Budgeting is the safety net that ensures you have control over your finances, and one of the simplest yet most effective budgeting methods is the 70/20/10 budget rule.

The 70/20/10 budget rule is a simple yet powerful framework that offers a structured approach to managing your finances, ensuring that your money works hard for you. By dividing your income into three distinct categories- needs, wants, and savings. This rule empowers individuals to take control of their financial destiny.

In this article, you can learn about how the 70/20/10 budget rule works, and the benefits of this formula. Moreover, I illustrate the step by step guidance for the implementation of the 70/20/10 budget rule and introduce you to budgeting tools and budget templates. By following the strategies outlined in this article, you can significantly improve your financial outlook. Take the time to read through it carefully to build a strong financial foundation.

What is the 70/20/10 Budget Rule?

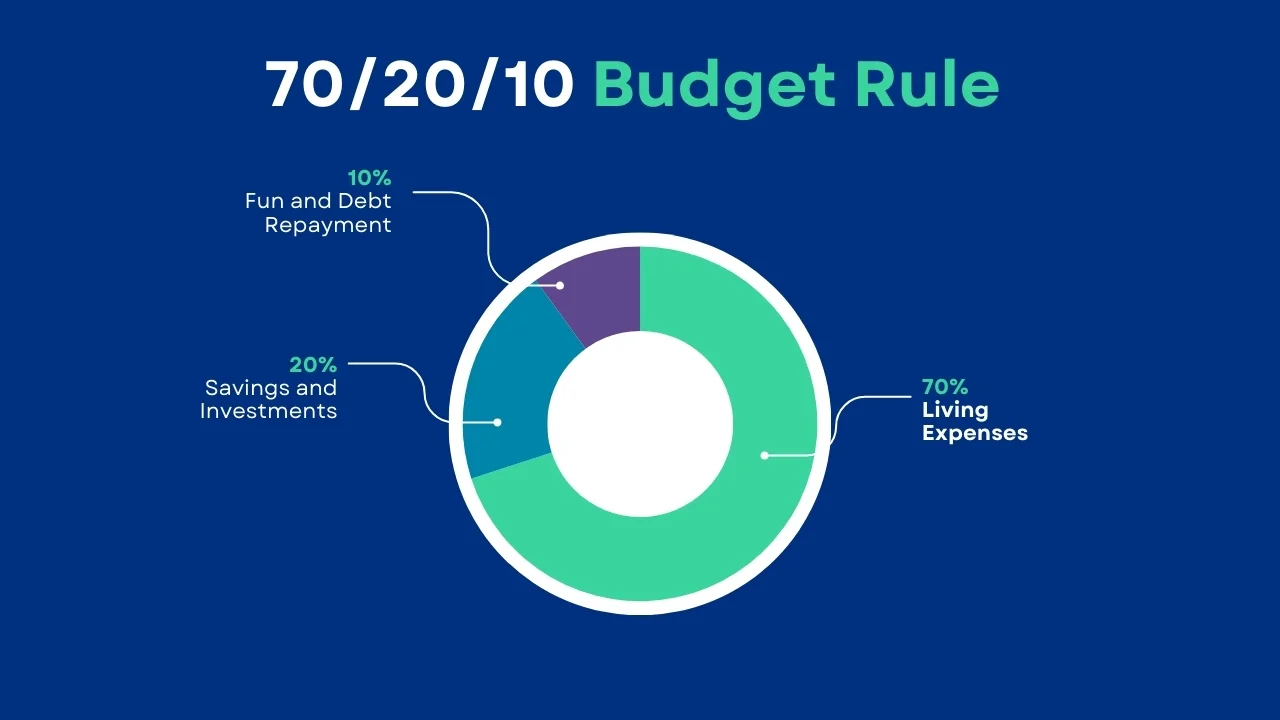

The 70/20/10 budget rule is a simple financial guideline that suggests you allocate your after-tax income into three distinct categories:

- 70% for living expenses

- 20% for financial goals

- 10% for fun or debt repayment

This rule offers a balanced approach to spending, saving, and enjoying your hard-earned money. Originating from the need to simplify personal finance, the 70/20/10 rule is ideal for a person or someone who wants to go about handling their income without being locked into the complications of a strict budgeting process.

Key Takeaways from the 70/20/10 Budget Rule

- Simple and Clear: The 70/20/10 rule is easy to understand and follow-spend 70% on needs, save 20%, and use 10% for fun or extra debt payments.

- Balanced Budgeting: It helps balance daily living costs, future savings, and enjoyment.

- Flexible for All Income Levels: It can be adjusted for low or high incomes and even works with variable earnings.

- Easy to Start: Steps include checking your income, sorting expenses, setting up accounts, and automating transfers.

- Effective Approach: The rule works because it’s simple, flexible and encourages saving.

How the 70/20/10 Rule Works

As I mentioned earlier this budget rule is divided into three categories. Your income will be allocated a ratio of 70:20:10. Let’s dig down the formula thoroughly

70% for Living Expenses: Covering Your Essentials

The majority of your income under this rule is earmarked for living expenses, which include:

- Housing Costs: Rent or mortgage payments, property taxes, and home insurance.

- Utilities and Transportation: Electricity, water, gas, and commuting costs.

- Groceries and Basic Needs: Food, household supplies, and necessary personal items.

Tips for staying within the 70%:

- Shop smart: Look for sales and use coupons.

- Reduce energy usage: Lower utility bills by being energy efficient.

- Consider cheaper alternatives: Use public transportation or carpooling.

20% for Savings and Investments: Building Your Future

This portion is all about securing your future. Whether it’s saving for retirement, investing, or paying off debt, the 20% allocation is vital.

- Savings Accounts and Emergency Funds: Start with a small emergency fund and gradually build it up.

- Retirement Savings (401(k), IRAs): Take advantage of employer matching programs and tax-advantaged accounts. However, if you are outside of the US, you get a similar type of project.

- Investment Opportunities: Consider investing in stocks, bonds, or mutual funds for long-term growth.

- Debt Repayment Strategies: Focus on high-interest debt first, using snowball or avalanche methods.

10% for Fun or Debt Repayment: Balancing Life and Finances

It’s important to enjoy the fruits of your labor, and the 70/20/10 rule allows for this:

Examples of Fun Expenses: Vacations, concerts, dining out, and personal hobbies.

Enjoying Your Money Responsibly: Whether it’s dining out, entertainment, or hobbies, spend this 10% guilt-free.

Prioritizing Debt Repayment: If you’re focused on becoming debt-free, use this portion to pay down additional debt faster.

Why the 70/20/10 Budget Rule Is Effective

The 70/20/10 budget rule is effective for several reasons:

- Simplicity: It’s easy to understand and implement, making it accessible to anyone.

- Flexibility: It works for various income levels and can be adjusted as your financial situation changes.

- Encourages Savings: By dedicating a portion of your income to savings and debt repayment, it promotes financial responsibility.

How to Start Using the 70/20/10 Budget Rule

In this section, I will make a guide on how to use the 70-20-10 budgeting rule. In addition, I will also inform you how to effectively follow this budget plan. Here, I explain the step-by-step guide for implementing the 70-20-10 Budget Rule. To successfully apply the 70/20/10 budget rule in your life, consider the steps provided below:

1. Assessing Your Income

The first step in applying the 70/20/10 rule is knowing your after-tax income. This is the amount of money you have available after taxes and other deductions. Knowing this figure guides you on the proper allocation of your money.

2. Categorizing Your Expenses

Next, categorize your expenses according to the 70/20/10 rule. First, list all expenses that have to do with living; second, savings and investment contributions; and lastly, debt or other financial goals. This helps you see where the money goes and where adjustments may be needed.

3. Setting Up Savings and Investment Accounts

To streamline the savings process, set up dedicated accounts for savings and investments. This may be in the form of high-yield savings accounts, retirement accounts, or brokerages for investments. Automating contributions to these accounts can help you stay on track.

4. Automating Your Budget

Automating your budget is a simple way to ensure you stick to the 70/20/10 rule. It means establishing automatic transfers of savings and investments, along with setting up bill payments so you don’t incur extra late fees. This automation reduces the risk of overspending and keeps your finances organized.

Tools and Resources

To effectively apply the 70/20/10 budget rule, various tools, and resources can help streamline the process and enhance your financial management. Here’s a list of useful options:

Budgeting Apps and Software

There are numerous budgeting apps and software available that can help you manage your 70/20/10 budget. Tools like Mint, YNAB (You Need a Budget), and EveryDollar allow you to track expenses, set financial goals, and monitor your progress.

Financial Planning Tools

In addition to budgeting apps, consider using financial planning tools to create a comprehensive financial plan. These tools can help you assess your financial health, plan for retirement, and make informed investment decisions.

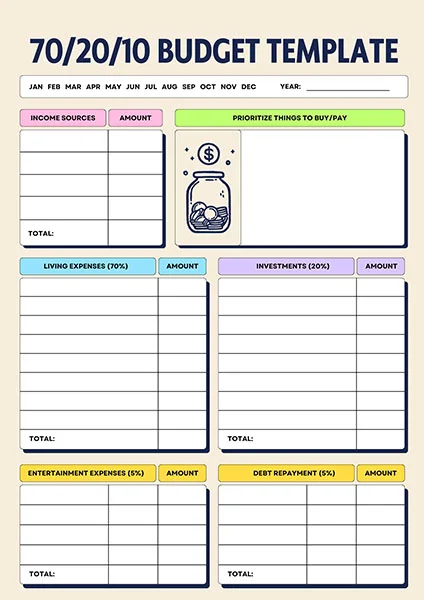

Download 70/20/10 Budget Template FREE!

Download this printable budget template and achieve your financial goals faster with our easy-to-use budget template.

70/20/10 Budget Rule Calculator

Our 70/20/10 Budget Rule Calculator is simple to use. Just type in your monthly income and select the currency, and it will show how much money goes into each group. This helps you stay in control of your money and save more without stress.

👉 Try the 70/20/10 Budget Calculator now and see how your money adds up!

70/20/10 Budget Planner

Professional Financial Advisors

If you’re unsure where to start or need personalized advice, consider consulting a professional financial advisor. They can help you tailor the 70/20/10 rule to your specific situation and provide guidance on achieving your financial goals.

Adapting the 70/20/10 Rule to Your Lifestyle

Everyone’s earnings are not the same. So how does a formula work for all? The best technique to apply the same formula to everyone is to adjust the framework to align with the lifestyle. Here I demonstrate how different income levels people adjust their lifestyles with the same framework.

Adjusting for Different Income Levels

Because different people earn differently, there needs to be a system of adjusting this 70/20/10 budget rule to ensure practicality and efficiency. The following are major concerns and measures for adjusting this approach to budgeting while considering fluctuations in income levels.

1. Lower Income Levels:

- Increase Needs Allocation: For those earning a lower income or living in high-cost areas, it may be necessary to allocate more than 70% to living expenses. This adjustment ensures that basic needs are met without financial strain.

- Reduce Savings Temporarily: If expenses are high, consider reducing the savings portion to 10% or even lower until income increases or expenses decrease. Focus on essential savings like an emergency fund before investing.

2. Higher Income Levels:

- Maintain or Increase Savings: Individuals with higher incomes can often afford to save more than 20%. Adjust the savings portion to 30% or more, allowing for aggressive investment strategies or larger contributions to retirement accounts. Another budget formula 50/30/20 Budget Rule would be the better option to choose for this group of people.

- Evaluate Wants: With more disposable income, individuals can afford to spend more on non-essentials. However, it’s wise to keep the wants allocation within 10-15% to maintain a balanced approach to spending and saving.

3. Variable Income Situations:

- Flexible Percentages: For those with irregular incomes, such as freelancers or gig workers, it’s crucial to remain flexible. Consider using a base income for budgeting and allocate additional income from bonuses or side jobs according to immediate needs, savings goals, or debt repayment priorities.

- Emergency Fund Priority: Focus on building a robust emergency fund during higher income months to cushion against leaner periods.

Bottom Line

The 70/20/10 budget rule is an ideal tool for anyone looking to take control of their finances. It’s simple, flexible, and encourages both savings and responsible spending. Whether you’re just starting your financial journey or have been searching for new ways of managing your money, the 70/20/10 rule will get you toward your set goals of financial freedom.

Leave a Reply