Tax season can be stressful, but the right software can make it easier. In this H&R Block review, we’ll explore whether this popular tax filing service is the right choice for you.

Filing taxes correctly is essential to avoid penalties and maximize refunds. While manual filing can be complicated and time-consuming, tax software simplifies the process by providing step-by-step guidance, automatic calculations, and error-checking. With the right tool, you can file with confidence and accuracy, even if you’re not a tax expert.

In this article, we’ll cover H&R Block’s features, pricing, ease of use, customer support, and how it compares to competitors like TurboTax and TaxAct. Whether you’re filing a simple return or managing self-employed taxes, this guide will help you decide if H&R Block is the best fit. Read until the end to make an informed choice!

Company Background

H&R Block is one of the most well-known tax preparation companies in the United States. It started in 1955, helping people file their taxes with expert support. Over the years, it has grown into a company that offers both online tax software and in-person tax filing services.

Today, H&R Block serves millions of customers each year. It has over 9,000 physical offices across the U.S., Canada, and Australia. Customers can choose to file taxes on their own using H&R Block’s online tax filing system or visit a tax professional for help. The company also provides tax refund advances and audit support.

H&R Block competes with other major tax software companies like TurboTax and TaxAct. Many people choose it because it offers both digital and face-to-face services. It is also known for its simple interface, making it easier for first-time users to file their taxes.

Over the years, H&R Block has continued to update its software to meet the latest tax laws. Whether you are an individual taxpayer or a small business owner, the company offers different tax filing solutions to fit various needs.

Service Offerings

H&R Block offers different ways to file taxes, depending on your needs. You can file online using tax software, get help from a tax professional, or visit a physical office. Here’s a closer look at what they offer.

Online Tax Preparation Services

H&R Block’s online tax filing is designed for people who prefer to do their own taxes. The platform guides users step by step, making it easier to enter income, deductions, and credits. The system checks for errors and suggests tax-saving opportunities.

There are different pricing tiers, depending on how complex your tax situation is. The free version is good for simple returns, but people with businesses or investments may need to upgrade to a paid version.

In-Person Tax Preparation

For those who need expert help, H&R Block has in-person tax filing at thousands of locations. You can schedule an appointment with a tax professional who will review your documents and file your return for you. This option is useful for people with complicated taxes, like freelancers or small business owners.

Additional Services

H&R Block offers extra services beyond tax filing.

- Tax Pro Review – A tax expert reviews your return before you submit it.

- Second Look Review – If you filed with another service in the past, H&R Block will check for mistakes and missed deductions.

- Audit Support – If the IRS audits you, H&R Block provides guidance.

- Emerald Card – A prepaid card that allows users to receive tax refunds faster.

H&R Block provides flexible options for different taxpayers. Whether you prefer online software, in-person help, or additional support services, they offer solutions for various tax needs.

Pricing Structure

H&R Block offers different pricing plans based on how complex your tax return is. There are online and in-person filing options, with costs varying depending on your chosen services.

Online Services Pricing

H&R Block’s online tax filing has four main plans:

- Free – Best for simple tax returns with W-2 income, student loans, and basic deductions.

- Deluxe ($44+) – Includes itemized deductions for homeowners and people with medical expenses.

- Premium ($76+) – Designed for freelancers, investors, and those with rental income.

- Self-Employed ($92+) – Best for small business owners, covering business deductions and expenses.

Prices may change based on add-ons like expert tax assistance.

In-Person Services Pricing

For those who prefer expert help, H&R Block has in-person tax preparation at over 9,000 locations. The price depends on how complex your taxes are. Basic returns may start at around $89, while more detailed tax situations, like those involving rental properties or businesses, cost more.

Is H&R Block Affordable?

Compared to competitors like TurboTax, H&R Block tends to be more affordable, especially for complex returns. It also provides in-person services, which some competitors do not offer. The H&R Block pricing structure makes it a flexible option for different taxpayers, whether they need a free plan or full professional assistance.

H&R Block Interface

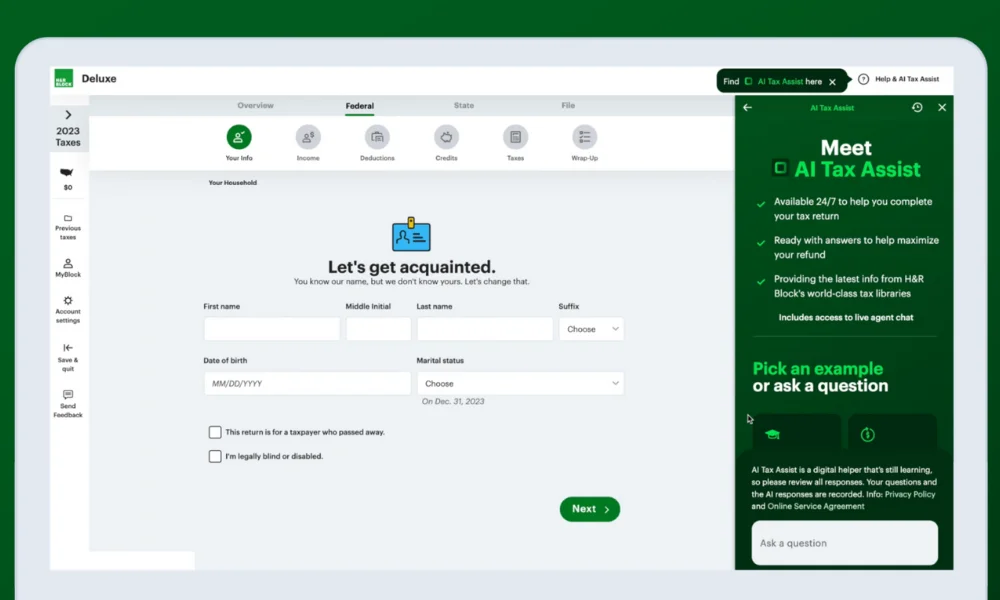

H&R Block is designed for ease of use, making it a great option for beginners and experienced tax filers. The platform provides clear instructions, helping users understand each step of the tax filing process.

Online Platform Usability

The online software has a simple layout. Users are guided through each section with easy-to-follow questions. Instead of complicated tax forms, H&R Block asks users for information in everyday language. It also offers helpful tips to explain tax terms.

A key feature is the ability to upload tax documents, such as W-2s and 1099s. Instead of entering numbers manually, users can take a picture or upload a file, and the system will automatically fill in the details. This saves time and reduces errors.

Another benefit is the real-time refund estimate. As users enter information, they can see their estimated refund or tax due change instantly. This helps them understand how deductions and credits affect their return.

Mobile Application

H&R Block also has a mobile app, which allows users to file their taxes from their phone or tablet. The app has the same guided process as the website and includes document scanning to speed up data entry. Users can also check their refund status, get tax tips, and access previous tax returns.

Ease of Filing for Small Business Owners

The platform includes tools for freelancers and small business owners to track business income and expenses. Users can also separate personal and business deductions, making it easier to file accurately.

Customer Support

H&R Block offers strong customer support options, making it easy for users to get help when needed. Whether filing taxes online or visiting a local office, there are multiple ways to reach out for assistance.

Live Chat and Phone Support

For online users, H&R Block provides live chat and phone support. Customers can talk to a tax expert or customer service representative during business hours. The live chat feature is useful for quick questions, while phone support is better for more complex tax issues.

In-Person Assistance

One of H&R Block’s biggest advantages is its network of over 9,000 physical locations. Customers who prefer face-to-face help can visit an office and speak directly with a tax professional. This option is especially useful for people with complicated returns or those who want extra reassurance before filing.

Online Help Center

H&R Block also has a detailed online knowledge base. It includes step-by-step guides, FAQs, and articles covering various tax topics. Users can find answers to common tax questions without needing to contact customer support.

Tax Pro Help and Audit Support

For an extra fee, customers can get expert tax advice or have a professional review their return before submission. H&R Block also offers audit support, guiding if the IRS audits a tax return.

H&R Block vs TurboTax vs TaxAct

Here’s a comparison table summarizing the differences between H&R Block, TurboTax, and TaxAct:

| Feature | H&R Block | TurboTax | TaxAct |

|---|---|---|---|

| Pricing | Free plan for simple returns, Deluxe from $35, Self-Employed from $85 | Free plan for simple returns, Deluxe from $60, Self-Employed from $120 | Free plan for simple returns, Deluxe from $24.95, Self-Employed from $64.95 |

| In-Person Support | Yes, available at over 9,000 locations | No in-person support | No in-person support |

| Document Upload | Yes, allows upload of W-2s, 1099s, etc. | Yes, allows upload of W-2s, 1099s, etc. | Yes, allows upload of W-2s, 1099s, etc. |

| Mobile App | Yes, includes document scanning and filing | Yes, includes document scanning and filing | Yes, includes document scanning and filing |

| Audit Support | Yes, included with most plans | Yes, available with most plans | No, limited audit support |

| Live Chat Support | Yes | Yes | Yes |

| Phone Support | Yes | Yes | Yes |

| Self-Employed Support | Yes, included in the Self-Employed plan | Yes, included in the Self-Employed plan | Yes, included in the Self-Employed plan |

| Refund Tracking | Yes, real-time refund estimate | Yes, real-time refund estimate | Yes, real-time refund estimate |

| Ease of Use | User-friendly, guided steps for beginners | Very user-friendly, step-by-step guidance | Simple, no-frills interface |

| Free Plan Availability | Yes, for simple returns | Yes, for simple returns | Yes, for simple returns |

| Customer Support Availability | 24/7 phone and live chat support, in-person available | Phone and live chat support | Email and live chat support |

Frequently Asked Questions

Is H&R Block better than TurboTax?

H&R Block vs. TurboTax comes down to preference. H&R Block is known for affordable tax preparation and strong in-person support, while TurboTax offers a more seamless online experience.

Does H&R Block have a free tax filing option?

Yes, H&R Block online tax filing offers a free edition for simple returns, but additional features require upgrades.

How much does H&R Block cost?

H&R Block pricing varies based on the plan chosen. It ranges from free (for basic returns) to premium packages costing over $100.

Can I file my taxes with H&R Block using my phone?

Yes, the H&R Block mobile app allows users to prepare and file taxes using a smartphone.

Is H&R Block safe to use?

Yes, H&R Block tax software uses encryption and security protocols to protect user data.

Bottom Line

In this H&R Block review, we covered its key features, pricing, ease of use, and customer support. We also compared it with TurboTax and TaxAct to highlight its strengths and differences. H&R Block stands out with its free plan for simple tax returns, in-person support at 9,000+ locations, and an intuitive mobile app. With features like audit support, refund tracking, and self-employed tax options, it remains a solid choice for individuals and small business owners.

If you found this review helpful, we’d love to hear your thoughts! Have you used H&R Block before? Share your experience in the comments. If you think this guide can help others, don’t forget to share it on social media so more people can make informed tax filing decisions. Thank you for reading!

Leave a Reply