A nonprofit chart of accounts (COA) is a comprehensive list of financial accounts and ledgers that a nonprofit organization uses to categorize and track its financial activities. It serves as the backbone of all accounting procedures and helps in organizing financial data for reporting and analysis. Here I have discussed the key components of a nonprofit chart of accounts, its purpose, its standard guidelines, and examples.

Key Components of Nonprofit Chart of Accounts

Here are the key components typically found in a nonprofit chart of accounts:

1. Assets

- Cash and Cash Equivalents: Bank accounts, petty cash, and highly liquid investments.

- Accounts Receivable: Amounts owed to the nonprofit by individuals or organizations.

- Investments: Stocks, bonds, and other securities owned by the nonprofit.

- Inventory: Supplies and materials held for sale or use.

- Prepaid Expenses: Expenses paid in advance, such as insurance or rent.

- Fixed Assets: Property, plant, and equipment owned by the nonprofit.

2. Liabilities

- Accounts Payable: Amounts owed to suppliers or creditors.

- Accrued Expenses: Expenses incurred but not yet paid, such as payroll taxes or utilities.

- Loans Payable: Amounts owed on loans or lines of credit.

- Deferred Revenue: Amounts received in advance for goods or services not yet provided.

3. Net Assets

- Unrestricted Net Assets: Funds available for general use.

- Temporarily Restricted Net Assets: Funds with donor-imposed restrictions on use.

- Permanently Restricted Net Assets: Funds with donor-imposed restrictions on both use and principal.

4. Revenue

- Contributions: Donations, pledges, and grants.

- Program Revenue: Fees for services, membership dues, and sales.

- Investment Income: Interest, dividends, and capital gains.

- Other Income: Miscellaneous revenue sources.

5. Expenses

- Program Services: Costs directly related to the nonprofit’s mission.

- Fundraising Expenses: Costs associated with raising funds.

- Management and General Expenses: Administrative and overhead costs.

- Other Expenses: Miscellaneous expenses.

The Purposes of Nonprofit Chart of Accounts

To gain valuable insights into a nonprofit organization’s financial health, make data-driven decisions, and demonstrate accountability to stakeholders a well-structured chart of accounts is required.

- Financial Reporting: The COA helps in creating financial reports such as the Statement of Financial Position (balance sheet), Statement of Activities (income statement), Statement of Cash Flows, and Statement of Functional Expenses.

- Audit and Compliance: It is essential for financial audits and compliance with reporting requirements, such as Form 990.

- Budgeting and Planning: The COA provides a framework for budgeting and planning by categorizing financial activities into logical groups.

- Internal Management: It helps in managing the organization’s finances by providing a clear understanding of financial positions and activities.

Standard Guidelines for Creating Nonprofit COA

A chart of accounts is the backbone of an organization’s financial reporting so you need to follow the guidelines on how to create and categorize a chart of accounts. Here are the standard guidelines for creating a nonprofit chart of accounts that supports effective financial management and reporting:

- Numbering Conventions: Accounts are typically numbered in a logical sequence, such as Assets (1000-1999), Liabilities (2000-2999), Net Assets (3000-3999), Revenue (4000-4999), and Expenses (5000+).

- Aligning with Accounting Standards: Adhere to relevant accounting standards, such as Generally Accepted Accounting Principles (GAAP) or the Financial Accounting Standards Board (FASB) guidelines

- Simplicity and Flexibility: Accounts should be grouped logically and leave room for future growth and changes.

- Consistency: Account names should be consistent across all financial reports and align with budget line items to ensure accuracy and efficiency.

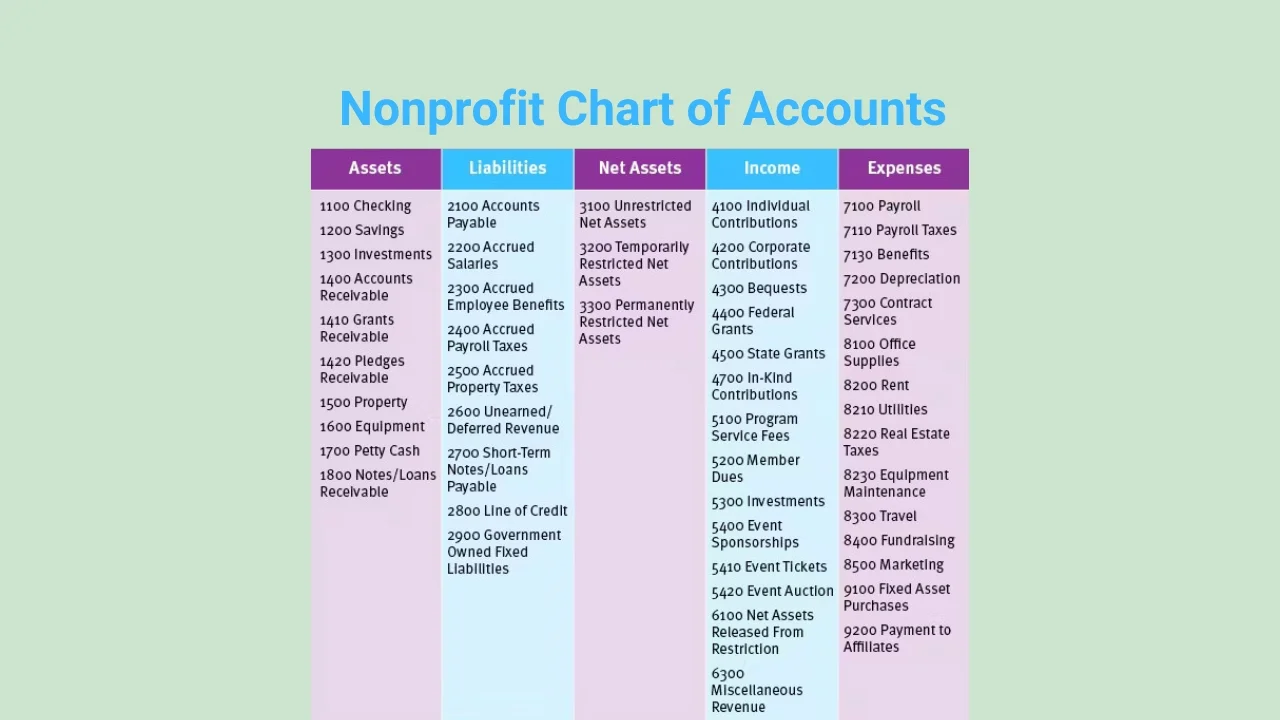

Sample Chart of Accounts for Nonprofit

Here the example illustrates how a nonprofit chart of accounts can be structured. But remember this is a sample chart of accounts. The actual chart of accounts can vary based on the specific nonprofit’s size, complexity, and accounting standards.

Nonprofit Chart of Accounts Example

1. Assets

1010: Checking (Bank Account)

1030: Savings (Bank Account)

1110: Investments

1210: Accounts Receivable

1310: Inventory

1410: Prepaid Expenses

1510: Property

1530: Equipment

1590: Accumulated Depreciation

1690: Accumulated Amortization

2. Liabilities

2010: Accounts Payable

2100: Accrued Salaries

2110: Accrued Payroll Taxes

2115: Accrued Employee Benefits

2150: Accrued Property Taxes

2200: Deferred Revenue

2300: Credit Card Payable

3. Net Assets

3100: Unrestricted Net Assets

3200: Temporarily Restricted Net Assets

3300: Permanently Restricted Net Assets

4. Revenue

4010: Donations and Grants – Individuals

4020: Donations and Grants – Government

4030: Donations and Grants – Foundations

4110: Special Events – Sponsorships

4120: Special Events – Auction

4130: Special Events – Ticket Sales

4200: Program Revenue

4300: Sales of Merchandise

4500: Membership Dues

4600: In-Kind Contributions

4700: Temporarily Restricted Income

4800: Permanently Restricted Income

4900: Interest Income

4910: Dividend Income

5. Expenses

- General and Administrative Expenses

5000: Salaries and Wages

5010: Payroll Taxes

5030: Health Insurance

5040: Dental Insurance

5050: Retirement Benefits

5060: Workers Compensation

5070: HSA Contributions

5120: Accounting Services

5230: Legal Services

5510: Rent Expense

5520: Utilities

5525: Telecommunications

5530: Maintenance and Repairs

5540: Office Supplies

5550: Printing and Copying

5560: Postage and Shipping

5570: Licenses and Permits

5610: Bank Fees

5620: Merchant Service Fees

5810: Board Expenses

5820: D&O Insurance

5890: Miscellaneous Expenses

- Non-operating Expenses

6000: Depreciation Expense

6100: Amortization Expense

- Cost of Goods Sold

7000: Cost of Goods Sold

- Fundraising and Development Expenses

8000: Fundraising Expenses

8100: Special Event Expenses

8200: Program Expenses

- Selling Expenses

9000: Marketing and Branding

9100: Advertising

9200: Contract Services

Download the Nonprofit Chart of Accounts Excel File

Final Thoughts

To create a nonprofit chart of accounts you can follow the above example. Remember that, initially you do not create all accounts. Review your chart of accounts and add new accounts based on your requirements. However, if you feel difficulties, you can outsource an experienced accountant for your organization.

Leave a Reply