Managing finances efficiently is crucial for any business, and a well-structured Chart of Accounts (COA) is a key tool in achieving this. Understanding how to use and categorize your COA can simplify your accounting processes and provide clear insights into your financial health. In this article, we will cover what a Chart of Accounts is, how to create it effectively, and the categories it is. We will discuss it from scratch so that anyone even a non-background accounting degree person can easily understand. Hope this article will be helpful for all accountants and business owners.

Currently, most accounting software offers a built-in chart of accounts and accounting automation for generating financial reports. If you can correctly set up your chart of accounts, you can easily generate financial reports and get insights into your business’s financial health accurately. No more introduction, let’s start our learning session.

What is a Chart of Accounts?

Think of a Chart of Accounts as the backbone of your business’s financial record-keeping. It is a comprehensive listing of all accounts used by a company to record financial transactions. Imagine it as the table of contents for your financial story, guiding you to specific sections like assets, liabilities, and income.

Why Use a Chart of Accounts?

Having a well-defined COA offers several advantages:

- Enhanced Organization: No more scrambling to remember where you categorized that important expense. A COA keeps everything organized and readily accessible.

- Accurate Reporting: When tax season rolls around, a well-maintained COA ensures accurate financial reports and simplifies the process.

- Financial Clarity: By categorizing your income and expenses, a COA unveils valuable insights into your spending habits and overall financial standing.

How to Create a Chart of Accounts

To set up a correct chart of accounts, you just need to know the different account types and how to categorize them. In addition, you have to know how to assign account numbers and keep consistency.

Understanding Components of a Chart of Accounts

A COA typically groups accounts into five main categories:

- Assets: Everything you own that holds value, like cash, inventory, or property.

- Liabilities: The money you owe, including loans, accounts payable, and credit card debt.

- Equity: The net worth of your business or personal finances, calculated as assets minus liabilities.

- Revenue: The income you generate through sales or services rendered.

- Expenses: The costs incurred in running your business or personal life, such as rent, salaries, or utilities.

Each of these main categories can be further divided into subcategories for more precise tracking. For instance, the “assets” category might have subcategories for “cash on hand,” “accounts receivable,” and “investments.”

Subcategories of a COA

Assets

- Current Assets: Cash, accounts receivable, inventory, and other assets that can be converted to cash within a year.

- Fixed Assets: Long-term assets like property, plant, equipment, and vehicles.

- Intangible Assets: Non-physical assets such as patents, trademarks, and goodwill.

Liabilities

- Current Liabilities: Debts or obligations due within a year, such as accounts payable, short-term loans, and taxes payable.

- Long-Term Liabilities: Debts or obligations due after a year, including long-term loans and bonds payable.

Equity

- Owner’s Capital: Investments made by the business owner.

- Retained Earnings: Profits reinvested in the business rather than distributed as dividends.

Revenue

- Sales Revenue: Income from selling goods or services.

- Interest Income: Earnings from investments or interest-bearing accounts.

- Other Revenue: Any additional income streams, such as rental income.

Expenses

- Operating Expenses: Day-to-day expenses like rent, utilities, salaries, and office supplies.

- Cost of Goods Sold (COGS): Direct costs related to producing goods or services sold by the business.

- Depreciation Expense: Allocation of the cost of fixed assets over their useful life.

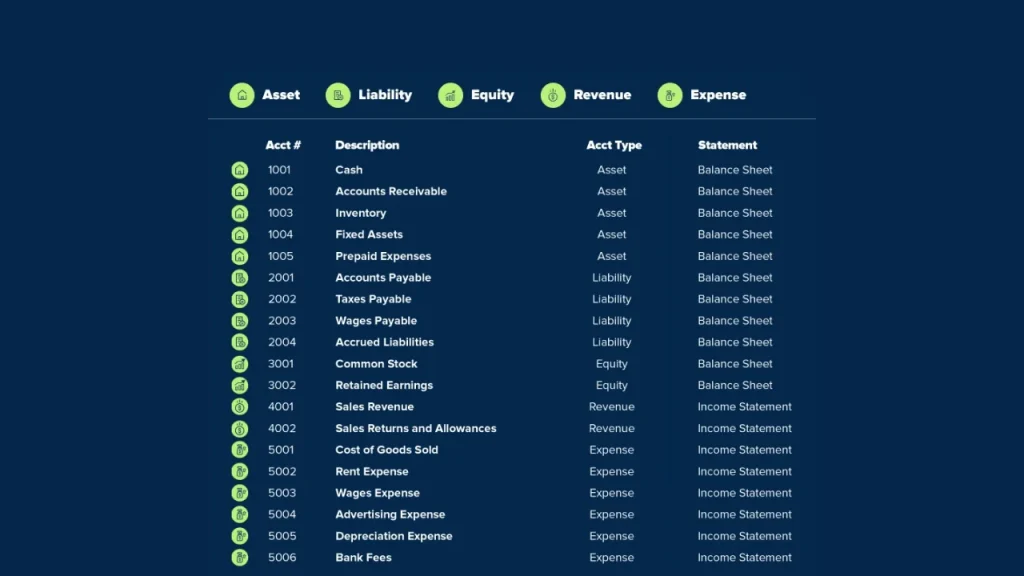

Assign Account Numbers

Assigning account numbers, while not mandatory, but assigning numbers helps an organization’s bookkeeping automation process. A typical method involves a four-digit system where the first digit denotes the primary category (e.g., 1 for Assets, 4 for Revenue).

Here’s a common template:

- Asset accounts: Numbered 1000–1900

- Liability accounts: Numbered 2000–2900

- Equity accounts: Numbered 3000–3900

- Revenue accounts: Numbered 4000–4900

- Expense accounts: Numbered 5000–5900

Tips for Optimizing Your Chart of Accounts

Here are some tips to help you set up a COA that suits your business needs:

1. Start Simple and Grow

Don’t need to create a comprehensive list right from the start. Start with the essential accounts needed for your daily transactions. When your business grows and needs a new account head, then add the required accounts.

2. Consistency is King

Once you establish your COA format, stick to it! Consistent categorization across different time periods ensures accurate comparisons and simplifies financial analysis. This will make tracking progress and identifying spending patterns a breeze.

3. Schedule Regular Reviews

Don’t let your COA become an afterthought. Schedule regular reviews to ensure it reflects your current financial situation. As your business grows or personal finances change, you might need to add new subcategories or adjust existing ones to maintain optimal organization.

4. Utilize Accounting Software

Most accounting software provides a Chart of Accounts template and tools to streamline the creation and maintenance of your COA. So, if you are not yet confident in creating a Chart of Accounts yourself, consider aligning your business with accounting software. This software can streamline the process and ensure your financial records are organized and accurate.

5. Seek Professional Advice

If you’re unsure about setting up your COA, consult with an accountant or financial advisor. They can provide guidance tailored to your business’s specific needs and ensure your COA meets best practices.

Final Thoughts

A well-structured Chart of Accounts is vital for effective financial management. By understanding how to set up, categorize, and maintain your COA, you can ensure accurate financial tracking and reporting, ultimately supporting the growth and success of your business. Whether you’re a small business owner or managing a larger enterprise, investing time in organizing your COA will pay off in the long run. Looking for a chart of accounts template? Visit the article titled “Sample Chart of Accounts” to find what you need.