Choosing the right accounting method for your business is crucial for accurate financial management. There are two main choices: single-sided and double-sided accounting. While both systems record financial transactions, they differ significantly in complexity, accuracy, and the depth of financial insights provided.

This article explores the details of single entry vs double entry accounting to assist you in deciding which is most suitable for your business requirements.

Single Entry vs Double Entry Accounting

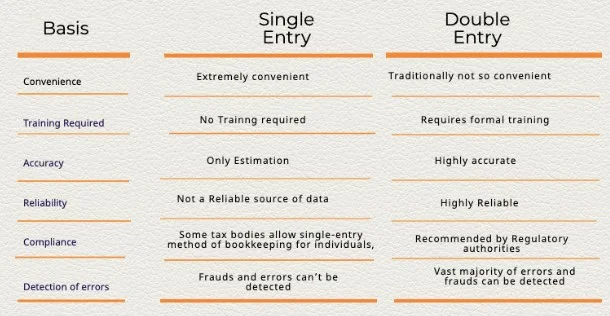

Double entry accounting and single entry accounting are two primary methods for recording financial transactions. Here is a comparison of their main distinctions.

Single Entry Accounting

- Recording Method: Each transaction is recorded only once, typically in a cash account.

- Simplicity: Less complex and easier, with less knowledge of accounting required; hence, it’s a great tool for small businesses that have fewer transactions.

- Limited Financial Insight: Establishes limited insight into the financial health of a company and mostly covers cash flow aspects.

- Regulatory Compliance: It does not follow accounting standards.

- Scalability: Difficult to accommodate as the business grows.

- Error Prone: More prone to errors and fraud due to the lack of a check and balance system.

- Financial Reporting: A very limited ability in financial reporting. Typically, it produces only an income statement.

- Financial Analysis: Limited capabilities for financial analysis.

- Cost-Effectiveness: The former is usually cheaper in terms of its setup and maintenance as compared to double entry accounting.

- Tools: Does not require specialized software.

Double Entry Accounting

- Recording method: Each transaction denotes both a debit and a corresponding credit to one other account, thus maintaining the accounting equation (Assets = Liabilities + Equity) at all times.

- Complexity: Requires more extensive accounting knowledge and is more structured, making it suitable for larger businesses and those with complex financial structures.

- Comprehensive Financial Data: It gives detailed and correct financial data, including all assets, liabilities, income, and expenses.

- Regulatory Compliance: Double entry accounting system follows accounting standards.

- Scalability: Can easily accommodate business growth.

- Error Detection: Any errors in the transactions can be detected easily and corrected with dual recording.

- Financial Reporting: Enables detailed preparation of financial statements, including balance sheets, income statements, and cash flow statements.

- Financial Analysis: Provides enough insights for in-depth financial analysis.

- Fraud Prevention: It aids in the reduction of fraud since it makes manipulation of the financial records very difficult to perform.

- Tools: Requires specialized accounting software.

Which Method is the Best for Your Business?

The best accounting method for your business depends on several factors, including the size of your business, your financial goals, and the complexity of your financial transactions. Lets find which accounting system is the best for your business:

- Small Businesses: If you are a business with limited financial transactions and just want something simple, then it makes the most sense to use the cash method and single entry accounting system. However, if you plan to grow your business or need more accurate financial reporting, the double entry accounting system is recommended.

- Large Businesses: Larger businesses, especially those subject to rigorous financial reporting standards (like GAAP or IFRS), almost exclusively use double-entry accounting. The complexity and volume of transactions, coupled with the need for precise financial statements, make it essential.

Final Thoughts

The choice between single entry vs double entry accounting ultimately depends on your business’s size, complexity, and financial reporting needs. While single entry is simpler for small businesses, double entry offers a more comprehensive and accurate financial picture, making it ideal for larger organizations. By understanding the strengths and weaknesses of each method, you can select the system that best suits your business’s requirements.

Leave a Reply