A well-structured financial framework is essential for the success of any business. The Chart of Accounts (COA) acts as the cornerstone of this framework, offering a precise and comprehensive structure for documenting all financial activities. However, there is no unified chart of accounts. It varies from industry to industry, business to business. I have also created a chart of accounts template that covers the main categories. You can initially use this chart of accounts template for your business.

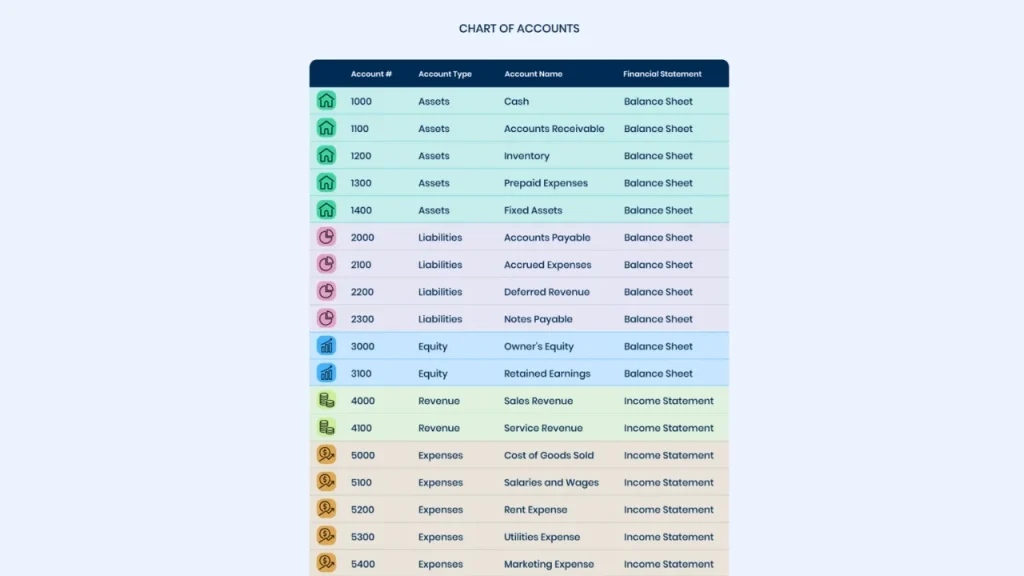

Sample Chart of Accounts Template

I have developed a sample chart of accounts template that provides a starting point with main categories and subcategories. Remember, you can customize this further based on your specific business needs.

1. Assets

- 1000 Current Assets

1010 Cash and Cash Equivalents

1020 Accounts Receivable

1030 Inventory

1040 Prepaid Expenses

(Add other relevant current asset accounts)

- 1100 Non-Current Assets

1101 Land

1102 Buildings

1103 Equipment

1104 Furniture and Fixtures

1105 Vehicles

1106 Patents

1107 Trademarks

1201 Less: Accumulated Depreciation (for depreciable assets)

(Add other relevant non-current asset accounts)

2. Liabilities

- 2000 Current Liabilities

2010 Accounts Payable

2020 Salaries and Wages Payable

2030 Income Taxes Payable

2040 Short-Term Loans Payable

(Add other relevant current liability accounts)

- 2100 Non-Current Liabilities

2101 Long-Term Loans Payable

2102 Mortgages Payable

(Add other relevant non-current liability accounts)

3. Equity

- 3000 Owner’s Equity

3010 Capital Stock (for corporations)

3020 Retained Earnings

3030 Dividends

3040 Owner’s Drawings (for sole proprietorships)

4. Revenue

- 4000 Sales

4010 Sales Revenue

4020 Service Income

(Add other relevant revenue streams)

5. Expenses

- 5000 Cost of Goods Sold (for product-based businesses)

5010 Direct Materials

5020 Direct Labor

5030 Manufacturing Overhead

- 5100 Selling Expenses

5110 Advertising Expense

5120 Sales Commissions

(Add other relevant selling expenses)

- 5200 General and Administrative (G&A) Expenses

5210 Rent Expense

5220 Office Supplies Expense

5230 Salaries and Wages Expense (indirect labor)

5240 Utilities Expense

(Add other relevant G&A expenses)

- 5300 Non-operating Expenses

5310 Interest Expense

5320 Depreciation Expense

(Add other relevant non-operating expenses)

Download Sample Chart of Accounts PDF File

Download Sample Chart of Accounts Excel File

Bottom Line

By understanding the components of a COA and following the steps to create a customized template, you can enhance your business’s financial organization and decision-making capabilities. Read this article about How to Create, Categories for the Chart of Accounts.