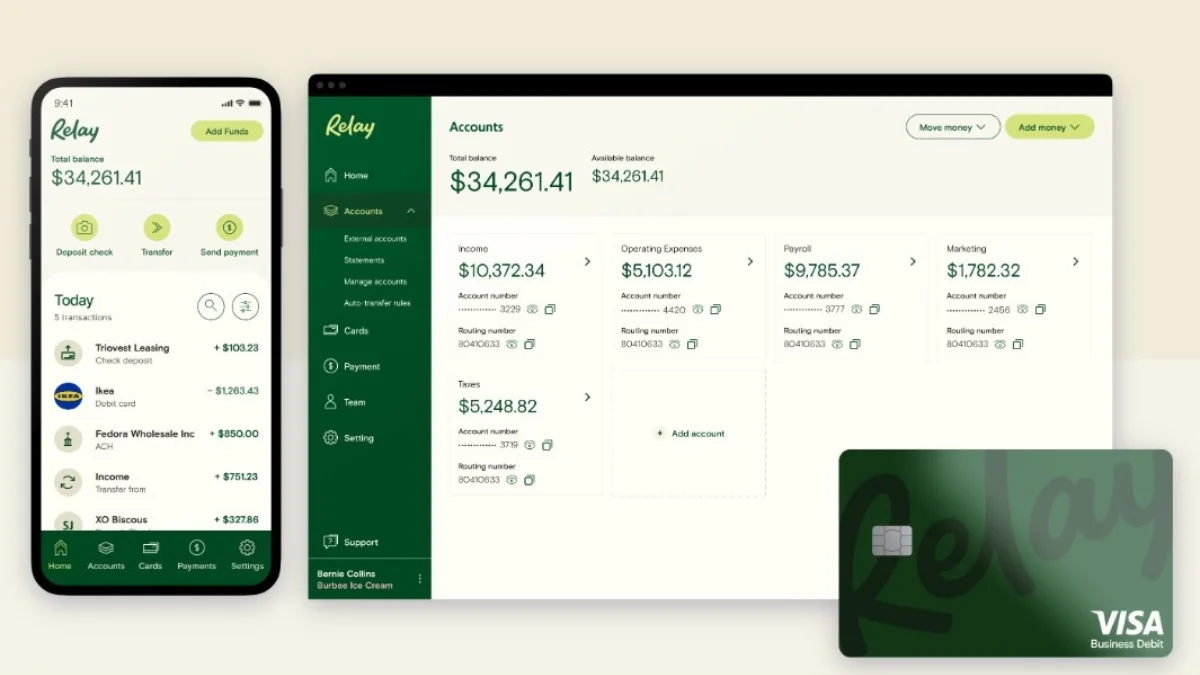

Relay is not a traditional bank. It offers banking services online. Thread Bank provides these services, making it secure and reliable. Relay focuses on making money management easy for small businesses.

Key Features of Relay

- Free Accounts:

- No monthly fees.

- No minimum deposit is required to open an account.

- Interest on Savings:

Relay offers interest based on how much money you save:- 1.00% for less than $50,000.

- 1.50% for $50,000 to $250,000.

- 2.00% for $250,000 to $1 million.

- 3.00% for more than $1 million.

- Debit and Credit Cards:

- Relay Visa Debit Card: Use it anywhere Visa is accepted.

- Relay Visa Credit Card: Get cash-back rewards for eligible purchases.

- Online Banking Only:

Relay has no physical branches. Everything is done online through its website or app.

Why Small Businesses Like Relay

Many small businesses are choosing Relay for their banking needs. Its simple design and special features help solve everyday financial problems. Here’s why small businesses like Relay:

1. No Hidden Fees

Small businesses don’t have to worry about surprise charges. Relay doesn’t charge for:

- Monthly maintenance.

- Minimum balance.

- Regular transactions.

2. High Savings Interest

Relay’s interest rates are higher than many traditional banks. Businesses with large savings can earn more money with Relay.

3. Easy to Use

Relay’s online platform is simple. It helps business owners:

- Track income and expenses.

- Set budgets.

- Create sub-accounts for different needs.

4. Multi-User Access

Multiple users can manage the account. Owners can control what each user can do. For example, a manager can access payroll, but not other funds.

How Relay Helps Different Businesses

Relay offers a range of features that cater to various types of businesses, particularly small businesses and startups. Here’s how Relay helps different business sectors:

For Freelancers

Freelancers work alone and have changing income. Relay’s no minimum balance and high savings rates are perfect for them. They can also make sub-accounts for taxes or personal savings.

For Small Shops

Relay helps track money from sales and pay employees. With its multi-user feature, owners can allow their accountant to access the account.

For Growing Startups

Startups with big funds benefit from Relay’s 3.00% interest on savings over $1 million. This helps them grow their money faster.

Limitations of Relay

Relay offers a range of features that appeal to small businesses, but it also has several limitations that potential users should consider:

No Cash Deposits

Relay cannot accept cash deposits. This may be difficult for businesses that deal with cash, as they cannot deposit it directly into their account.

Slow Check Clearing

Checks take 6–7 business days to clear. This can delay access to money and affect cash flow.

Limited Customer Support

Some users report slow customer service, especially when help is needed urgently.

No Physical Branches

Relay is online-only, which means no in-person services for things like cash deposits.

Limited Financial Products

Relay only offers checking accounts, with no loans or credit options available.

Dependence on Partner Banks

Relay works with partner banks like Thread Bank, which can cause issues if there are problems with these partners.

How Relay Compares to Other Options

Relay is one of many online business banking platforms. Let’s compare it to a few other popular options: Bluevine, Novo, and Mercury.

Relay vs. Bluevine

- Interest Rates:

Relay offers tiered interest, up to 3.00%, based on savings balance. Bluevine offers 2.00% APY, but only if specific criteria are met, such as making monthly purchases or receiving payments. - Cash Deposits:

Bluevine allows cash deposits at Green Dot locations, which can be convenient for cash-heavy businesses. Relay has limited options for cash deposits, making it less ideal for businesses that deal in cash.

Relay vs. Novo

- Ease of Use:

Both platforms are simple to use, but Relay’s sub-account feature gives it an edge for businesses that need to separate funds for different purposes, like taxes or payroll. Novo does not offer this feature. - Fees:

Like Relay, Novo does not charge monthly fees, but Novo does not offer interest on savings, which could be a drawback for businesses with large balances.

Relay vs. Mercury

- Target Audience:

Mercury focuses on tech startups, offering tools like API banking and venture debt resources. Relay, on the other hand, serves a broader range of businesses. - Rewards and Interest:

Mercury does not offer cash-back rewards or interest on balances. Relay stands out with these features, especially for businesses looking to maximize returns.

Customer Experiences with Relay

Small business owners who use Relay often praise its simplicity and cost savings. Many like that they can manage their accounts without paying fees or worrying about minimum balances.

One user shared how Relay’s sub-account feature helped them separate funds for taxes, emergency savings, and operating costs. This made budgeting much easier.

However, some users pointed out challenges. Businesses that handle cash found it hard to deposit money. Others wished for in-person support during account setup. Despite this, most reviews are positive.

Who Should Use Relay?

Relay is best for businesses that:

- Operate mostly online.

- Want a fee-free banking experience.

- Don’t rely on cash transactions.

- Need tools to manage money effectively.

For businesses that deal in cash or prefer face-to-face banking, Relay might not be the right fit.

How to Get $50 Bonus

Just in three steps, you will get a $50 Bench Bonus.

Step 1: Apply for a new Relay account

Step 2: Get approved and activate your card once it arrives

Step 3: $50 will be automatically deposited into your Relay account

Real-Life Scenarios: How Businesses Use Relay

Relay is designed to solve common financial problems for businesses. Here’s how different types of businesses can benefit:

1. Freelancers and Consultants

Freelancers often juggle irregular payments and need to keep track of expenses. Relay helps by offering:

- No minimum balance requirements, so you won’t face penalties during slow months.

- Sub-accounts, make it easier to save for taxes, personal goals, or emergencies.

For example, a freelance designer could use one account for project payments, another for taxes, and a third for personal savings.

2. Small Retailers

Retail shops handle employee payroll, supplier payments, and sales tracking. Relay supports these needs with:

- Multi-user access, letting managers or accountants handle specific transactions.

- Integration with accounting software like QuickBooks, making financial reporting faster.

For instance, a boutique owner could give their accountant access to reconcile payments, while still maintaining control over larger transactions.

3. Startups

Startups often raise significant funding and need to maximize their returns. Relay’s tiered interest rates help startups earn more on their savings. A company with $1 million in reserves can earn 3.00% APY—far higher than most traditional banks offer.

Additionally, Relay’s budgeting tools allow startups to allocate funds for marketing, operations, and payroll with ease.

Step-by-Step Guide to Getting Started with Relay

To start with Relay, follow these easy steps to open your business account. The process is simple and quick, making sure you have all you need to set up your account.

Step 1: Visit the Relay Website

- Go to the Relay website at relay.com.

- Click on the option to “Bank with Relay” to begin the application process.

Step 2: Create Your Account

- Fill in your legal first and last name, phone number, and date of birth. Ensure that you are at least 18 years old.

- Indicate whether you are an accountant or bookkeeper (select “No” if you’re applying as a business owner).

- Enter a work email address. It’s recommended to use an email from a domain you own, as using free email services like Gmail may require additional verification.

- Create a password and agree to the terms and conditions, then click “Create Account”.

Step 3: Provide Owner Information

- Enter your personal information, including:

- Legal name

- Date of birth

- Social Security number (or equivalent for non-U.S. residents)

- Personal address

- Position/title within the business

- Provide your business details, including:

- Legal business name

- Employer Identification Number (EIN), if applicable

- Type of business entity (e.g., LLC, Corporation, Sole Proprietor)

Step 4: Verification Process

- After submitting your application, Relay will ask for verification:

- Upload a photo of your government-issued ID (driver’s license or passport).

- Take a selfie for identity verification.

- You will receive a text message with a verification code; enter this code to verify your phone number.

Step 5: Wait for Approval

- Relay typically processes applications within 2 to 3 business days, but many users report faster approvals.

- Keep an eye on your email for confirmation of your account approval.

Step 6: Set Up Your Account

- Once approved, log into your Relay account using your email and password.

- Complete any remaining setup tasks outlined in the setup checklist provided on the dashboard.

- You can add money to your account through various methods as instructed in the platform.

Step 7: Explore Features

- Familiarize yourself with Relay’s features such as creating multiple checking accounts, setting up virtual debit cards, and integrating with accounting software like QuickBooks or Xero.

Relay’s customer support team is available to help during this process.

Final Thoughts: Is Relay Still the Best Choice?

After completing of relay review we can conclude that it is an excellent option for many small businesses, especially those that value online convenience and low costs. Its key strengths include:

- High interest on savings.

- No monthly fees.

- Powerful tools for managing money.

However, businesses that rely on cash transactions or prefer in-person banking might need to consider other options. Alternatives like Bluevine or traditional banks may offer better solutions for those needs.

Relay continues to set a high standard for online banking. Whether it’s the best choice for you depends on your business’s unique needs and priorities.

Leave a Reply