The recent closure of Bench has left many searching for the best Bench bookkeeping alternatives for small businesses. Finding a reliable service is now more important than ever.

Whether you need help with tax filing, financial statements, or advanced accounting closure, the right bookkeeping service can make all the difference. From inexpensive bookkeeping tools to cloud-based accounting software like QuickBooks and Xero, there are plenty of options for businesses with unique needs. Popular names such as Pilot and Bookkeeper.com also feature highly in accounting reviews for their flexibility and pricing.

In this article, we’ve rounded up the 10 best alternatives to Bench for 2025. These options offer tailored solutions for small business owners, helping you navigate financial reporting and online bookkeeping with ease. Read on to find the perfect fit and secure your financial future.

What are Online Bookkeeping Services?

Online bookkeeping services help businesses manage their financial records over the Internet. Instead of hiring a local bookkeeper, you can use digital tools or services to handle tasks like tracking income and expenses, preparing financial statements, and managing tax filing.

These services are usually cloud-based, meaning you can access your data anytime, from anywhere. They are ideal for small businesses that need inexpensive bookkeeping solutions but don’t want to compromise accuracy.

Key Benefits of Online Bookkeeping

- Accessibility: Manage your finances on the go with just an internet connection.

- Automation: Many tools, like QuickBooks or Pilot bookkeeping, automate repetitive tasks, saving time.

- Cost-Effectiveness: Online tools are often more affordable than hiring full-time bookkeepers.

- Scalability: As your business grows, you can upgrade plans to include features like payroll or advanced financial reporting.

Why Look for Bench Alternatives?

Bench stopped working right before tax season, leaving its customers scrambling for help. It has allowed users to download financial records until March 7 and suggested they ask for more time to file taxes.

This shows why it is good to think about other options. Relying on only one service can be risky. A new provider should be stable and easy to use. It should also have good support if there are problems. Having backup plans can save businesses from trouble in the future.

Additionally, not every business has the same requirements. For example, a construction company might need job costing, while a freelancer might prefer a simpler and cheaper solution. This is why it’s important to look for alternatives that fit your specific requirements, offer stability, and provide excellent support. Choosing the right service can save businesses from disruptions and help them stay financially healthy.

Why Reliable Bookkeeping Matters

Good bookkeeping helps small businesses stay organized and grow. It ensures all your financial statements, like profit and loss reports, are accurate. This is important for making smart decisions and meeting deadlines for tax filing.

A reliable bookkeeping service helps:

- Track income and expenses.

- Prepare for audits or tax seasons.

- Avoid errors that can lead to financial loss.

For small businesses, picking the right service can mean the difference between stress and success. Exploring alternatives to Bench gives you the chance to find something that matches your business’s unique needs and budget.

How to Choose the Right Bookkeeping Service for Your Small Business

Choosing the right bookkeeping service for your small business is essential for maintaining financial health and efficiency. Here are key considerations and steps to help you make an informed decision.

Key Features to Look For

When selecting a bookkeeping service, ensure it offers the core features your business needs. This includes tools for financial reporting, accounting closure, and tax filing. Look for services that can:

- Generate accurate financial statements (e.g., income and cash flow reports).

- Automate tasks like expense tracking and invoice management.

- Provide online bookkeeping for easy access from anywhere.

For example, services like QuickBooks or Pilot bookkeeping excel in offering these features with user-friendly interfaces. Businesses that value convenience and efficiency should prioritize services that are cloud-based or include mobile apps.

Budget Considerations

Affordability is crucial for small businesses. Inexpensive bookkeeping options like basic accounting software or DIY platforms can work well for startups. However, you may need to invest more in bookkeeping services if your business has complex needs.

Think about:

- Pricing plans: Are they flexible enough for your business size?

- Hidden costs: Some platforms charge extra for additional users or tax support.

For example, while Bench might charge higher fees, alternatives like Wave or FreshBooks can offer more affordable plans.

Integration with Existing Tools

Choose a service that works well with the tools you already use. Integration with software like QuickBooks, payroll systems, or CRM platforms can save time and reduce errors. For example:

- If you use an accounting software, ensure your bookkeeping service syncs smoothly.

- If you manage inventory, find a service with real-time tracking features.

A service that integrates seamlessly ensures your workflow is uninterrupted, helping you focus on growing your business.

Top 10 Bench Bookkeeping Alternatives

| Service | Key Features | Pros | Pricing |

|---|---|---|---|

| QuickBooks Live | Certified bookkeepers, month-end close assistance, custom chart of accounts, real-time collaboration. | Easy to use, expert support, time-saving, scalable, accurate books ready for tax filing. | $200-$600/month based on expenses. |

| Pilot | Dedicated accountant, accrual-based bookkeeping, tax services, custom reports, CFO services. | Specialized for startups, comprehensive services, scalable, integrates with QuickBooks/Xero. | Starts at $349/month, custom pricing. |

| Bookkeeper.com | Full-service bookkeeping, payroll, tax filing, financial planning, dedicated account managers. | Tailored for professional services, certified QuickBooks ProAdvisors, comprehensive service. | Starts at $399/month. |

| Merritt Bookkeeping | Automated bookkeeping, QuickBooks integration, monthly reports, tax reporting tools. | Affordable flat-rate, ease of use, reliable support. | $250/month. |

| InDinero | Accrual bookkeeping, tax compliance, financial forecasting, fractional CFO services, customized solutions. | All-in-one service, startup-friendly, advanced insights. | Starts at ~$75/month, custom pricing. |

| Less Accounting | Income/expense tracking, bank reconciliation, invoicing tools, tax reporting, integrations. | Simple, affordable, time-saving, intuitive platform. | Starts at $24/month, custom services. |

| Fiverr Bookkeeping | Freelance bookkeepers for reconciliation, tax prep, payroll, financial reporting. | Cost-effective, customizable solutions, scalable services. | $5-$500+/project, flexible pricing. |

| Zinance | Cloud-based bookkeeping, income/expense categorization, tax readiness, monthly financial reports. | Transparent pricing, user-friendly, small business focus. | Starts at $150/month. |

| FlowFi | Automated bookkeeping, real-time reporting, dedicated financial advisor, tax compliance support. | Tech-driven, personalized support, scalable options. | Starts at $299/month. |

| Bookkeeper360 | Real-time bookkeeping, payroll/HR, CFO advisory, dashboards, tax compliance. | Scalable, comprehensive services, integrates with accounting platforms. | $399-$1,149/month, custom options. |

QuickBooks Live Bookkeeping

QuickBooks Live Bookkeeping is a service designed for small business owners who want expert assistance with managing their books. It integrates seamlessly with QuickBooks Online, providing access to certified bookkeepers who help organize financial data, ensure accuracy, and handle month-end tasks. This service is ideal for businesses looking for a trusted partner to manage their bookkeeping while focusing on growth.

Features:

- Certified Bookkeepers: Access to QuickBooks-certified experts for guidance and support.

- Month-End Close Assistance: Professional help in reconciling accounts and closing books each month.

- Custom Chart of Accounts: Tailored setup to match your business needs and industry.

- Real-Time Collaboration: Communicate with bookkeepers via video calls and messaging.

- Detailed Reports: Gain insights into financial health through accurate reporting.

Pros:

- Ease of Use: Seamlessly integrates with QuickBooks Online for a streamlined experience.

- Expert Support: Personalized assistance from experienced bookkeepers.

- Time Savings: Offloads bookkeeping tasks, allowing business owners to focus on core operations.

- Scalability: Suitable for small businesses with growing needs.

- Accuracy and Compliance: Ensures books are error-free and ready for tax filing.

Pricing:

QuickBooks Live Bookkeeping pricing varies based on business size and complexity:

- Starter Plan: $200/month – for businesses with up to $25,000 in monthly expenses.

- Growth Plan: $400/month – for businesses with expenses between $25,001 and $150,000.

- Advanced Plan: $600/month – for businesses with over $150,000 in monthly expenses.

Pricing includes access to dedicated bookkeepers and all core services, making it a comprehensive solution for small business owners.

Pilot

Pilot offers bookkeeping and accounting services tailored to startups and growing businesses. The service connects clients with dedicated accountants to manage their financials, ensuring accurate reporting and a solid foundation for growth. Pilot’s team specializes in working with technology companies and provides advanced features like CFO services and tax support.

Features

- Dedicated Accountant: Each client is matched with a personal accountant to handle bookkeeping and financial reporting.

- Accrual-Based Bookkeeping: Pilot offers comprehensive accrual accounting to reflect a more accurate financial position.

- Tax Services: Pilot provides tax compliance and filing services, including quarterly filings and year-end tax prep.

- Custom Financial Reports: Clients receive tailored reports to help track performance, profits, and other key financial metrics.

- CFO Services Add-Ons: For businesses in need of additional strategic financial insights, Pilot offers fractional CFO services.

Pros

- Specialized for Startups: Expert understanding of the unique needs of fast-growing businesses.

- Comprehensive Services: Includes both bookkeeping and tax services, as well as advanced financial insights.

- Dedicated Support: Provides a personal accountant who can advise on business strategy and financial planning.

- Scalable: Pilot’s services grow with your business, making it suitable for startups to large enterprises.

- Seamless Software Integration: Integrates with tools like QuickBooks and Xero, offering a smooth transition from manual accounting to automation.

Pricing

Pilot’s pricing starts at $349 per month, but the cost can vary depending on the size and complexity of the business. Custom pricing is available for clients with more complex needs, especially those requiring CFO services or additional reporting.

Bookkeeper.com

Bookkeeper.com offers full-service bookkeeping solutions specifically designed for small to mid-sized businesses, including those in professional services. Their services are geared towards helping businesses maintain accurate financial records, streamline payroll processes, and ensure tax compliance. With a team of certified professionals, Bookkeeper.com supports businesses in industries like law, accounting, and consulting, offering tailored solutions to meet their specific needs.

Features

- Full-Service Bookkeeping: Includes all aspects of bookkeeping, from transaction recording to financial reporting.

- Payroll Management: Handles payroll services and ensures compliance with tax regulations.

- Tax Filing Support: Provides assistance with preparing and filing business taxes, minimizing the risk of errors.

- Financial Planning: Helps with budgeting, forecasting, and making financial decisions based on up-to-date financial data.

- Dedicated Account Managers: Each client gets a dedicated bookkeeper to oversee their financials and offer personalized support.

Pros

- Tailored for Professional Services: Provides specialized solutions for industries like law, consulting, and medical services.

- Certified QuickBooks ProAdvisors: Work with experts who are certified in QuickBooks, ensuring accurate bookkeeping and compliance.

- Affordable Plans: Offers competitive pricing that suits small businesses in professional services.

- Comprehensive Service: From bookkeeping to tax filing, it offers an all-in-one solution for financial management.

- Scalable Solutions: Suitable for growing businesses, with flexible plans that can be adjusted to your needs.

Pricing

Bookkeeper.com offers various pricing plans based on the size of the business and the complexity of services required:

- Bookkeeping Plan: Starts at $399/month – for small businesses with basic bookkeeping needs.

- Tax Plan: Starts at $350/month – for preparation of Federal and State tax returns, tax planning.

- Payroll Plan: Starts at $125/month – for comprehensive payroll solutions.

The pricing includes all core services such as bookkeeping, payroll, and tax filing, with customizable add-ons depending on specific business needs.

Merritt Bookkeeping

Merritt Bookkeeping is an affordable, straightforward bookkeeping service designed for small businesses. It offers a simple, flat-rate pricing structure, providing a hassle-free solution for managing your books without the need for complex accounting software or tools.

Features:

- Automated Bookkeeping: Automatic syncing with your bank accounts for easy transaction tracking.

- QuickBooks Online Integration: Seamless integration with QuickBooks for easy access to financial data and reports.

- Monthly Financial Reports: Regularly updated reports to keep you informed about your financial health.

- Tax Reporting Tools: Tools to help with tax filing and compliance, ensuring you are prepared come tax season.

- Dedicated Support: Access to customer support for questions and troubleshooting.

Pros:

- Affordable Pricing: Offers a flat-rate pricing model starting at $190/month, making it a cost-effective option for small businesses.

- Ease of Use: Simplifies bookkeeping tasks with automated processes and easy-to-understand reports.

- No Hidden Fees: Transparent pricing with no surprises, making budgeting easier for small businesses.

- Scalable Solution: While it is tailored for small businesses, it can grow with your business as needs increase.

- Reliable Support: Dedicated support team available for assistance, helping you avoid potential issues.

Pricing:

Merritt Bookkeeping offers a flat-rate pricing plan of $250 per month. This price includes automated bookkeeping, monthly reports, QuickBooks integration, and basic tax reporting tools. Additional services may incur extra costs.

InDinero

InDinero is a financial management platform offering a combination of bookkeeping, accounting, and tax services. It caters primarily to startups and growing businesses, providing tailored solutions to streamline financial processes and ensure compliance.

Features

- Comprehensive Bookkeeping: Accrual-based bookkeeping services to maintain accurate financial records.

- Tax Compliance and Filing: Assistance with tax preparation, filing, and compliance.

- Financial Forecasting: Advanced tools for creating financial projections and budgets.

- Fractional CFO Services: Access to experienced financial professionals for strategic insights.

- Customized Solutions: Tailored services to meet the unique needs of startups and small businesses.

Pros

- All-in-One Service: Combines bookkeeping, accounting, and tax support in a single platform.

- Startup-Friendly: Designed to meet the needs of tech startups and growing businesses.

- Dedicated Account Manager: Provides personalized support for financial management.

- Advanced Insights: Offers in-depth financial analysis and forecasting for strategic decision-making.

Pricing

InDinero offers custom pricing based on the specific needs and size of your business. Plans start at approximately $75/month and increase with added features like tax services and CFO-level support.

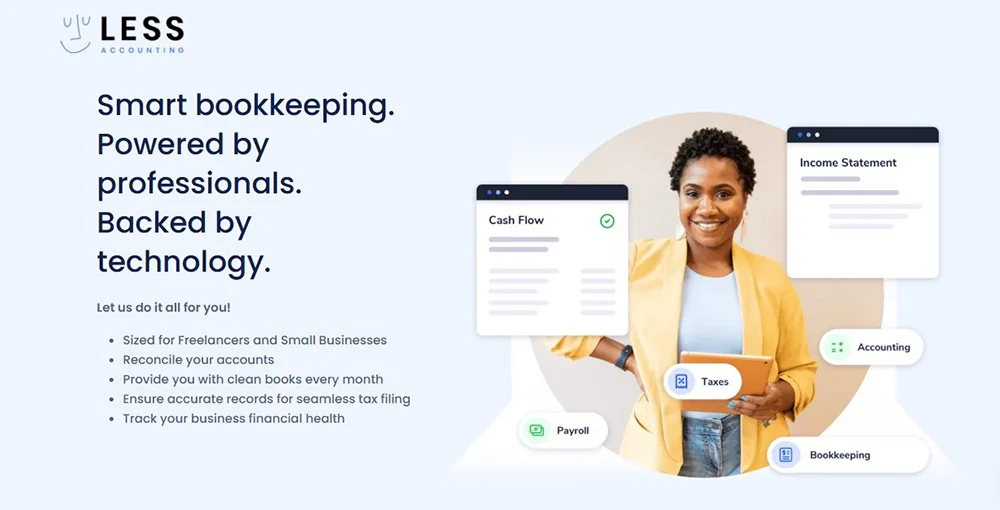

Less Accounting

Less Accounting is a straightforward bookkeeping solution designed for small businesses and freelancers who want to minimize time spent on accounting tasks. It offers a user-friendly platform with essential features for managing finances without the complexities of full-service accounting software.

Features

- Income and Expense Tracking: Simplifies the process of recording transactions and monitoring cash flow.

- Bank Reconciliation: Automatically matches transactions with bank statements for accuracy.

- Invoicing Tools: Create, send, and manage invoices effortlessly.

- Tax Reporting: Prepares data for tax season with organized financial records.

- Integration Options: Connects with various third-party tools for enhanced functionality.

Pros

- Ease of Use: Intuitive design suitable for users with minimal accounting knowledge.

- Affordable: Cost-effective solution for small businesses and freelancers.

- Time-Saving Tools: Streamlined processes for invoicing and reconciliation.

- Customization: Features can be tailored to fit specific business needs.

- Excellent Support: Responsive customer service for troubleshooting and guidance.

Pricing

Less Accounting pricing is straightforward, starting at $24/month for basic software. Bookkeeping services can be added as custom packages, depending on the business’s needs.

Fiverr Bookkeeping

Fiverr Bookkeeping connects small business owners with freelance bookkeepers who offer customized services. It provides a platform where users can browse, select, and hire professionals based on their specific financial management needs, making it an affordable and flexible option for businesses of all sizes.

Features

- Wide Range of Services: Options include bank reconciliation, tax preparation, payroll management, and financial reporting.

- Customizable Packages: Services tailored to specific business needs and budgets.

- Diverse Expertise: Access to freelancers with various levels of experience and specializations.

- Transparent Reviews and Ratings: Enables informed decisions when choosing a bookkeeper.

- Global Access: Hire professionals worldwide for a broader range of expertise.

Pros

- Cost-Effective: Flexible pricing to fit any budget, starting as low as $5 per project.

- Custom Solutions: Allows businesses to choose exactly what they need without paying for extra features.

- Quick Turnaround Times: Many freelancers offer expedited services for urgent tasks.

- Scalable Services: Suitable for one-time tasks or ongoing bookkeeping needs.

- Convenient Platform: User-friendly interface for browsing, hiring, and communicating with freelancers.

Pricing

- Fiverr bookkeeping services range from $5 to $500+ per project, depending on the freelancer’s expertise, service scope, and delivery timeline.

- Hourly rates and custom pricing are also available for long-term or complex tasks.

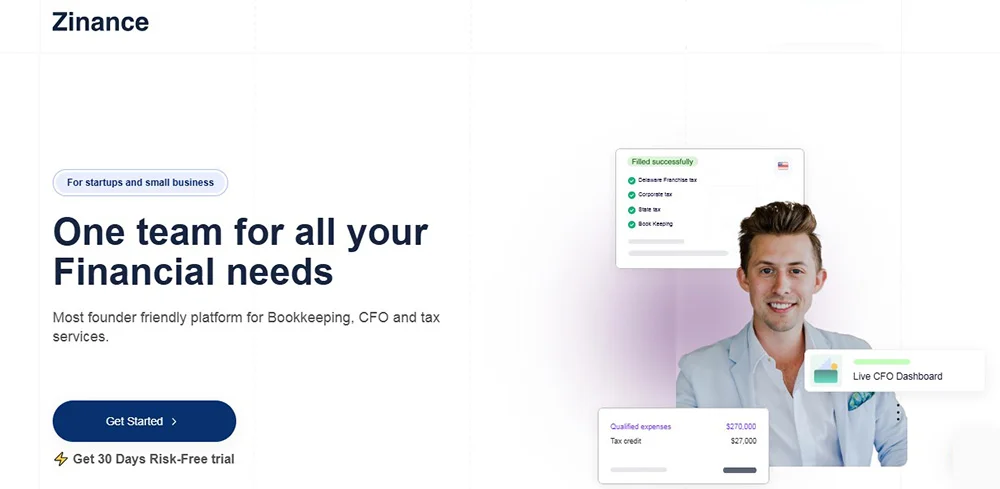

Zinance

Zinance is a bookkeeping service tailored for small businesses, offering cloud-based financial solutions that emphasize simplicity and cost-effectiveness. It is designed to help business owners manage their finances with minimal hassle while ensuring accuracy and tax readiness.

Features

- Cloud-Based Bookkeeping: Access your financial data from anywhere with secure cloud storage.

- Income and Expense Categorization: Automatically organize transactions for streamlined reporting.

- Monthly Financial Reports: Get clear and concise financial insights to aid decision-making.

- Tax Readiness: Ensure your records are prepared for tax season with professional support.

Pros

- Transparent Pricing: Clear and affordable pricing plans with no hidden fees.

- User-Friendly Platform: Simple interface suitable for non-accounting professionals.

- Small Business Focus: Services designed specifically to meet the needs of small enterprises.

- Scalable Services: Flexible options to grow with your business.

Pricing

Zinance pricing starts at $150 per month, making it an affordable choice for small businesses. Custom plans are available for businesses with unique or complex needs, ensuring personalized support.

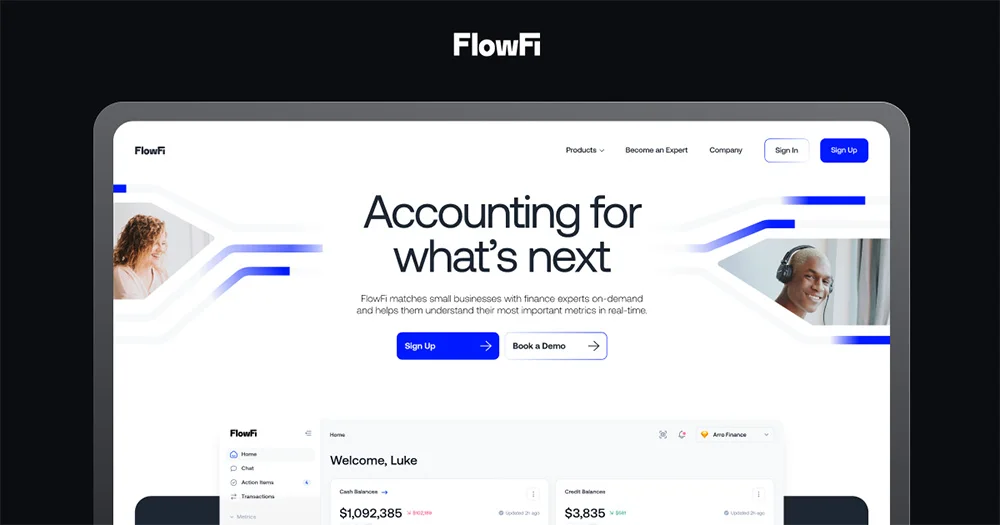

FlowFi

FlowFi is an innovative bookkeeping service that combines automation and expert financial guidance to help small businesses manage their finances efficiently. It caters to businesses looking for streamlined financial tracking and personalized support.

Features

- Automated Bookkeeping: Uses technology to automate income and expense categorization.

- Real-Time Reporting: Provides up-to-date insights into financial health.

- Dedicated Financial Advisor: Access to experts for guidance and support.

- Tax Compliance Support: Prepares books for tax season with accurate data.

- Customizable Solutions: Tailored services to meet specific business needs.

Pros

- Tech-Driven Efficiency: Automation reduces errors and saves time.

- Personalized Support: Combines automation with human expertise.

- Scalable Options: Suitable for businesses at various stages of growth.

- Transparent Communication: Real-time updates and reports ensure clarity.

Pricing

FlowFi pricing starts at $299/month, with additional services available for businesses requiring advanced features or customized solutions. Packages are flexible to adapt to the unique needs of each business.

Bookkeeper360

Bookkeeper360 is a cloud-based bookkeeping service tailored for small businesses. It integrates seamlessly with accounting platforms like QuickBooks and Xero, offering a range of financial management solutions. Bookkeeper360 caters to startups, e-commerce businesses, and growing enterprises, providing scalability and customization.

Features

- Real-Time Bookkeeping: Automates bookkeeping tasks and provides up-to-date financial data.

- Payroll and HR Services: Offers payroll processing and human resource support.

- CFO Advisory Services: Provides financial insights, forecasting, and growth strategies.

- Customizable Dashboards: Enables businesses to track key performance indicators (KPIs) and monitor financial health.

- Tax Compliance: Assists with tax planning and preparation to ensure accuracy and compliance.

Pros

- Scalable Solutions: Flexible plans that adapt to growing business needs.

- Comprehensive Services: Combines bookkeeping, payroll, and advisory services in one platform.

- Integrations: Works seamlessly with QuickBooks, Xero, and other tools.

- Dedicated Support: Access to a team of experts for personalized assistance.

- Transparency: Clear pricing structure with no hidden fees.

Pricing

- Essential Plan: Starts at $399/month for basic bookkeeping services.

- Controller Plan: Starts at $1,149/month, includes additional services like advisory support.

- Custom Plan: Tailored pricing for businesses with unique needs or high transaction volumes.

Pricing depends on the business size, number of transactions, and selected add-ons, making it suitable for businesses of various sizes and industries.

Cloud-Based Accounting Software Solutions

If you have basic knowledge of accounting and are interested in allocating time to manage your account yourself, then you can subscribe to cloud-based accounting software. These software are developed to be user-friendly and flexible. So anyone with little accounting knowledge can manage their accounting books using cloud-based accounting software. Xero, QuickBooks, and FreshBooks are the popular accounting software developed especially for small business and mid-sized business houses. Here I’ve pointed out key features of this software. However, if you want to learn more about this software you can find our dedicated review pages for these.

QuickBooks Online

QuickBooks is a leading cloud-based accounting software designed for small to medium-sized businesses. With a range of comprehensive features, QuickBooks helps businesses manage everything from invoicing and expense tracking to payroll and tax filings. The platform offers real-time financial data, making it ideal for business owners who need to stay on top of their finances while on the go. QuickBooks integrates seamlessly with a variety of third-party apps, providing businesses with customizable solutions tailored to their specific needs.

Key Features:

- Invoicing and billing

- Expense tracking

- Payroll management

- Financial reporting

- Tax filing

- Mobile app for remote access

Pros:

- Intuitive and user-friendly interface

- Seamless integration with third-party apps

- Scalable, suitable for both small businesses and larger enterprises

- Automated features to save time and reduce errors

- Strong customer support

Pricing:

QuickBooks offers several pricing plans to cater to different business needs:

- Simple Start: $25/month – for freelancers and sole proprietors

- Essentials: $50/month – includes bill management and time tracking

- Plus: $80/month – ideal for businesses needing project tracking

- Advanced: $180/month – designed for larger businesses with custom reporting needs

Read the Full Review of QuickBooks Online

Xero

Xero is a robust, cloud-based accounting software designed for small to medium-sized businesses. Known for its comprehensive features, Xero helps businesses manage everything from invoicing to payroll and tax filings. The platform offers real-time financial data, which is particularly beneficial for business owners on the go. Xero integrates seamlessly with over 800 third-party apps, enabling businesses to customize their accounting systems according to their needs.

Key Features:

- Invoicing and billing

- Payroll management

- Bank reconciliation

- Financial reporting

- Multi-currency support

Pros:

- Excellent mobile app for remote access

- User-friendly interface

- Scalable, making it suitable for businesses of various sizes

Pricing:

Xero offers three pricing plans:

- Early: $13/month

- Growing: $37/month

- Established: $70/month

FreshBooks

FreshBooks is another popular cloud-based accounting solution, particularly favored by freelancers and small businesses. It focuses on simplifying accounting tasks like invoicing, time tracking, and expense management. FreshBooks is known for its clean interface and intuitive design, making it easy for users with little accounting knowledge to navigate. FreshBooks offers strong customer support, and its integration with other tools adds to its functionality.

Key Features:

- Customizable invoices

- Time tracking and project management

- Expense tracking

- Reporting and analytics

- Client management

Pros:

- Excellent customer support

- Easy-to-use interface

- Ideal for service-based businesses

Pricing:

FreshBooks offers four pricing plans:

- Lite: $15/month

- Plus: $25/month

- Premium: $50/month

- Select: Custom pricing for high-volume businesses

Read the full review of FreshBooks

How to Transition to a New Bookkeeping Service

Transitioning to a new bookkeeping service can seem overwhelming, but with the right approach, it can be done smoothly without disrupting your small business operations. Here are the essential steps to ensure a seamless transition from your current service, like Bench, to a new one.

Preparing Your Financial Data

Before switching, make sure all your financial records are up to date and complete. Gather your bank statements, invoices, receipts, and any other important financial documents. Having accurate and organized data will make the transfer process much easier for the new bookkeeping service.

Setting Up the New Service

Once you’ve selected a new service, set up your accounts with all the necessary information. This includes connecting your bank accounts, integrating your preferred software, and configuring your chart of accounts. Make sure the new service understands your business needs and offers features that align with your goals.

Training Your Team

Your team must be comfortable with the new system. Schedule training sessions for anyone involved in the bookkeeping process to ensure everyone knows how to use the new service effectively. This will prevent delays and confusion moving forward, allowing the transition to be smooth.

Final Thoughts

When selecting a bookkeeping service, it’s important to carefully evaluate your options to find the one that best fits your needs. Consider factors like pricing, features, customer support, and integration with your existing systems. Exploring the best Bench bookkeeping alternatives for small business can provide you with a range of choices, each tailored to different business requirements. Make sure to choose a service that not only meets your current needs but also scales as your business grows.

I’d love to hear your thoughts! Have you tried any bookkeeping services? Share your feedback and experiences with us to help others make informed decisions for their business.

Leave a Reply