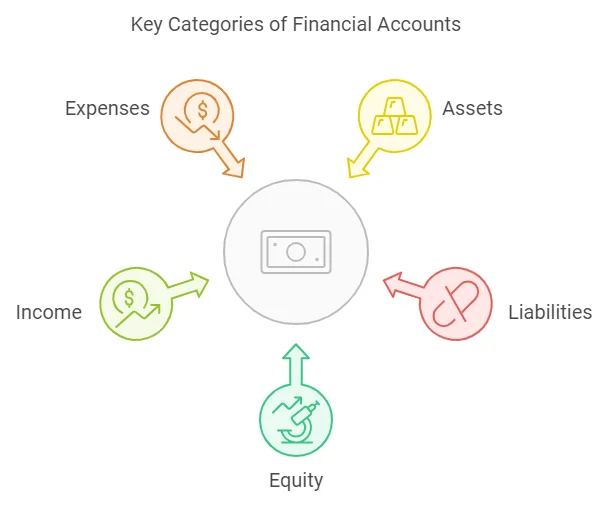

In the complex accounting field, it is important to understand the different types of accounts to manage business financial health effectively. Accounts, considered from an accounting perspective, are the foundation of the financial statements usually giving insight into an entity’s financial situation and performance. These accounts are divided into five main types: assets, liabilities, owner’s equity, income, and expenses. Each type of account has a unique role to play in reflecting the business and financial positions of the business.

This comprehensive guide will help you delve deeper into the world of financial accounts, exploring their significance, types, and how they impact financial statements. I hope that after reading this article, you have a more thorough understanding of what goes into your accounts so that you can be better at managing your money and making financial reports that are always associated with stable financial health!

A Detailed Look at the Types of Accounts

In accounting, accounts like Checking, Petty Cash, and Accounts Payable are all part of the five main categories of assets, liabilities, equity, revenue, and expenses. We see in business operations, break down these major accounts into sub-accounts. For example, instead of listing all utility expenses under “Expenses,” you can group similar sub-accounts like water, electricity, and so on under the broader “Utilities” category. The sub-accounts help to track details about each expense. Sub-accounts can be used within any of the main account types to provide more clarity on financial transactions. Here we explain details about each major account and its sub-accounts including examples so that you get a clear idea of the types of accounts.

I hope this article helps you to create a perfect Chart of Accounts for your business or organization. Be sure to read the entire article thoroughly.

1. Asset Accounts

Asset accounts represent the resources a company owns or controls. These resources can be tangible, such as property, plant, and equipment, or intangible, like patents and goodwill. Asset accounts are essential for understanding a company’s financial strength and its ability to generate future revenue.

Types of Asset Accounts

Based on the liquidity assets can be classified into two categories such as current assets and fixed assets. On the other hand, assets are also categorized as tangible assets and intangible assets based on its physical existence. However, the intangible assets are also part of the fixed assets.

- Current Assets: These are assets that a company expects to convert into cash within the next year. Examples include:

- Cash

- Accounts receivable (money owed by customers)

- Inventory (goods held for sale)

- Prepaid expenses (costs paid in advance)

- Fixed Assets: Also known as property, plant, and equipment (PP&E), these are long-term assets used in a company’s operations. Examples include:

- Land

- Buildings

- Machinery

- Equipment

- Intangible Assets: These assets lack physical form but have value due to their rights or benefits. Examples include:

- Patents (exclusive rights to an invention)

- Copyrights (exclusive rights to a creative work)

- Trademarks (symbols or logos identifying a product)

- Goodwill (the value of a company’s reputation and customer loyalty)

Examples of Asset Accounts

As an example, consider a company that buys a brand new delivery truck. The new delivery truck is a fixed asset on a balance sheet. If the company sells products on credit, then the customer would owe an amount from its side which should be recorded as accounts receivable. In doing so, the company records a prepaid expense in that commercial rent will not be expensed but pre-paid for.

2. Liability Accounts

Liability accounts represent the debts or obligations a company owes to others. These obligations can be short-term, such as accounts payable, or long-term, such as loans and bonds. Understanding liability accounts is crucial for assessing a company’s financial stability and its ability to meet its obligations.

Types of Liability Accounts

The liability accounts can be classified into three categories, such as

- Current Liabilities: These are debts that a company expects to pay within the next year. Examples include:

- Accounts payable (money owed to suppliers)

- Notes payable (short-term loans)

- Accrued expenses (expenses incurred but not yet paid)

- Taxes payable

- Long-term Liabilities: These are debts that a company expects to pay after one year. Examples include:

- Bonds payable (long-term debt securities)

- Mortgage payable (loans secured by real estate)

- Lease liabilities (obligations under lease agreements)

- Contingent Liabilities: Contingent liabilities are potential obligations that may arise from past events, such as lawsuits or product warranties. They are only recorded as liabilities if it is probable that a loss will occur and the amount can be reasonably estimated.

Examples of Liability Accounts in Practice

Imagine a company purchases inventory on credit. This would create an accounts payable liability, representing the amount owed to the supplier. If the company takes out a loan to purchase new equipment, this would be recorded as a long-term liability. And if the company incurs payroll expenses but hasn’t yet paid its employees, these would be recorded as accrued expenses.

3. Equity Accounts

Equity accounts represent the residual interest in a company’s assets after deducting its liabilities. In simpler terms, equity is the owner’s stake in the company. It reflects the amount of money invested by the owners, plus any profits retained by the company.

Components of Equity

The primary components of equity are two:

- Capital Stock: This represents the amount of money invested by the owners when they purchase shares of the company’s stock. It can be divided into:

- Common stock: Shares that give owners voting rights and a share of profits.

- Preferred stock: Shares that often have priority over common stock in terms of dividends and liquidation.

- Retained Earnings: This is the accumulated profits that a company has retained over time, after paying dividends. Retained earnings can be used to reinvest in the business or to pay dividends to shareholders.

Equity Accounts: A Closer Look

Think of equity as the owner’s skin in the game. The higher the equity, the more invested the owners are in the company’s success. Equity can be affected by factors such as profits, losses, dividends, and new investments.

4. Income and Expense Accounts

Income and expense accounts are used to track a company’s revenues and costs. Income accounts represent the money a company earns, while expense accounts represent the costs it incurs. The difference between income and expenses determines a company’s net income or net loss.

Types of Income Accounts

The income accounts can be classified into several types based on the nature of the income. Here are the main types of income accounts:

- Operating Income Accounts: This is the primary source of income for most businesses, representing the revenue generated from the sale of goods or services.

- Non-Operating Income Accounts: This is income earned from secondary sources activities that are not the primary focus of the business, such as savings accounts, bonds, or loans.

- Other Income: This can include income from various sources that are not part of the business such as rental income, royalty income, or gain on the sale of assets.

Types of Expense Accounts

The expense accounts can be classified into various types but the main types of expense accounts include:

- Cost of Goods Sold (COGS): This is the direct cost of producing goods or services, including the cost of materials, labor, and manufacturing overhead.

- Operating Expenses: These are the costs incurred in the day-to-day operations of a business, such as rent, utilities, salaries, and advertising.

- Non-Operating Expenses: These are expenses not directly related to the core business activities, such as interest paid on loans or bonds, losses on asset disposals, fines and penalties.

Understanding Income and Expense Accounts

By carefully tracking income and expense accounts, companies can assess their profitability, identify areas for improvement, and make informed business decisions. The goal is to generate more income than expenses, resulting in a net profit.

For example, if a company sells a product for $100 and the cost of producing that product is $70, the net income from the sale would be $30. This information can be used to evaluate the company’s pricing strategy, production costs, and overall profitability.

FAQs

What is the difference between a debit and a credit?

A debit is an increase in an asset or expense account or a decrease in a liability or equity account. A credit is a decrease in an asset or expense account or an increase in a liability or equity account.

What is the accounting equation?

The accounting equation is a fundamental principle in accounting that states: Assets = Liabilities + Equity. This equation ensures that a company’s resources are equal to its claims on those resources.

How do accounts relate to financial statements?

Accounts are the foundation of financial statements. The balance sheet lists a company’s assets, liabilities, and equity at a specific point in time. The income statement shows a company’s revenues and expenses over a period of time.

Bottom Line

Throughout this guide, we’ve explored the various types of accounts used in accounting. We’ve covered asset accounts, liability accounts, equity accounts, income accounts, and expense accounts. Each type plays a vital role in understanding a company’s financial health and performance.

Accurate accounting is essential for maintaining financial stability, ensuring compliance with regulations, and building trust with stakeholders. Understanding the fundamentals of account types makes it easier to create a chart of accounts. This chart of accounts serves as the foundation for generating accurate financial reports and financial reports provide the actual scenario of the business’s financial health. So, if you have any queries about financial accounting types, feel free to ask your question. I am always available to answer questions.